Etsy Xero Integration: How to Set it Up for Accurate Accounting

Written by Amy Crooymans, Product Marketing Manager at A2X

Updated on February 5, 2025

Integrating Etsy and Xero is a great way to make accounting and bookkeeping for an Etsy store more accurate and efficient.

Etsy sellers and accountants and bookkeepers who work with Etsy sellers will all understand that managing Etsy financials can get complicated.

One of the factors that makes it complicated is the fact that Etsy deposits aren’t entirely made up of sales – so you can’t code them to a ‘Sales’ account and call it a day. Etsy deposits are actually made up of sales, fees, refunds, and other transactions, and it’s important to properly account for them all.

Fortunately, there’s a way to make this easy. Setting up an integration between Etsy and Xero will allow your Etsy data to flow seamlessly into Xero for easy and accurate monthly reconciliation.

In this guide, we’ll explain how to integrate Etsy and Xero.

Key takeaways:

- Integrating Etsy and Xero means setting up a connection so that Etsy transactional data can flow into Xero, making reconciliation quick, easy, and accurate.

- Xero does not offer a direct integration with Etsy, so you need to use a third-party tool to establish an integration. There are a couple of options, and the one you choose will depend on your unique business needs.

- Setting up a Etsy-Xero integration with A2X is easy and just takes a few steps, outlined below.

Table of Contents

Integrate Etsy and Xero for accurate accounting

A2X auto-categorizes your Etsy sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today

Does Etsy integrate with Xero?

Yes, Etsy can integrate with Xero using an app or a tool. An integration between Etsy and Xero will allow Etsy transaction data to flow into Xero.

Xero does not currently support a direct integration with Etsy. This simply means that you’ll need an additional tool to set up the integration.

We’ve outlined a couple of integration tool options below. Before you choose the tool that’s the best fit for your business, however, it’s important to think about how your Etsy store currently operates and how you can prepare for growth.

The accounting method you choose can play a role in your store’s growth – which is why it’s important to familiarize yourself with settlement accounting and accrual accounting (if you’re not already).

Settlement accounting and accrual accounting for Etsy

Settlement accounting focuses on how you record your financial activity, and accrual accounting focuses on the timing that you record the activity.

Practicing both settlement accounting and accrual accounting in tandem is considered best practice when it comes to ecommerce accounting, and Etsy is no exception.

Let’s explore why.

What is settlement accounting?

When we talk about settlement accounting for ecommerce, we’re referring to how your data from Etsy is recorded in your accounting software.

Rather than having an overload of individual orders at the transactional level, the preference should be to manage batches of transactions, which are generated automatically and organized according to your settlement payouts.

Why is that the preference?

This method is highly organized, and easier for both you and your accounting software to digest. As your business grows, neither you nor your accounting software will be overwhelmed and your tech stack will scale with you.

Moreover, it focuses on reconciling the payout you receive from your sales channel, rather than just getting data from Etsy into your accounting software.

What is accrual accounting?

Accrual accounting is all about the timing of your records. Rather than waiting until a sale has been completed and money is in your account, with the accrual method, a record is made of orders when they come through, even if payment isn’t due yet.

How is this helpful?

Cash flow is the movement of value within your business. You need to know what you’ve got now, but also what’s coming up and when you’ll get it.

Recording all future transactions gives you a clearer picture of your business’ performance and more accurate forecasting data.

Accrual accounting is also considered best practice if you’re interested in obtaining a loan or investment for your ecommerce store.

The benefits of settlement and accrual accounting

By recording your financial activity via settlement batches and the accrual method, you will have:

- Quicker and easier reconciliation – As your transaction batches have been calculated and summarized for you, it’s easy to match them against payouts. You have your final bank deposit, with the detail of income and expenses associated with it immediately at your disposal.

- Greater scalability – Accounting software doesn’t work best when overloaded with individual transactions. It’s possible to clog it up, which doesn’t bode well for booming businesses with a lot of financial data. By batching your information, you give your software a break without losing the crucial details you need.

- Professional, industry-standard books – Whether you’re managing your books solo or with an accountant, they need to meet certain standards to be efficient, effective, and investor-ready. Fortunately, integration software can categorize and organize your data for you into the right statements and accounts, ensuring that you have books ready for external use.

The bottom line is that sticking to settlement and accrual accounting can save time and headaches, especially when working to obtain industry-standard books and actionable financial data.

While Xero is a great choice for accounting software for Etsy sellers, it doesn’t do settlement accounting and accrual accounting for you.

But, it is possible if you use an ecommerce integration tool like A2X.

How to integrate Etsy and Xero

As mentioned, Xero does not support a direct integration with Etsy, so you’re going to need an additional tool to help you out with this.

You have a couple options:

- A data syncing app

- An ecommerce accounting automation app that is designed for reconciliation, such as A2X

Use a data syncing app

Generic data syncing apps are usually an inexpensive option that might work for Etsy sellers who are just getting started.

However, there are some limitations to these apps that might cause some issues – especially as your Etsy store begins to grow:

- They might only post data for individual orders – which means that it’s not possible to implement settlement accounting, as discussed above.

- They might not identify all transaction types – which can make it tricky to get accurate, investor-ready financials.

- They’re usually not designed for accounting and bookkeeping purposes – which can make reconciliation challenging.

Use A2X to integrate Etsy and Xero

A2X is a connector app that sits between Etsy and Xero.

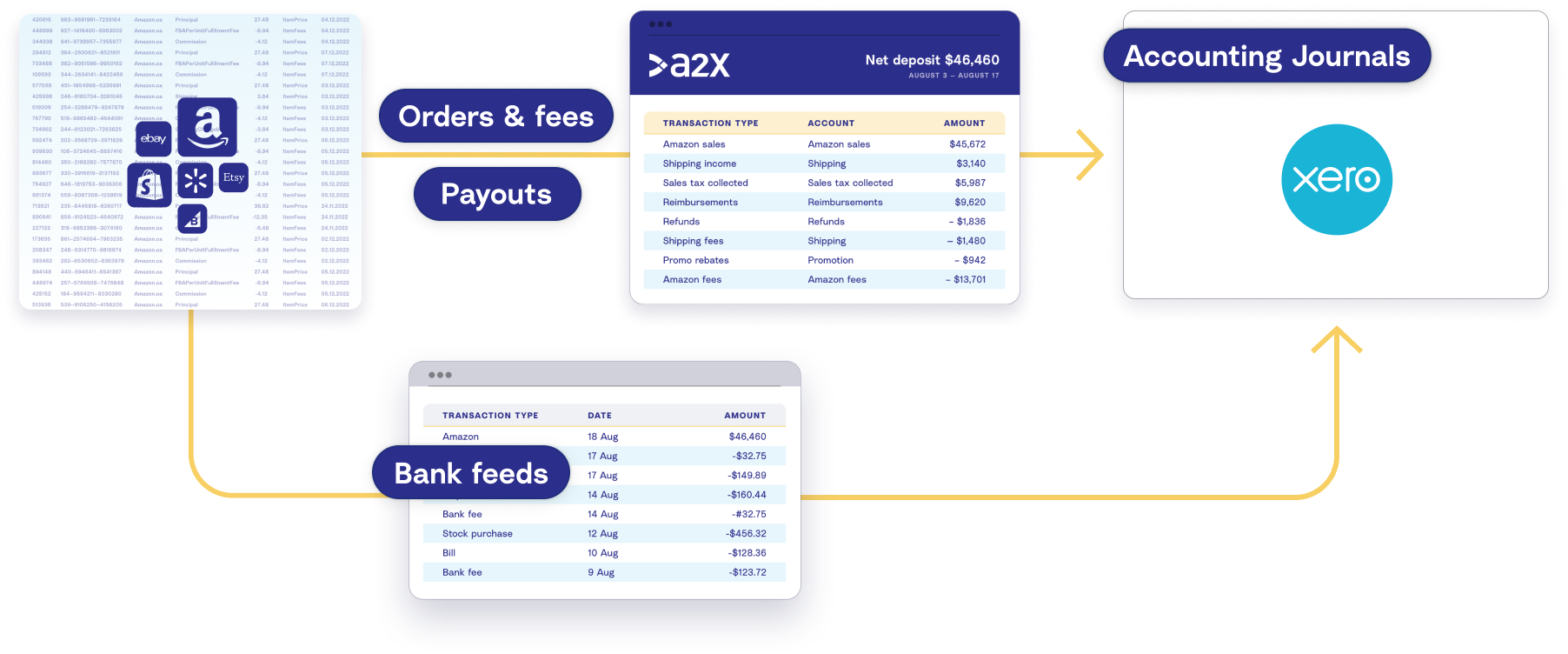

Rather than Etsy flooding your Xero account with individual orders, A2X intercepts that data flow and organizes it for you.

A2X batches your transactions by settlement payout, calculates all the line items associated with each one, and posts them to Xero in neat invoice summaries. All those benefits we discussed from settlement and accrual accounting can be achieved with the help of A2X for Etsy.

A2X also helps you track and calculate your COGS (Costs of Goods Sold) for accurate profit margins, and can even backdate your books if you’ve been operating without it for a while.

Step-by-step: How to integrate Etsy and Xero with A2X

Watch this video to learn how to integrate Etsy and Xero with A2X, then follow the steps below for more details.

1. Sign up for A2X

Sign up for an A2X account here – click ‘Try A2X for free’ in the top right.

You’ll be prompted to select which channel you’d like to connect to first – select Etsy.

Then, follow the prompts to sign up using your preferred method, and enter your necessary information.

Once you’re done, you’ll end up on the A2X dashboard.

Note – When you sign up for A2X, you’ll be in “free trial mode”. This means that you’ll be able to use A2X as a free trial (i.e., with some limited functionality) until you choose to subscribe.

2. Connect to Xero

On the A2X dashboard, you’ll be prompted to connect to your accounting software.

Click the Xero logo, then click ‘Connect to Xero’.

You will be prompted to provide A2X with permission to the Xero organization you’d like to connect to.

Once the connection is established, you’ll end up back on the A2X dashboard.

3. Connect to Etsy

Next, you’ll be prompted to connect to Etsy.

You have two options:

- Option 1: If you are the store owner or have access to the Etsy store you are connecting, select ‘I have access’. Follow the prompts to connect to Etsy.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

After permission is granted, A2X will return you to your A2X dashboard, and your deposits data will automatically start to be fetched by A2X (which you can see in the ‘Deposits’ tab).

4. Map accounts and taxes

Next, it’s time to map your accounts and taxes.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get it right for your specific business.

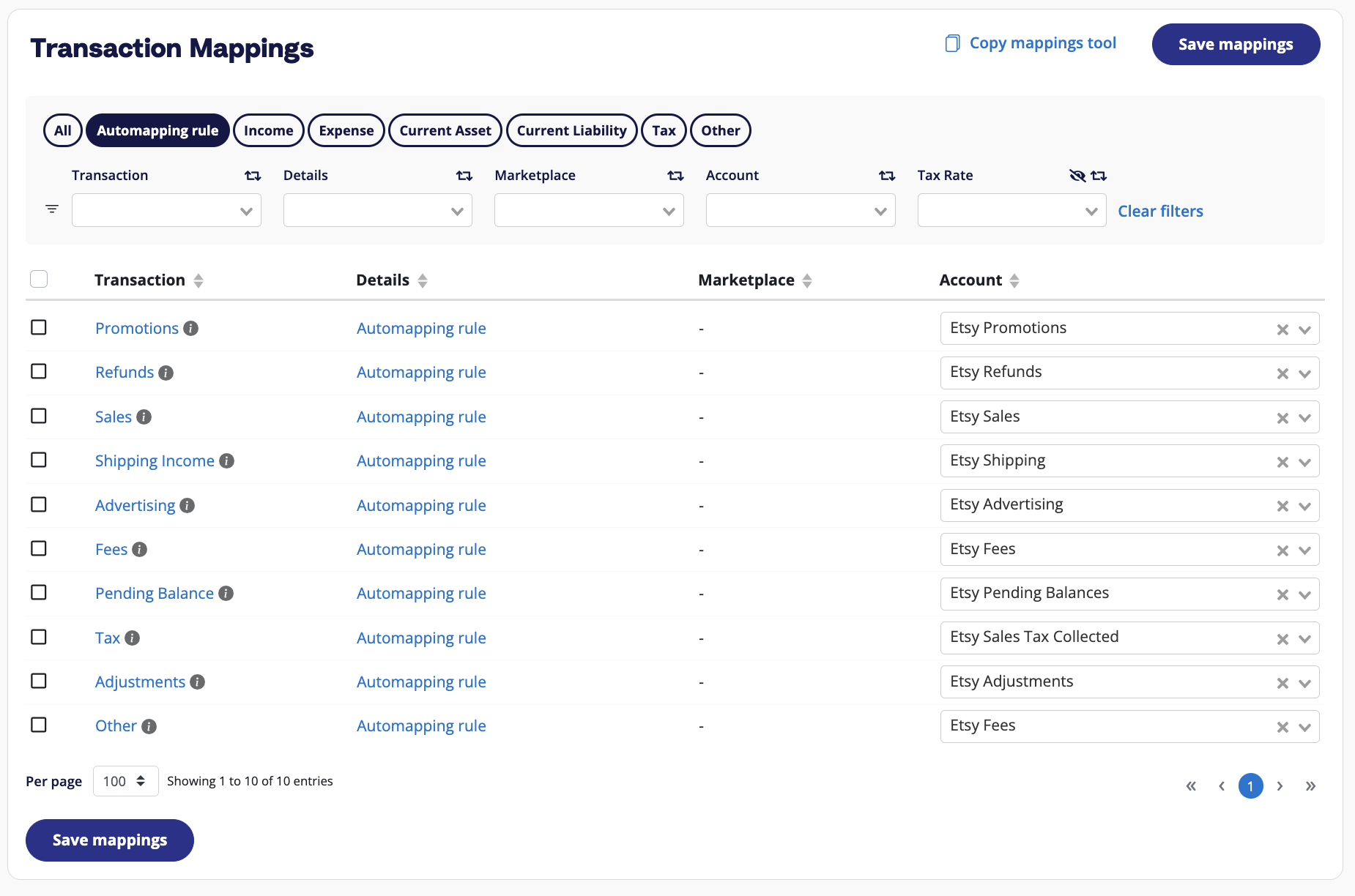

Mapping accounts and taxes is the process of selecting which account in the Chart of Accounts you want each transaction type to be posted to in Xero for all deposits moving forward. For example, sales transactions will be posted to an Etsy Sales account.

A2X can automate this process for you, or you can map it yourself. Once you set this up, all Etsy deposits will be coded according to the settings you’ve selected moving forward.

- Click ‘Setup Account and Taxes’.

- The first time you visit the Accounts and Taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted setup or Custom setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in Xero and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

5. Review and send to Xero

At this stage, you’ve completed your A2X setup!

This step (and the following step) outline how you can complete reconciliation for Etsy using A2X and Xero.

Go to ‘Deposits’, and click ‘Review’ beside the settlement you wish to review and post.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to Xero’ when you’re ready.

Note – auto-posting is available to you when you’re ready to use this.

6. Reconcile in Xero

The post from A2X will appear as an invoice in Xero.

Log in to Xero, then navigate to the bank feed. Beside the deposit from Etsy, you should see the invoice from A2X, ready to be reconciled!

Ready to integrate Etsy and Xero with A2X? Sign up for a free trial here!

Integrate Etsy and Xero for accurate accounting

A2X auto-categorizes your Etsy sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today