Amazon Seller Bookkeeping in Xero: Step-by-Step Guide

Written by: Allanah Faherty

No matter if you’re stepping into the world of Amazon entrepreneurship or already well on your way to building a successful business, you’ll have to wrestle with the complexities of managing your Amazon seller bookkeeping and accounting. Far from solely being a way to keep your store compliant, maintaining reliable financials actually equips your business with the knowledge necessary to guide you through good strategic decisions.

Think of your Amazon accounting system as a symphony orchestra. It takes more than a bunch of instruments to produce harmonious music—it’s about getting the right instruments fine-tuned and played in the correct rhythm without eating up all your valuable time. This means leveraging modern technology, effective processes, and a blend of in-house and external expertise. Adapting your tune to your business’s current growth tempo is the very cornerstone of financial triumph.

Note: Some of the advice in this article is specific to UK and EU-based sellers.

Learn from the experts with ‘By the Books’

To help you on your journey to accurate ecommerce accounting, A2X has created the By the Books series. This series offers step-by-step guides created in partnership with expert ecommerce accountants or bookkeepers to help you accurately account for your Shopify, Amazon, eBay, Etsy, Walmart, and BigCommerce sales in QuickBooks Online or Xero using A2X. This series outlines processes, provides tips and tricks, and so much more—all to help you save time, money, and achieve true financial visibility.

In this episode of the By the Books series, we’ve partnered with UK-based Elver E-Commerce Accountants—A2Xpert accounting and bookkeeping partners—on a step-by-step guide to Shopify and Xero bookkeeping with A2X. This guide is the process that Elver’s accountants and bookkeepers use when working with their clients. It has also been reviewed by A2X’s expert in-house support team, making it thoroughly expert-approved.

If you’re not working with an expert ecommerce accountant or bookkeeper you can find Elver E-Commerce Accountants, and others on the A2X Directory.

Why is accurate bookkeeping important for my Amazon business?

If you already know the answer to this question, feel free to skip this section. But read on if you’re looking at your Amazon Seller Central dashboard, reviewing your sales, and wondering why you need accurate bookkeeping in addition to this data.

Most channels and marketplaces, like Amazon, will give you a high-level overview of your sales. But that overview lacks critical context and doesn’t tell you how your business is actually performing. To truly know your numbers and set yourself up for cashflow success, you need to account for sales, expenses, loans, payables, inventory, COGS, etc. $1,000,000 in sales might sound amazing, but not if it’s costing you $975,000, and especially if you don’t even know it.

So, while it’s important to have tidy books to make it easy to file taxes without overstating or understating your income, if you only use them for this purpose, you’re missing out on a multitude of other benefits.

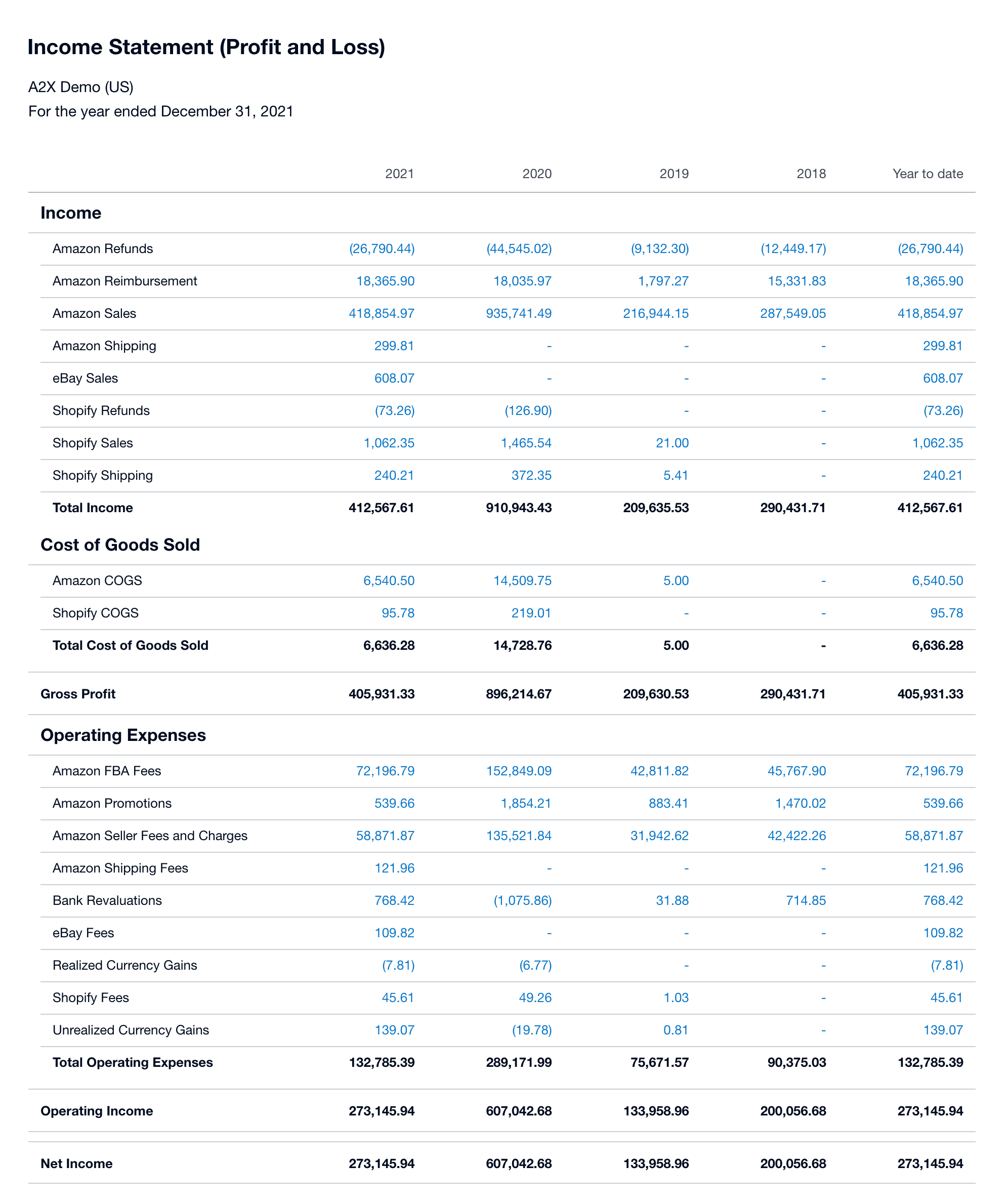

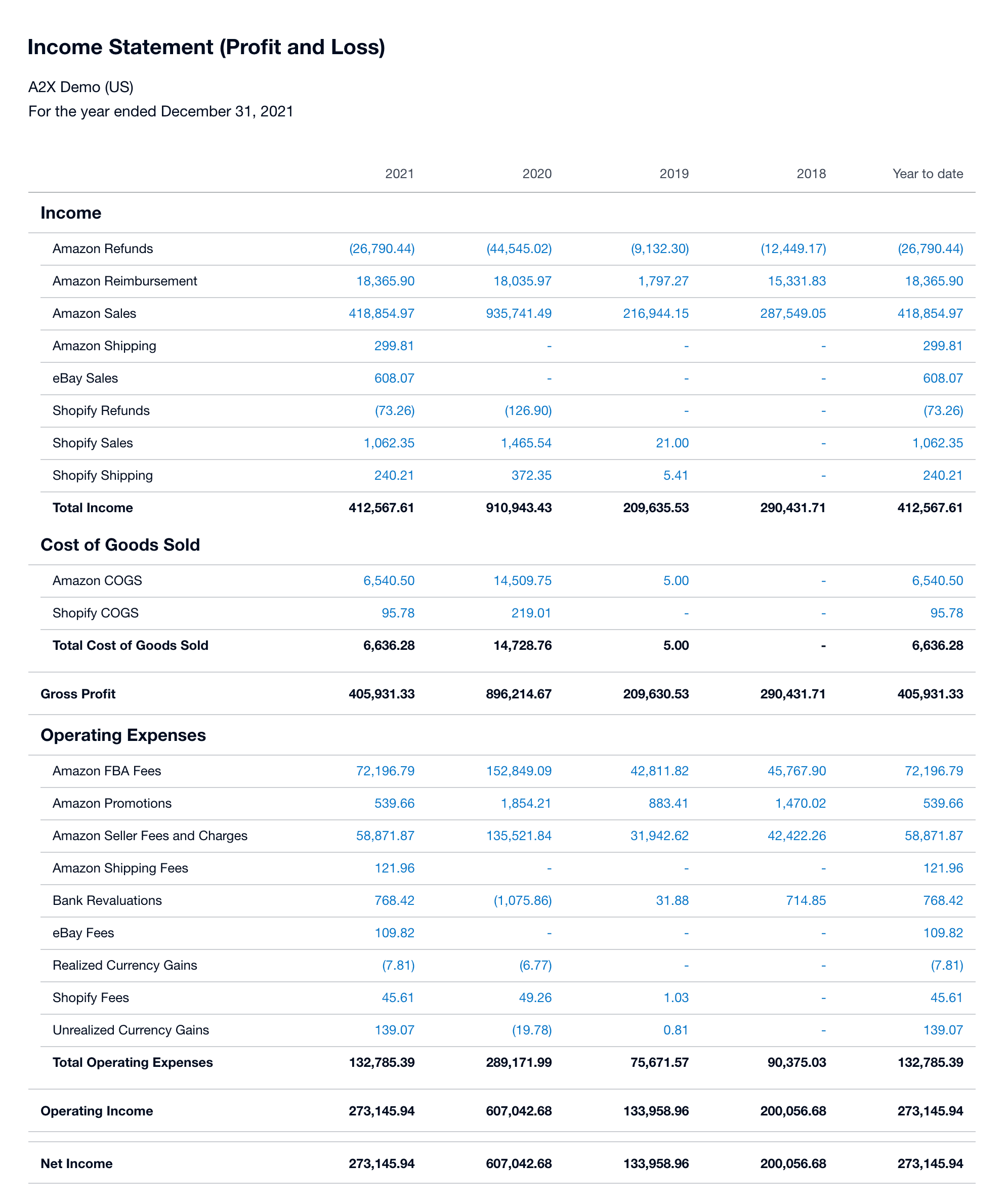

For example, when you accurately account for your Amazon store in Xero using A2X, you’ll receive a comprehensive Profit & Loss Statement (P&L) that itemizes your revenue, COGS, operating expenses, and other relevant information. This report allows you to compare different periods and gain insight into the flow of your finances, enabling you to ask tough questions and address any challenges that arise. For instance, you may need to investigate if your advertising expenses are too high, why your COGS have increased, whether you should raise your prices, or if your business systems are cost-effective.

See this example P&L for a multichannel seller on Shopify, Amazon, and eBay:

The step-by-step guide to monthly Amazon bookkeeping with Xero and A2X

Monthly bookkeeping follows a standard process that requires access to certain documents and recording of information, such as sales, income, expenses, etc.

Before we jump into the high-level review of transactions, you need to have completed a few steps first. Here we’ll briefly outline what you need before you can start a month-end process before we dig in deeper. You can also access our Ecommerce Bookkeeping Checklist as a Google Sheet.

Items or access needed before starting

Whether you’re doing this yourself, working with an in-house team, or a member of an outsourced practice, you need access to a range of documents to accurately complete the month-end process. The following list is an example of what you may need for Amazon bookkeeping, though you may need different documents depending on your situation:

- Monthly Bank and/or credit card statements

- Amazon tax document library (Amazon Seller Central → Reports → Tax Document Library). Here you can access Amazon ads invoices, Amazon FBA fee invoices, Amazon merchant fee invoices.

Pro tip: Conducting a regular review of your Amazon VAT invoices ensures there has been no change in the VAT treatment for costs such as selling fees, FBA fees, and advertising costs, etc. You can do this by reviewing your Amazon VAT invoices in Amazon Seller Central.

Occasionally Amazon has been known to change the billing location and VAT treatment of their fees, and if that occurs you will need to change the mapping in A2X. VAT treatment can also change when a business provides a new VAT number to Amazon. Please remember to add any new VAT registered countries in the “Registered Countries” box in A2X.

- Amazon Loan statement, if applicable

- Invoices for purchase of stock for Amazon sales

Review transactions

This is the first step of the month-end close process. This is when you start using A2X and Xero to review and record transactions.

- Record sales and income (do this by sending sales/income from A2X to Xero)

- Note: Amazon EU VAT data finalizes on the 4th of the following month, e.g., March 25 and ends on April 5 will be on hold until May 4. Until that date, settlements will be marked “on hold” in A2X, we recommend waiting until that date to post these periods as then you will have full country data for VAT purposes.

- Raise any stock purchase invoices in Xero

- Reconcile the bank feed in Xero for the period

- Check for any duplicate invoices or bills in Xero after the bank reconciliation (they will be marked as unpaid).

- Note: If there are bank deposits that cannot be matched with any A2X invoices, the settlement may have been archived in Amazon. Go to Amazon Seller Central → Reports → Payments → All Statements tab to confirm all settlement files are available for direct download in the V2 Flat File format. If they are available, run a history fetch. If they aren’t available, they may have been archived. Contact the A2X support team to get help fetching the payout.

- Reconciliation of Amazon Pending Balances account

- In marketplaces where transaction volumes are low, the net value of the settlement may be negative. Amazon often finalizes the settlement on the basis that they will collect the value of this settlement from the seller. However, this often does not occur and the balance is carried forward into the next settlement. In this circumstance, the initial settlement should include an entry referred to as a “pending balance,” reducing the net settlement value to nil. However, because Amazon has assumed it will collect this balance, the pending balance entry is not created. On the following settlement, a pending balance brought forward entry is created, but because there was no carry forward entry on the first settlement, the Amazon Pending Balances account will be out of balance and there will be an unpaid bill in aged payables. The outstanding bill will therefore need to be edited to include the pending balance and bring the Amazon Pending Balances account back into balance. The Amazon Pending Balances account balance should be equal to any pending balances held by Amazon at the end of any given month. Read more about this in our support center.

- Reconciliation of Amazon Reserved Balances account

- The Amazon reserve balance should equal the value of any funds held back by Amazon at the end of any given month.

- Reconciliation of Amazon Carried Balances account

- Carried balances are created when A2X splits a settlement that crosses over a month end into two separate invoices.

- The invoice for the earlier period will include a balance posted to the Amazon Carried Balance account that is equal and opposite to the carried balance brought forward on the second invoice for the later month. This makes the bank reconciliation process easier because the second invoice will always equal the amount received into the bank. The balance on this account should therefore equal the carried balances for all marketplaces that had a carried balance at the end of the month.

- Run the Profit and Loss account for the period (account and balance sheet report)

If you’ve never used A2X before, take advantage of the A2X certification course. This self-paced course will teach you what you need to know about using A2X.

Update COGS / Inventory accounts

After reviewing transactions, next move on to updating COGS or inventory accounts.

- Update any missing costs in A2X

- Record COGS (send COGS information to Xero from A2X, if this is set up)

- Review month-end inventory balance (if your A2X plan supports inventory, you can get the inventory report from A2X for Amazon, if inventory is being held in a FBA facility).

- Note: Amazon also finalizes its inventory data on or around the 10th of the following month.

- A2X COGS adjusts for sales and so a manual journal is required at month-end to adjust for sellable returns, removals, adjustments, and reimbursements. Reports on these can be found in Amazon. A2X support can help you with more information on this process.

Digging deeper

Now that these tasks have been completed we can start with our high level review:

Review of Amazon Pending/Reserved/Carried Balances for foreign exchange differences

Amazon settlements are created in the currency of the marketplace you sell in, therefore you could have settlements in GBP, USD, EUR, AUD, etc.

The invoices that A2X creates will be converted to your accounting base currency using the exchange rate for that day.

Your Pending/Reserved and Carried balances should always balance in the market currency because every entry will be followed by an equal and opposite reversing entry. However these two entries will not net out to zero in your accounting base currency, as they will be converted at different exchange rates. Because of this, you need to determine the foreign currency exchange difference in each of these accounts and write this off to foreign exchange differences.

Reconciliation of VAT/GST liability accounts

If you are selling in multiple marketplaces you may be recording VAT and GST liabilities across many jurisdictions and you could have multiple VAT/GST liability accounts in your balance sheet.

Sales may also be subject to the marketplace rules and therefore accounted for by Amazon. Therefore some of your sales tax may be collected and remitted by Amazon. A2X splits out these transactions using the description MFV/MFT ( marketplace facilitator VAT and Marketplace facilitator tax). This allows you to isolate these transactions and avoid remitting the tax twice on these sales. The A2X Support center has more information on MFV and MFT.

The VAT/GST liability accounts in Xero will be derived from the entries made from the A2X invoices and should be reconciled back to the VAT/GST returns.

The marketplace rules apply:

- When a seller is located outside of the country/countries they are selling to.

- Only to consumer sales, not to business-to-business sales.

- When the goods sold are fulfilled from outside the region of the seller.

For example, if an EU-based seller sells goods in the UK, they are subject to marketplace rules for those sales, but not for their sales within the EU. The same is true for a UK seller selling goods in the EU.

However, even if a seller is selling goods within their own country, they can still be subject to marketplace rules if the goods are fulfilled from outside that country.

If you have sales to business customers, the marketplace rules do not apply.

A2X will enable you to isolate sales subject to the marketplace rules. Marketplace rules are also applicable in many other jurisdictions, such as the USA and Australia.

Zero-rated sales

Certain products are also zero-rated for VAT purposes, meaning the VAT rate is 0%. This includes most food, children’s clothing, and books. A2X can identify these zero-rated products, however this is dependent on receiving the right data from Amazon. This is why it’s important that your products are correctly categorized in Amazon Seller Central. And if you sell a mix of products with different VAT rates you should not apply default VAT rates in Amazon.

Identifying VAT transactions by jurisdiction

A2X can help identify sales that are subject to VAT across different jurisdictions, something that can be challenging depending on the countries you operate from and into.

For non-EU sellers operating in the EU, the situation is generally straightforward. Unless they’re making B2B sales, all their transactions will be subject to marketplace rules.

On the other hand, EU sellers who fulfill orders within the EU need to account for VAT at rates that vary depending on their location. Similarly, a UK seller using Amazon FBA must register for VAT in each country where their inventory is stored. This is required even though, in some cases, no VAT may be due. In certain instances, this registration could be beneficial if there is import VAT to reclaim—a factor that depends on the route the goods take to reach the Amazon FBA warehouses.

The good news is that Amazon does a great job calculating VAT jurisdiction and marketplace categorization. For more information, refer to the article on Amazon methodology, specifically Section 6: Determining the VAT jurisdiction.

As long as the VAT Calculation Service has been enabled in Amazon Seller Central, A2X is able to import the jurisdictional and marketplace VAT data from Amazon directly. You will see transactions such as:

- Marketplace Facilitator VAT (Marketplace VAT)

- B2B (Business to Business Sale)

- Jurisdiction (Country where Amazon has determined the VAT jurisdiction on a transaction lies)

Splitting out your transactions helps you have a better understanding of profitability and avoids you paying VAT on transactions where it has already been remitted by Amazon.

Product Costs

If A2X is being used for determining COGS the product costs will need to be updated. Review your costs in A2X and make sure you’ve posted all your product costs through to Xero and approved those bills.

Note: A2X adjusts the costs for sales, but does not adjust for sellable returns, removals, and damages to stock. Therefore a month-end manual adjustment will be needed for these events. If needed, A2X support can assist with specific instructions for each of these.

Inventory Valuation

When accounting for COGS, all inventory costs will be coded to inventory in the balance sheet in the accounting system. It is good practice to review the resulting inventory balance and perform an inventory valuation at least at year end.

Non Amazon orders fulfilled by Amazon

FBA services may be used for non Amazon sales, but there may also be some orders fulfilled by other means. The COGS calculation should be reviewed to ensure the COGS for these sales are correctly accounted for.

Note: if you prefer your costs to be split out, A2X allows you to split your costs by merchant fulfilled (MFN), Fulfillment by Amazon, and non-Amazon FBA.

Prepare financial statements

After reviewing everything, it’s now time for the final parts of the month-end close process: generating your financial statements in Xero. You should:

- Review and finalize Profit and Loss statement

- Review and finalize Balance Sheet

And that’s it, the Amazon bookkeeping month-end process is complete.

Overwhelmed? The experts can help

As mentioned above, these monthly financial statements are not just about staying compliant; they also contain essential information to help make financial decisions for your business.

If you think you’re missing out on crucial insights, speak with an expert ecommerce accountant, they’ll be able to analyze your statements and assist in planning your next growth phase. Elver can be found on the A2X Directory, along with many other ecommerce accounting experts.

Integrate Amazon and Xero for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today