Accounting and Bookkeeping Guide for Etsy Sellers

Written by: Elspeth Cordray

• 13 min read

Accounting and bookkeeping for an Etsy shop comes with a unique set of challenges.

Once a platform primarily for artists, crafters, and vintage resellers, Etsy has grown into a thriving marketplace for entrepreneurial sellers. With this growth comes the need for well-organized and accurate accounting and bookkeeping to maintain and scale your business.

Our guide is designed to support you through this journey! Whether you’re an Etsy seller scaling up and seeking clarity on how to manage your finances, an experienced ecommerce seller adding Etsy as a new sales channel, or an accountant aiming to accurately record Etsy sales in QuickBooks or Xero, this guide provides all the essential insights you need.

Key takeaways:

- Etsy sellers need bookkeeping for tax compliance, tracking profits, managing inventory, and making informed business decisions.

- Etsy accounting is complex due to lump sum payments, sales tax/VAT management, multi-currency transactions, Etsy fees, and inventory tracking.

- Best practices for Etsy accounting and bookkeeping include using accounting software, separating business and personal finances, reconciling transactions, and consulting an ecommerce accountant.

Still have questions about Etsy accounting? You can always reach out to the A2X team at contact@a2xaccounting.com.

Getting started with Etsy accounting and bookkeeping

Not sure where to start with accounting and bookkeeping for your Etsy shop? Don’t worry, we’ve got you covered! We’ll start with the fundamentals so you can build a strong foundation.

If you’re already familiar with basic accounting and bookkeeping principles, feel free to scroll down to dive into the specific challenges and nuances of managing the books for an Etsy store.

What’s the difference between accounting and bookkeeping?

Bookkeeping is all about keeping a detailed record of every business transaction, like sales, expenses, and payments. For your Etsy shop, this means recording things like sales from Etsy, Etsy fees, shipping costs, and tracking inventory purchases and product returns. The goal is to keep your financial records organized and up to date.

Accounting takes that recorded data and uses it to create important reports, such as Profit and Loss Statements, Balance Sheets, and tax documents. For your Etsy business, accounting also means looking at sales trends, figuring out your cost of goods sold (COGS), and understanding how Etsy fees affect your profits. It’s about using this information to see how your business is doing and to help make smart decisions.

In short, bookkeeping focuses on tracking your transactions, while accounting helps you understand what those numbers mean and how to use them to grow your Etsy shop.

Why am I required to do accounting and bookkeeping for my Etsy shop?

Accounting and bookkeeping are crucial for running a successful Etsy shop, helping you stay organized and compliant with financial obligations. Here are the key reasons why they are essential:

- Tax compliance – To file your taxes correctly, whether it’s income tax, sales tax, or VAT, you need detailed records of your sales and expenses. Etsy sellers are responsible for reporting their earnings, and having accurate financial data ensures you meet all tax obligations.

- Tracking sales and expenses – Keeping accurate records of your transactions, such as sales, Etsy fees, and shipping costs, helps you understand how much money is coming in and going out. This gives you a clear picture of your business’s financial health.

- Understanding profitability – By analyzing your sales, fees, and expenses, you can see your actual profits. This insight helps you adjust your pricing, manage costs, and plan for future growth.

- Managing inventory – For Etsy sellers, keeping track of inventory purchases, stock levels, and returns is vital. Proper inventory management ensures that you can calculate your cost of goods sold (COGS) accurately and avoid stock shortages.

- Informed decision-making – Regular financial reports, such as Profit and Loss Statements, help you assess your Etsy shop’s performance, manage cash flow, and make informed decisions for the future.

It’s important to understand that your accounting and bookkeeping needs will vary depending on your location, business type (e.g., sole proprietor, LLC), and whether you’re registered for sales tax, VAT, or GST.

We highly recommend consulting with a bookkeeping or accounting professional who specializes in ecommerce and Etsy sellers to ensure you’re meeting your tax requirements.

Regardless of your Etsy business setup, adopting basic accounting and bookkeeping practices is a smart move. Here’s what that looks like:

For bookkeeping:

- Keep your personal and business finances separate.

- Record all transactions accurately, including Etsy sales, expenses, and payments.

- Regularly reconcile your bank transactions with Etsy sales data to ensure your financial records are correct.

For accounting:

- Prepare essential financial reports, such as Profit and Loss statements, Balance Sheets, and Cash Flow Statements.

- File timely and accurate tax returns based on your business structure, ensuring you comply with tax laws and Marketplace Facilitator Tax regulations.

Cash vs. accrual accounting for Etsy

When managing your Etsy store’s finances, you have two main accounting methods to choose from: cash accounting and accrual accounting.

With cash accounting, transactions are recorded when money is actually received or spent. For Etsy sellers, this means recording sales when payment is received from Etsy and documenting expenses when they are paid. This method is often simpler and provides an immediate view of your cash flow, making it ideal for smaller Etsy shops or sellers with straightforward transactions. However, it may not always give a complete picture of your business’s financial health if you have pending orders, unpaid invoices, or delayed payments.

Accrual accounting, on the other hand, is typically the preferred method for ecommerce businesses as they grow. With this approach, transactions are recorded when they occur, regardless of when the money is received or paid. For Etsy sellers, this means recognizing sales when an order is placed, even if the payment hasn’t been processed yet, and recording expenses when they are incurred, not just when they’re paid.

Accrual accounting provides a more accurate picture of your Etsy shop’s profitability by matching revenues to the costs involved in making those sales. It gives a clearer view of your business’s long-term financial health. Although accrual accounting is a bit more complex, with the right accounting tools, it becomes manageable and highly beneficial for Etsy sellers as their business scales.

Can Etsy manage the accounting/bookkeeping for me?

While Etsy provides helpful tools for tracking sales, fees, and some expenses, it does not handle your accounting or bookkeeping for you.

Etsy generates transaction reports and summaries, but you’ll still need to organize and input this information into your accounting system. Essential tasks like tracking all your expenses, reconciling transactions, managing inventory, and preparing financial reports remain your responsibility.

To simplify this process, many Etsy sellers use accounting software like QuickBooks Online or Xero. When integrated with tools like A2X, these platforms can automatically sync data from Etsy, helping to ensure accurate financial management and making it easier to stay on top of your taxes and bookkeeping.

Do I still need to manage tax/VAT if my shop’s transactions fall under Marketplace Facilitator rules?

If your Etsy shop’s transactions fall under Marketplace Facilitator (MFV) rules, Etsy handles collecting and remitting sales tax or VAT for you. This typically applies to most sales in the US and the UK. However, not all transactions are covered by MFV rules. For example, if you sell high-value items to customers in the EU, these transactions may fall outside MFV coverage, requiring you to manage VAT compliance yourself.

The good news is that tools like A2X can help by separating MFV transactions from those that fall outside these rules, giving you greater clarity over your obligations.

Additionally, you are still responsible for other tax obligations. This includes reporting your Etsy income on your annual tax returns, as MFV rules do not cover income tax. You must also comply with any local or regional taxes or duties that Etsy does not manage, such as specific customs fees or non-VAT-related levies.

In short, while Etsy handles many tax obligations through MFV rules, you remain responsible for tracking income and managing taxes on transactions not covered by these rules.

We strongly recommend consulting a tax advisor to ensure you’re meeting your specific tax/VAT obligations.

Do I need accounting software for my Etsy store?

If you’re managing a small Etsy shop with a lower volume of transactions, you might consider using a spreadsheet for your accounting and bookkeeping. However, this requires manual data entry, which increases the risk of errors and can become time-consuming as your shop grows.

A better option is to use accounting software, which automates much of the bookkeeping process. With just a few clicks, you can generate key financial reports like Profit and Loss Statements, Balance Sheets, and Cash Flow statements – helping you stay on top of your finances more easily.

What’s the best accounting software for Etsy sellers? The best choice will depend on your specific needs, but popular options include QuickBooks Online, Xero, and Sage. When choosing, think about factors like the size of your Etsy business, your location, and the features you require.

It’s important to note that many accounting platforms don’t have a direct integration with Etsy. To bridge this gap, tools like A2X can sync your Etsy data with your accounting software, ensuring your financial management is both accurate and efficient.

Do I need to hire a professional accountant or bookkeeper for my Etsy shop?

We strongly recommend working with a professional accountant or bookkeeper who specializes in working with other Etsy and/or ecommerce businesses.

Managing Etsy accounting and bookkeeping can be more complex than handling finances for a traditional business. A professional will help ensure you stay compliant with tax laws and will give you an accurate picture of your shop’s profitability, helping you make informed decisions.

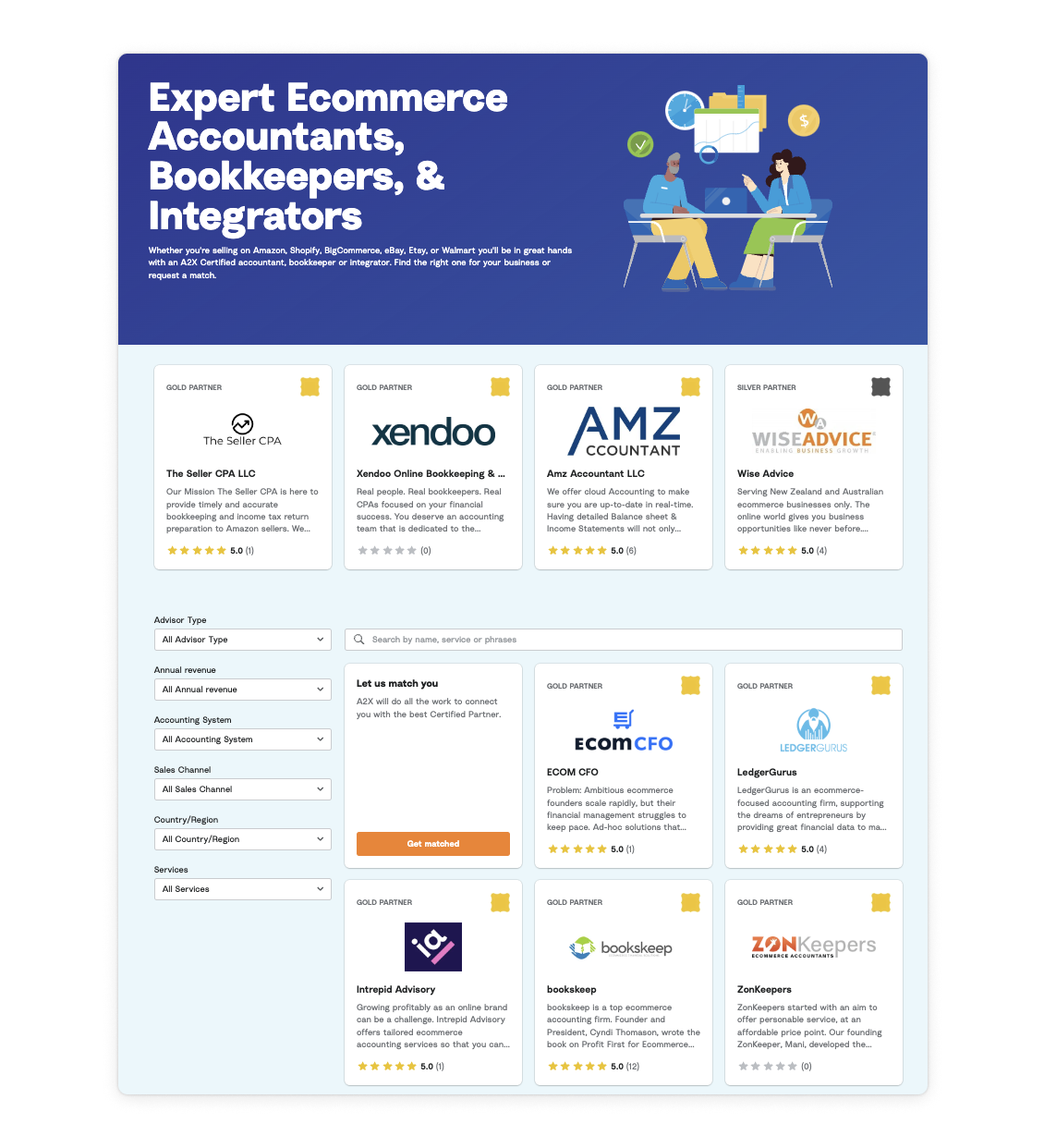

Where can you find an accountant or bookkeeper experienced with Etsy sellers? A great starting point is A2X’s Ecommerce Accountant Directory. You can either input your business details or choose the “get matched” option to find a professional tailored to your specific needs.

If you’re already selling on platforms like Amazon, Shopify, or eBay and are considering adding Etsy, here are some important accounting and bookkeeping considerations:

- Etsy-specific fees – Etsy charges various fees such as listing fees, transaction fees, and payment processing fees. Be sure to track these fees separately for accurate reporting of your expenses, as they can quickly add up.

- Marketplace Facilitator Taxes – Etsy often collects and remits sales tax or VAT for you under Marketplace Facilitator rules. However, you’re still responsible for keeping detailed records of these taxes and ensuring they are accurately reflected in your tax filings.

- Multi-channel inventory management – If you sell on multiple platforms, ensure your accounting system can track inventory across all channels. Etsy sales will impact your stock levels and cost of goods sold (COGS), so it’s crucial to have a system that manages inventory seamlessly.

For a more comprehensive look into the complexities of Etsy accounting and bookkeeping, and how to simplify these tasks, read on.

What makes Etsy accounting and bookkeeping complicated

We’ve mentioned that Etsy accounting and bookkeeping is complicated – but what exactly is complicated about it?

Let’s dive into some of the specific complexities, and some solutions that will help you make Etsy accounting/bookkeeping easy.

Lump sum payments

Etsy payouts are made in lump sum deposits, but this total is not entirely made up of “sales” (and should not be entirely recorded in a “sales” or “income” account).

Etsy deposits often include multiple sales, fees (such as listing and advertising fees), and taxes bundled into one deposit. Etsy deducts these fees before transferring the lump sum to your account. Additionally, as a Marketplace Facilitator, Etsy may collect and remit sales tax or VAT on your behalf, which is reflected in the gross transaction amount.

It’s important to break down these transactions accurately in your accounting. Reporting the full lump sum as “sales” can misrepresent your revenue, leading to inaccurate tax filings and a distorted view of your business performance.

While Etsy provides reports to help you review payouts, manually categorizing each transaction can be time-consuming and prone to errors.

Solution: Use A2X, which automatically imports and categorizes fees (listing, transaction, payment processing, etc.) for each sale. This reduces manual tracking and ensures accurate financial reporting.

Sales tax and VAT management

While Etsy collects and remits sales tax or VAT in some jurisdictions due to Marketplace Facilitator laws, sellers still need to track this for their records and ensure taxes are properly reported on their tax returns.

Additionally, Etsy does not handle all tax scenarios, particularly for international or higher-value sales, leaving sellers responsible for managing tax obligations in certain regions.

Solution: Leverage Etsy’s tax settings to ensure that sales tax and VAT are collected where applicable. To simplify record-keeping, use A2X to automatically track tax amounts, and consult with an accountant to ensure compliance with local and international tax laws.

Inventory management

If you’re selling on multiple platforms, managing inventory can be a challenge. Etsy sales affect your overall stock levels, and it’s essential to track inventory across all sales channels. Without an integrated inventory system, sellers may struggle to keep accurate records of cost of goods sold (COGS) and avoid stock discrepancies.

Solution: Implement inventory management software that syncs with Etsy and other platforms you sell on, ensuring real-time tracking of stock levels across all channels. Learn how to manage COGS and Inventory with A2X here.

Currency conversion and international sales

Etsy sellers may deal with international customers and payments in different currencies, leading to complications with currency conversion. Etsy charges a currency conversion fee if your shop’s currency is different from your payment account’s currency. Tracking exchange rates and accurately recording international transactions adds another layer of complexity.

Solution: Use a multi-currency accounting software like Xero or QuickBooks, which tracks exchange rates and handles currency conversion fees automatically. This will help you accurately record international transactions and manage the impact of currency fluctuations on your bottom line.

Offsite Ads fees

Etsy’s Offsite Ads program can create confusion, as it charges sellers an additional fee (12-15%) for sales driven by external ads. Since this fee is applied only when a sale is made through these ads, it needs to be accounted for separately from other transactions, making bookkeeping more complex for sellers subject to this fee.

Solution: Use A2X to separate Offsite Ads fees from other expenses. Automating this process ensures these fees are tracked and categorized correctly without the need for manual entry, improving accuracy in expense reporting.

Shipping and fulfillment costs

Etsy allows sellers to purchase shipping labels through the platform, adding another expense to track. In addition, shipping costs can vary depending on the carrier, destination, and package size. Keeping accurate records of these shipping expenses is crucial for properly calculating profits and managing expenses.

Solution: Use Etsy’s shipping integration with ShipStation or Pirate Ship to keep shipping costs organized. You can also use A2X to ensure these costs are automatically recorded in your accounting system to accurately track expenses related to shipping and fulfillment.

Customization and variability in products

Etsy sellers often deal with custom or handmade items, which can complicate inventory tracking and pricing. The time and materials for each item might differ, making it difficult to calculate the cost of goods sold (COGS) consistently. Custom orders also often have different pricing or requirements, further complicating revenue tracking.

Solution: For custom or handmade items, maintain detailed records of materials and labor costs using an inventory tracking system that allows for flexible COGS calculations. Learn more about managing COGS with A2X here.

Seasonal sales and cash flow fluctuations

Etsy shops often experience seasonal sales peaks, such as during the holiday season. Managing cash flow during these periods and accounting for fluctuating sales and expenses adds an extra challenge for bookkeeping, as it affects inventory planning, taxes, and profitability analysis.

Solution: Stay up-to-date with your bookkeeping using A2X, and use cash flow forecasting tools in your accounting software to anticipate seasonal fluctuations. Plan inventory purchases, expenses, and tax obligations around peak seasons, and use historical data to create a financial cushion for slower periods.

How to record Etsy sales

Learn how to record Etsy sales in QuickBooks Online quickly and easily in this video.

Need help with Etsy accounting and bookkeeping?

Find an accountant or bookkeeper who specializes in working Etsy sellers in the A2X Ecommerce Accountant Directory.

Frequently Asked Questions

Integrate Etsy and your accounting software for accurate accounting

A2X auto-categorizes your Etsy sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today