Comparing A2X with Synder? You're in the right place.

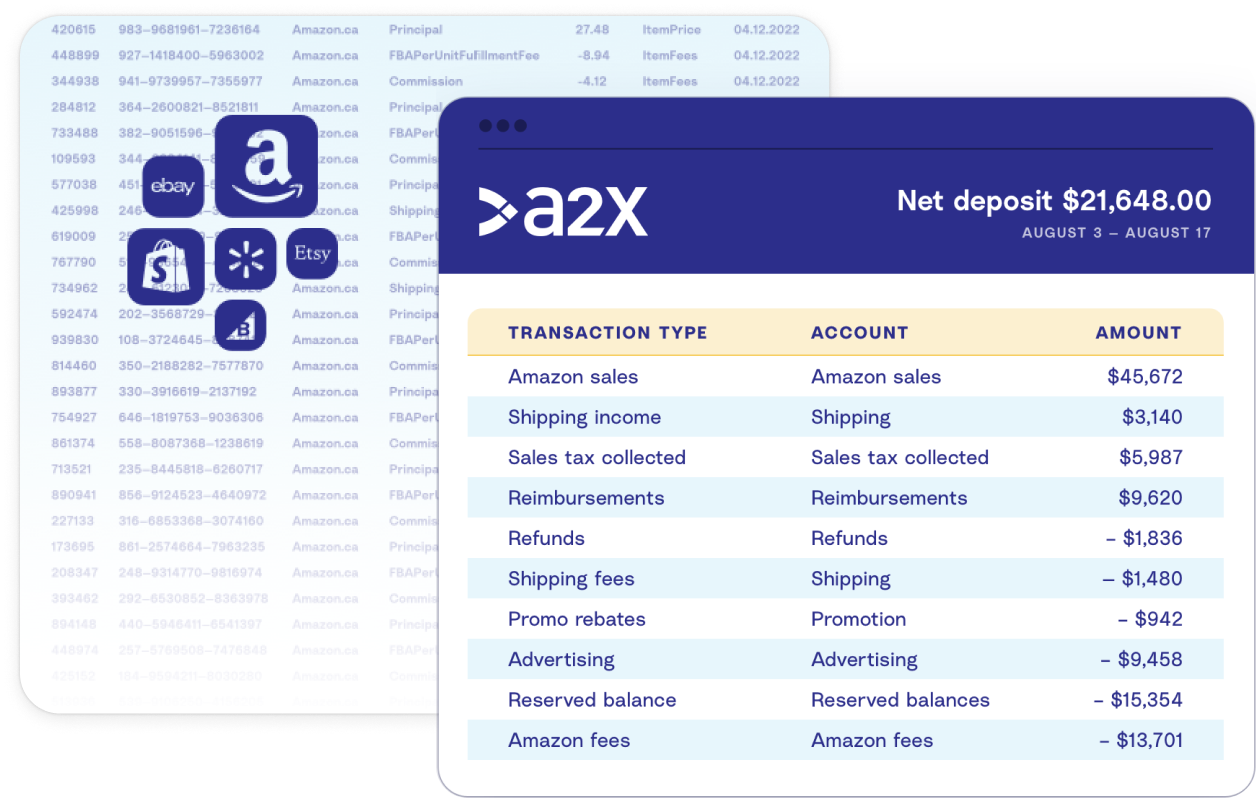

A2X transforms your ecommerce transaction data into organized summaries that reconcile perfectly in your accounting software. Whereas Synder syncs your sales data as individual orders or daily entries. There are some key differences. Find out if A2X is the right solution for your ecommerce business.

The #1 choice

Award–winning solution, loved by over 12,000 merchants and accountants

A2X & Synder

What sets them apart?

Accounting for ecommerce is complicated and time-consuming. Automating this process can save time and money, but with different options available, it can be hard to know which option is best for your business.

A2X and Synder are ecommerce automation apps that post orders from channels to accounting software to be reconciled.

A2X is built for businesses that care about accurate accounting. Whether you’re selling in multiple countries or currencies, A2X provides you with customization options to accurately summarize sales, taxes, and other transaction types. A2X focuses on one, summarised entry giving you the exact accounting entry you need. Synder posts either daily or summary entries, which may be better suited for businesses that are just starting out with less complex need.

A2X provides advanced functionality for accurate accounting at every stage of your growth

Industry leader in ecommerce accounting automation

Focused on accurate data categorization for scaling businesses

Customizable to suit advanced accounting, tax, currency, and multi-channel requirements

Provides expert ecommerce support

a2x features

Whether you’re selling on one channel or many; in different currencies, tax rates, and locations, A2X has you covered

Entries that reconcile and scale

Individual orders or daily entries might seem appealing, but they can cause accounting complications. That’s why A2X’s entries focus on reconciling your payout.

Used by top ecommerce accounting experts

A2X is used by the top ecommerce accountants and bookkeepers around the world. They trust A2X's accuracy for their clients’ financials.

Audit supporting entries

A2X follows best practice ecommerce accounting, including attaching a data file to the summary entry it posts to your accounting system that is easily accessible.

compare solutions

A2X vs. Synder

Although A2X and Synder are both ecommerce accounting automation apps, they provide different solutions for reconciling your ecommerce payouts.

|

Synder |

|

|

|---|---|---|

|

Amazon |

|

|

|

Shopify |

|

|

|

eBay |

|

|

|

Etsy |

|

|

|

Walmart |

|

|

|

QuickBooks Online |

Daily summary & individual order posting |

|

|

Xero |

individual order |

|

|

NetSuite |

|

|

|

Sage BCA |

|

|

|

|

|

|

|

Posts COGS |

|

|

|

|

|

|

|

Integrates with some |

|

|

|

Ability to match back to the Shopify Finance Summary Report |

|

|

|

Regions supported |

US, UK, Canada, and Australia |

UK, EU, US, CA, AU, NZ, and all countries globally |

|

Currencies & taxes supported |

Limited by plan and to a singular tax rate |

US, UK, EU, AU, NZ, & MORE |

|

24/7 expert chat support available |

Limited by plan |

|

|

Onboarding included on premium plans |

|

|

|

Ability to map tax rates on all transaction types |

|

|

|

Ability to split sales by SKU or product type |

|

|

|

All transaction data split by taxed and non-taxed |

|

|

|

Maximum history available |

|

|

|

Two accrual entries when the settlement crosses a month end |

N/A |

|

|

Entry types |

Sales entries, payout entries to a clearing account, then transferred to the bank, invoice, and/or journal entries |

Journals (QuickBooks Online, Sage, NetSuite, & Custom) or invoices (Xero) matching to the bank deposit |

|

Ecommerce Partner Program for all accountants and bookkeepers |

|

|

|

Certification available for accountants and bookkeepers |

|

|

|

Integrates with products or inventory within QuickBooks Online |

|

|

|

Ability to update the settings on past payments |

|

|

|

Ability to exclude data or transaction types from an entry |

|

|

| Price | Starting at $13 per month for up to 50 transactions per month | Starting at $29 per month for up to 200 transactions per month |

Synder

Amazon

Shopify

eBay

Etsy

Walmart

QuickBooks Online

Daily summary & individual order posting

Xero

individual order

posting only

NetSuite

Sage BCA

Posts COGS

Integrates with some

payment gateways

Ability to match back to the Shopify Finance Summary Report

Regions supported

US, UK, Canada, and Australia

UK, EU, US, CA, AU, NZ, and all countries globally

Currencies & taxes supported

Limited by plan and to a singular tax rate

US, UK, EU, AU, NZ, & MORE

24/7 expert chat support available

Limited by plan

Onboarding included on premium plans

Ability to map tax rates on all transaction types

Ability to split sales by SKU or product type

All transaction data split by taxed and non-taxed

Maximum history available

Two accrual entries when the settlement crosses a month end

N/A

Entry types

Sales entries, payout entries to a clearing account, then transferred to the bank, invoice, and/or journal entries

Journals (QuickBooks Online, Sage, NetSuite, & Custom) or invoices (Xero) matching to the bank deposit

Ecommerce Partner Program for all accountants and bookkeepers

Certification available for accountants and bookkeepers

Integrates with products or inventory within QuickBooks Online

Ability to update the settings on past payments

Ability to exclude data or transaction types from an entry

Price

frequently asked questions

Still have questions? We’re here to help

A2X supports growing sellers, handling upwards of 200 orders per month all the way up to 1M+ orders per month. A2X provides summarized accrual accounting entries that reconcile the sales payout in just one click. A2X offers advanced tax tracking functionality, more granularity, and attached data files in case you need to look up a specific order. A2X supports sellers who sell in multiple countries with different currencies and on multiple platforms. Sellers with payment gateways on their site, or with POS locations can use A2X.

In deciding whether to use A2X or Synder, consider your specific needs and the type of business you run. If you're a small business owner managing a low volume of orders, your tax is relatively straightforward, you’re using QuickBooks Online, and/or you want all your orders posted directly to your accounting software, then Synder could be a good option for you.

A2X creates journal entries for the exact period you were paid for, meaning they will always cover the same orders you have been paid for. These entries match perfectly with the payout you’ve received from your ecommerce channel. Synder posts individual orders to Xero and offers the choice of individual orders or daily summary entries to QuickBooks Online.

As your business grows, your number of orders will increase. If each order were posted individually, you would end up with a high volume of entries, potentially overwhelming your accounting software. Additionally, you don't receive payment for every order individually; you're paid in batches (lump sum payouts covering multiple orders and/or spanning several days). Reconciling each individual order to a single deposit would be extremely challenging. Moreover, some transactions are periodic and aren't tied to specific orders. Reserve balances and certain fee types are examples of these. Posting individual orders wouldn't account for these transaction types.

A2X will separate transactions that were taxed from non-taxed transactions. For example, if you had sales that didn’t include tax, A2X would have two separate lines for sales; sales taxed and sales not taxed. A2X also allows you to track tax on expenses such as advertising, fees, and many others. It will track both the marketplace facilitator tax collected and remitted.

Yes, A2X provides an assisted setup feature, enabling you to get up and running in minutes. A2X can automate account mapping for all countries and can automate tax mapping for most countries (including UK/EU) for Amazon, Shopify, and eBay.

A2X can generate a value-based COGS entry in QuickBooks Online or Xero. Once you've uploaded your SKU costs, A2X will create a summary entry for the total amount of your COGS for the period. This entry will debit your inventory asset account and credit your COGS expense account for the value of the goods sold during that period. In addition, A2X can split COGS by product type and can map these to different accounts allowing for advanced reporting.

A2X covers all transaction types, including fees, lending, warehousing, refunds, advertising, and even reserve balances among many more. All of the different transaction types will be grouped under categories, such as 'commission and selling fees' or 'fulfillment and warehousing'.

Yes. A2X has direct integration with Shopify. If you use payment gateways on your site, A2X will identify which sales occurred through these third-party gateways. These gateways will automatically be split out into their own entry and you will just need to account for the fees these gateways charge. The benefit of this approach is that it isn’t limited by direct integration; A2X will pick up all payment gateways

Yes. A2X operates independently from your accounting software, so you can disconnect it and, or reconnect it at any time.

Yes, A2X collaborates with some of the world's leading ecommerce accountants and bookkeepers. You can find the right professional for your needs in the A2X Directory

Yes, A2X supports both. Click here to find out more about QuickBooks Online tracking classes and click here to find out more about Xero’s tracking codes.

INDEPENDENT REVIEWS

There are a number of independent blogs written about A2X by ecommerce accounting experts

A2X is also listed on all major review websites, such as;

Ready to get started?

Save time, work smarter, and get accurate Amazon and Shopify financials in QuickBooks Online or Xero you can trust.