Comparing A2X with Link My Books? You’re in the right place.

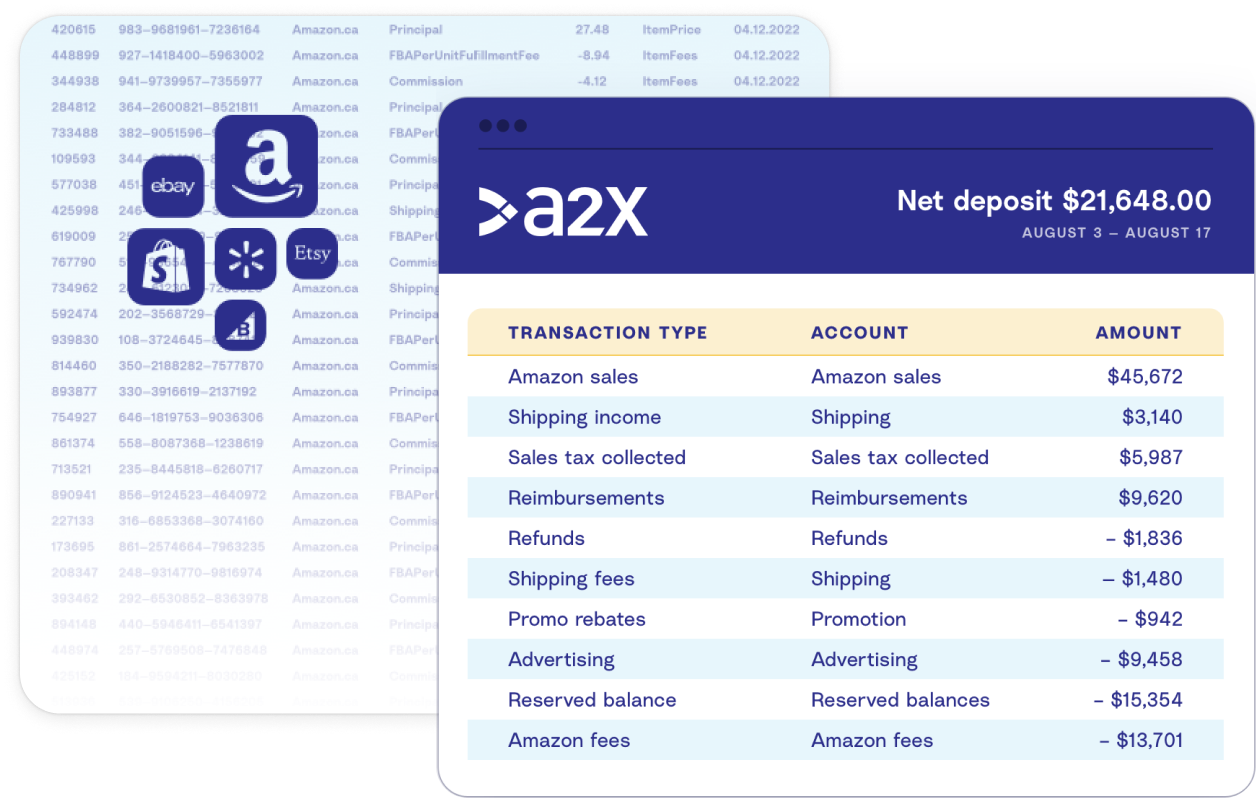

A2X is an award-winning ecommerce accounting automation software that transforms messy payout data into organized summaries that reconcile perfectly in Xero or QuickBooks Online. Link My Books also posts sales to your accounting software, but there are key differences. Find out if A2X is the right solution for you.

The #1 choice

Award–winning solution (Xero Awards), loved by over 12,000 merchants and accounting professionals

A2X & LINK MY BOOKS

So, what’s the difference?

A2X and Link My Books are ecommerce automation apps that post transaction data from sales channels to accounting software for reconciliation.

A2X is built for businesses seeking maximum compliance, accuracy, and scalability. Recognized by Xero as the Practice App of the Year in both the UK and Canada, A2X offers award-winning accuracy that sets it apart. A2X ensures the highest level of compliance with HMRC’s Making Tax Digital (MTD) requirements.

A2X uniquely guarantees provable reconciliation, ensuring that accounting software, A2X, and sales channel data all align seamlessly. With a UK team comprising certified bookkeepers and accounting professionals, and backed by top UK ecommerce accounting firms, A2X delivers unmatched expertise in UK-specific accounting practices and VAT requirements.

A2X provides advanced functionality for accurate accounting at every stage of your growth

A2X ensures the highest level of compliance with HMRC’s Making Tax Digital (MTD) requirements.

A2X’s unmatched accuracy earned it the Xero Practice App of the Year in the UK and in Canada.

A2X is the only tool that provides monthly reconciliation reports that ensure your accounting software, A2X, and sales channel data all tie back.

Our team includes UK-certified accountants and bookkeepers, accredited by recognized accounting bodies dedicated to resolving your queries.

a2x features

Whether you’re selling on one channel or many; in different currencies, tax rates, and locations, A2X has you covered

Don’t overpay tax

Get the most advanced tax mapping to categorize taxed, untaxed, and tax exclusive transactions with A2X.

MTD compliance

Feel confident in your compliance with a clean, searchable transaction summary attached to every accounting entry.

Accounting accuracy you can trust

When it comes to transaction granularity and tax categorization, A2X is the most accurate solution used by top ecommerce accounting and bookkeeping practices around the world.

compare solutions

A2X vs. Link My Books

Although A2X and Link My Books are both ecommerce accounting automation apps, they provide different solutions for reconciling your ecommerce payouts.

|

Link My Books |

|

|

|---|---|---|

|

Amazon, Shopify, eBay, Etsy, and Walmart |

|

|

|

PayPal |

|

|

|

Xero and QuickBooks Online |

|

|

|

NetSuite and Sage |

|

|

|

Ability to post COGS |

|

|

|

Advanced history fetch capabilities that can service large Shopify sellers and keep up with their order volumes |

|

|

|

Has integrations to automate SKU cost import (including Finale IMS, Shopify Costs, Google Sheets, and Cloud CSV) |

|

|

|

Supports third-party payment gateways on your Shopify |

|

|

|

Allows for daily posting of payment gateways to ensure MTD compliance |

|

|

|

Supports Xero Tracked Inventory |

|

|

|

Has reports that allow you to tie your numbers back to your sales channel to verify the accuracy |

|

|

|

Ability to match back to the Shopify Finance Summary Report |

|

|

|

Ability to match back to the Amazon Summary Report |

|

|

|

Xero Practice App UK & Canada Awards winner |

|

|

|

Accredited support team available in all regions |

|

|

|

Trusted by the top ecommerce accountants and bookkeepers in the UK and around the world. |

|

|

|

Currencies & taxes supported |

US, UK, NZ, AU |

Automated for UK/EU, US, CA, AU, NZ |

|

Onboarding included on all plans |

|

|

|

Ecommerce Partner Program for all accountants and bookkeepers |

UK & EU Focused |

Global |

|

Certification available for accountants and bookkeepers |

|

|

|

Customisable to exclude data or transaction types from an entry |

|

|

| Price | Starting at $17 per month for up to 200 transactions per month | Starting at $29 per month for up to 200 transactions per month |

Link My Books

Amazon, Shopify, eBay, Etsy, and Walmart

PayPal

Xero and QuickBooks Online

NetSuite and Sage

Ability to post COGS

Advanced history fetch capabilities that can service large Shopify sellers and keep up with their order volumes

Has integrations to automate SKU cost import (including Finale IMS, Shopify Costs, Google Sheets, and Cloud CSV)

Supports third-party payment gateways on your Shopify

Allows for daily posting of payment gateways to ensure MTD compliance

Supports Xero Tracked Inventory

Has reports that allow you to tie your numbers back to your sales channel to verify the accuracy

Ability to match back to the Shopify Finance Summary Report

Ability to match back to the Amazon Summary Report

Xero Practice App UK & Canada Awards winner

Accredited support team available in all regions

Trusted by the top ecommerce accountants and bookkeepers in the UK and around the world.

Currencies & taxes supported

US, UK, NZ, AU

Automated for UK/EU, US, CA, AU, NZ

Onboarding included on all plans

Ecommerce Partner Program for all accountants and bookkeepers

UK & EU Focused

Global

Certification available for accountants and bookkeepers

Customisable to exclude data or transaction types from an entry

Price

frequently asked questions

Still have questions? We’re here to help

A2X is best suited for growing sellers, handling upwards of 200 orders per month all the way up to 1M+ orders per month. A2X provides accrual accounting entries, advanced tax tracking functionality, and attaches a data file to support MTD compliance. Should you need to look up a specific order. A2X supports sellers who sell in multiple countries with different currencies and across multiple platforms. Sellers with payment gateways on their site, or those with POS locations, can use A2X. A2X caters to more complex tax and VAT requirements.

If you're a UK seller with relatively straightforward tax/VAT requirements, then Link My Books could be suitable for you. It's always best to discuss your business requirements, including MTD compliance with your accountant or bookkeeper to ensure you're choosing the right solution.

Yes, A2X provides an assisted setup feature, enabling you to get up and running in minutes. A2X can automate account mapping for all countries and can automate tax mapping for most countries (including UK/EU) for Amazon, Shopify, and eBay.

Yes, A2X has direct integration with Shopify. This means that if you use payment gateways on your site, A2X will identify which sales occurred through these third-party gateways. These gateways will automatically be categorized into their own entry and can be posted daily, weekly, or monthly. All sales, tax, discounts, etc., will be included in these summaries; you will only need to account for any fees payment gateways have charged you.

Yes, the tax rates you select within A2X are directly linked to your Xero tax rates. If you apply tax to a transaction type, Xero will calculate tax for that transaction type accordingly.

Yes, A2X can differentiate between sales taxed vs. sales not taxed. If you want to set up further differentiation, you can create product groups within A2X or split your sales by SKU.

Yes, A2X identifies which sales occurred within your home country and which sales were shipped overseas. For example, it would differentiate between UK and non-UK sales.

Yes, A2X will identify transactions where the tax has already been paid, for instance, if Amazon collected your tax under the marketplace facilitator tax rule. Within A2X, you can differentiate between sales taxed and sales not taxed.

Alongside sales, A2X will also categorize the NET amount on expenses, allowing your accounting software to calculate the VAT on expenses.

A2X offers several ways to help you comply with MTD requirements, including the types of entries it posts and how it categorizes your tax. You can find more information on how A2X supports ecommerce sellers to be MTD compliant here.

A2X differentiates between transactions that were taxed and those that weren't. For example, if you had sales that didn't include tax, A2X would create two separate lines for sales: sales taxed and sales not taxed. A2X also allows you to track tax on expenses like advertising, fees, and many others. Furthermore, A2X can track both the marketplace facilitator tax collected and the marketplace facilitator tax remitted.

A2X can generate a value-based COGS entry in QuickBooks Online or Xero. Once you've uploaded your SKU costs, A2X will create a summary entry for the total amount of your COGS for the period. This entry will debit your inventory asset account and credit your COGS expense account for the value of the goods sold during that period. In addition, A2X can split COGS by product type and can map these to different accounts allowing for advanced reporting.

A2X covers all types of transactions, including fees, lending, warehousing, refunds, advertising, reserve balances, and many more. All of the different transaction types are grouped under categories such as 'commission and selling fees' or 'fulfillment and warehousing'.

Yes, A2X collaborates with some of the world's leading ecommerce accountants and bookkeepers. You can find the right professional for your needs in the A2X Directory.

Yes, A2X operates independently from your accounting software, so you can disconnect or reconnect it at any time.

Yes, A2X supports both. Click here to find out more about QuickBooks Online tracking classes and click here to find out more about Xero’s tracking codes.

INDEPENDENT REVIEWS

There are a number of independent blogs written about A2X by ecommerce accounting experts

A2X is also listed on all major review websites, such as;

Ready to get started?

Save time, work smarter, and get reliable Amazon and Shopify financials into Xero or QuickBooks Online that you can trust.