Comparing A2X with QuickBooks Online Connector? You’re in the right place.

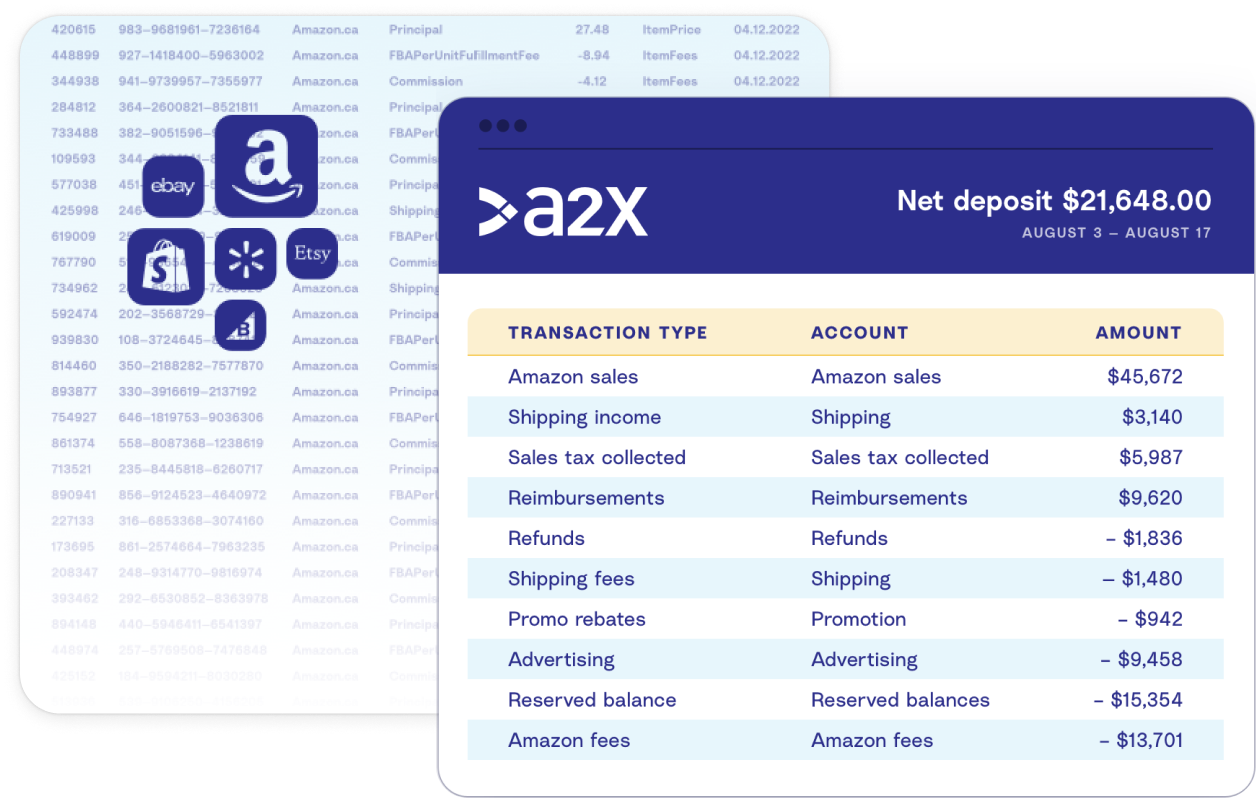

A2X integrates Amazon, Shopify, and other sales channels with QuickBooks Online Online for accurate accounting. QuickBooks Online can also collect sales data from channels using its Connector, but with limitations. Find out if A2X is the right solution for your ecommerce business.

The #1 choice

Award–winning solution, loved by over 12,000 merchants and accountants

A2X & QUICKBOOKS CONNECTOR

So, what’s the difference?

A2X and QuickBooks Connector are ecommerce automation apps that post transaction data from Amazon, Shopify, and other sales channels to QuickBooks Online for reconciliation.

A2X has advanced functionality and control designed for businesses that are scaling or planning to scale, as well as their accounting partners. Whether you’re selling in multiple states, countries, or currencies, A2X provides you with customization options to accurately track sales, taxes, and other transaction types. QuickBooks Connector supports businesses that are just starting out with less complex needs.

A2X provides advanced functionality for accurate accounting at every stage of your growth

Industry leader in ecommerce accounting automation

Focused on accurate data categorization for scaling businesses

Customizable to suit advanced accounting, tax, currency, and multi-channel requirements

Provides expert ecommerce support

a2x features

Whether you’re selling on one channel or many; in different currencies, tax rates, and locations, A2X has you covered

Proven ecommerce track record

A2X has been built on years of experience in ecommerce accounting. A2X entries follow accounting best practices and we keep up with the ever-evolving ecommerce landscape.

Accounting accuracy you can trust

When it comes to transaction granularity and tax categorization, A2X is the most accurate solution used by top ecommerce accounting and bookkeeping practices around the world.

Expert support at your fingertips

The A2X team has deep ecommerce accounting expertise and can support you on your journey. They are available in every time zone.

compare solutions

A2X & QuickBooks Connector

Although A2X and QuickBooks Connector are both ecommerce accounting automation apps, they provide different solutions, for different stages of growth, to reconcile your ecommerce payouts.

|

QuickBooks Connector |

|

|

|---|---|---|

|

Amazon |

|

|

|

Shopify |

|

|

|

eBay |

|

|

|

Etsy |

|

|

|

Walmart |

|

|

|

QuickBooks Online |

|

|

|

Xero |

|

|

|

NetSuite |

|

|

|

Sage BCA |

|

|

|

|

|

|

|

Posts COGS |

|

|

|

|

|

|

|

|

|

|

|

Ability to match back to the Shopify Finance Summary Report |

|

|

|

Countries supported |

US only |

UK, EU, US, CA, AU, NZ, and all countries globally |

|

Currencies & taxes supported |

US only |

US, UK, EU, AU, NZ, & MORE |

|

24/7 expert chat support available |

|

|

|

Onboarding included on premium plans |

|

|

|

Ability to map tax rates on all transaction types |

|

|

|

Ability to split sales by SKU or product type |

|

|

|

All transaction data split by taxed and non-taxed |

|

|

|

Maximum history available |

|

|

|

Two accrual entries when the settlement crosses a month end |

|

|

|

Entry types |

Sales receipt, expense entry, refund entry, and bank deposit, all posted to a clearing account |

Journals (QuickBooks Online, Sage, NetSuite and Custom) or invoices (Xero) matching to the bank deposit |

|

Ecommerce Partner Program for all accountants and bookkeepers |

|

|

|

Certification available for accountants and bookkeepers |

|

|

|

Integrates with products or inventory within QuickBooks Online |

|

|

|

Ability to update the settings on past payments |

|

|

|

Ability to exclude data or transaction types from an entry |

|

|

| Price | Free for QuickBooks Online users | Starting at $29 per month |

QuickBooks Connector

Amazon

Shopify

eBay

Etsy

Walmart

QuickBooks Online

Xero

NetSuite

Sage BCA

Posts COGS

Ability to match back to the Shopify Finance Summary Report

Countries supported

US only

UK, EU, US, CA, AU, NZ, and all countries globally

Currencies & taxes supported

US only

US, UK, EU, AU, NZ, & MORE

24/7 expert chat support available

Onboarding included on premium plans

Ability to map tax rates on all transaction types

Ability to split sales by SKU or product type

All transaction data split by taxed and non-taxed

Maximum history available

Two accrual entries when the settlement crosses a month end

Entry types

Sales receipt, expense entry, refund entry, and bank deposit, all posted to a clearing account

Journals (QuickBooks Online, Sage, NetSuite and Custom) or invoices (Xero) matching to the bank deposit

Ecommerce Partner Program for all accountants and bookkeepers

Certification available for accountants and bookkeepers

Integrates with products or inventory within QuickBooks Online

Ability to update the settings on past payments

Ability to exclude data or transaction types from an entry

Price

frequently asked questions

Still have questions? We’re here to help

A2X provides greater granularity, which is beneficial for scaling sellers, especially in terms of account mapping and tax calculations. Unlike QuickBooks Connector, A2X supports all regions, currencies, and tax rates, not just those within the US. Moreover, A2X integrates with a wider range of ecommerce channels and supports various payment gateways. Plus, A2X has a dedicated support team on hand to assist users.

A2X is ideally suited for growing sellers handling anywhere from 200 to over 1 million orders per month. A2X offers advanced tax tracking functionality and greater granularity for data segmentation, such as splitting data by product group or SKU. It's particularly beneficial for sellers who operate in multiple countries, deal with different currencies, or sell on multiple platforms. Furthermore, A2X can be utilized by sellers who have integrated payment gateways on their websites or operate point of sale (POS) locations.

The QuickBooks Connector could be a good fit for smaller sellers who operate within the US and have relatively straightforward tax situations. For instance, it might be ideal for those who don't need to track different tax rates and have uniform taxation across all sales. To use it with Shopify, your store would be required to exclusively accept Shopify Payments, with no other payment gateways in operation.

A2X separates transactions into those that were taxed and those that were not. For instance, if you had sales that did not include tax, A2X would present this information on two separate lines: one for sales that were taxed, and another for sales that were not taxed. A2X also enables tracking of tax on various expenses such as advertising, fees, and many others. Additionally, A2X keeps track of both the marketplace facilitator tax collected and the marketplace facilitator tax remitted.

A2X generates journal entries that directly correspond to the ecommerce payout in your bank account. On the other hand, the QuickBooks Connector posts a variety of different entry types, such as sales receipts, expenses, and bank deposit entries, to a clearing account.

A2X can generate a value-based COGS entry in QuickBooks Online or Xero. Once you've uploaded your SKU costs, A2X will create a summary entry for the total amount of your COGS for the period. This entry will debit your inventory asset account and credit your COGS expense account for the value of the goods sold during that period. In addition, A2X can split COGS by product type and can map these to different accounts allowing for advanced reporting.

A2X includes all transaction types, encompassing fees, lending, warehousing, refunds, advertising, reserve balances, and many more. These various transaction types will be grouped under relevant categories such as 'commission and selling fees' or 'fulfillment and warehousing'.

In addition to the entries for Shopify Payments, A2X will create separate entries for each of your payment gateways. You will be required to account for any fees imposed by your payment gateways in your accounting software.

Yes. A2X lives outside of your accounting software, so you can disconnect it and/or reconnect it at any time.

As your business grows, your number of orders will increase. If each order were posted individually, you would end up with a high volume of entries, potentially overwhelming your accounting software. Additionally, you don't receive payment for every order individually; you're paid in batches (lump sum payouts covering multiple orders and/or spanning several days). Reconciling each individual order to a single deposit would be extremely challenging. Moreover, some transactions are periodic and aren't tied to specific orders. Reserve balances and certain fee types are examples of these. Posting individual orders wouldn't account for these transaction types.

Yes, A2X collaborates with some of the world's leading ecommerce accountants and bookkeepers. You can find the right professional for your needs in the A2X Directory.

Yes, A2X supports both. Click here to find out more about QuickBooks Online tracking classes and click here to find out more about Xero’s tracking codes.

INDEPENDENT REVIEWS

There are a number of independent blogs written about A2X by ecommerce accounting experts

A2X is also listed on all major review websites, such as;

Ready to get started?

Save time, work smarter, and get accurate Amazon and Shopify financials into QuickBooks Online you can trust.