Ecommerce Balance Sheet: What to Include & How to Get Insights

Written by: Geoffrey Gualano

What is your ecommerce business’s net worth?

Your balance sheet is the key to answering this question.

If you’re using accounting software, then you can generate a balance sheet in just a few clicks and get a comprehensive understanding of your business’s financial position at a certain point in time.

But… you might have poor data that can lead to inaccuracies, so you don’t trust the numbers. Or, maybe your balance sheet isn’t set up well for your ecommerce business, so you don’t review it on a regular basis.

This guide is here to help! We’ll cover the basics of a balance sheet for ecommerce, including how to build one that you’ll actually want to review, and how to generate insights, with expertise from Jason Snider, Managing Director at Summit eCommerce Advisors.

Key takeaways:

- What is an ecommerce balance sheet, and why is it important? An ecommerce balance sheet provides a snapshot of a business’s financial position, detailing assets (e.g., inventory, pending payments), liabilities (e.g., credit card debt, sales tax obligations), and equity. It’s crucial for compliance, financial decision-making, and securing investments or loans, helping businesses track financial health and stability over time.

- What’s different on an ecommerce balance sheet? Ecommerce businesses have unique financial considerations, such as “Inventory in Transit” (prepaid inventory not yet received), pending payments from online platforms (e.g., Shopify, PayPal, Affirm), and complex sales tax liabilities across multiple regions. Unlike traditional businesses, ecommerce companies may have fewer fixed assets but rely heavily on digital payment processing and clearing accounts.

- How can ecommerce businesses get accurate insights from a balance sheet? Using accounting software (e.g., QuickBooks, Xero) and integration tools like A2X helps ensure accurate transaction tracking. Regularly analyzing trends in assets and liabilities, monitoring financial commitments, and working with an ecommerce-savvy advisor can provide valuable insights for growth and profitability.

What is a balance sheet?

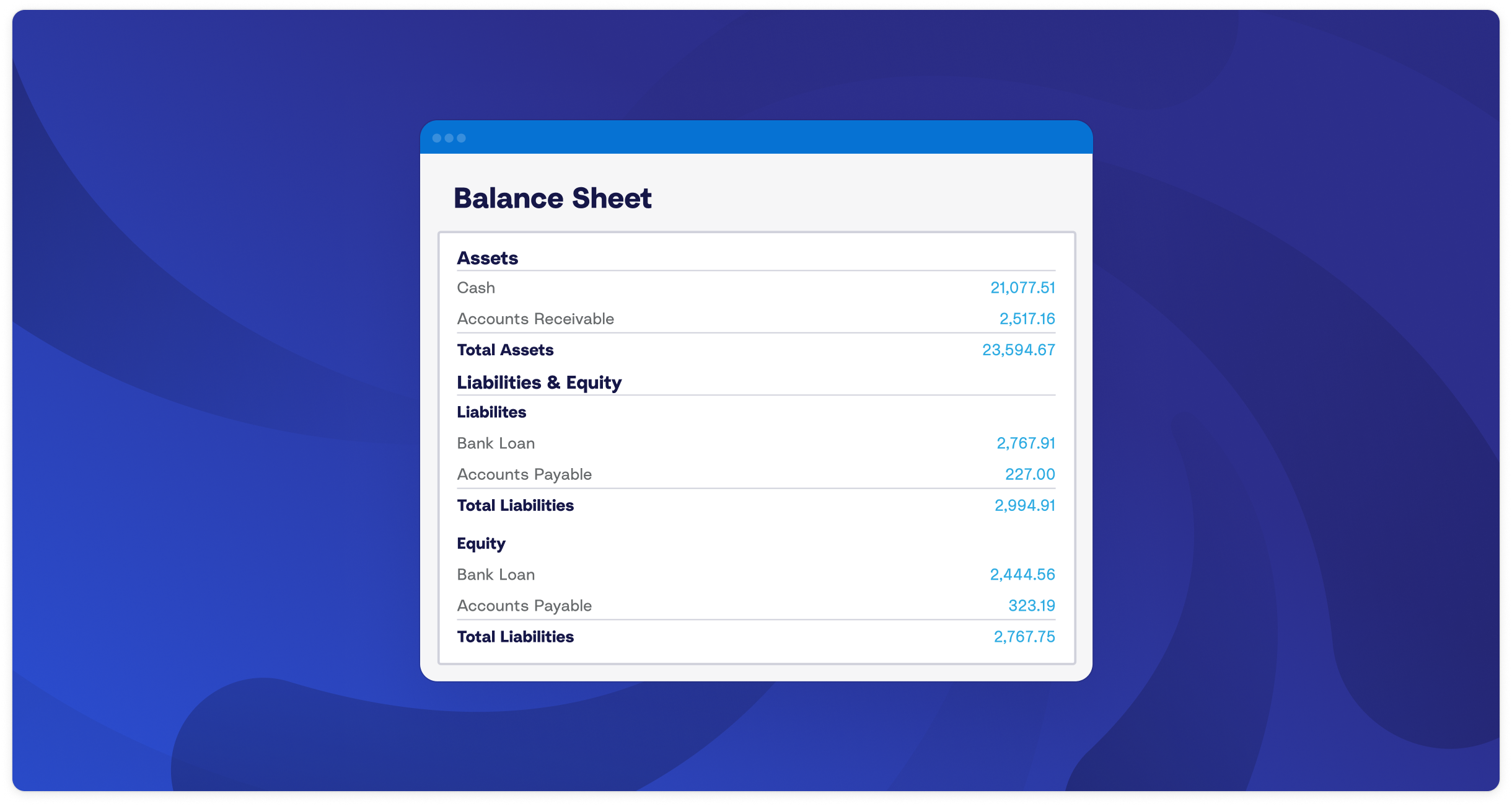

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time, typically highlighting the company’s assets, liabilities, and equity.

A business’s balance sheet also provides a cumulative understanding of their financial position. According to Jason:

The balance sheet is the accumulation of all the transactions on the general ledger over the number of years the business books have been in existence.

The balance sheet plays a key role in helping stakeholders understand an ecommerce business’s financial health and stability by helping solve the equation: If your ecommerce business had to settle all your debts (liabilities) with what you have (assets), what would you have left today (equity)?

It’s important to note that you should look at your balance sheet alongside two other important financial reports – your Income Statement (a.k.a., Profit and Loss) and your cash flow forecast – to get a complete picture of how your ecommerce business is performing. You can learn more about the differences between an income statement vs. a balance sheet vs. a cash flow forecast here.

In this guide, we’ll focus on what ecommerce businesses should include in their balance sheet and what they can learn from it.

Why do I need a balance sheet for my ecommerce business?

If you’re laser-focused on profitability, then your interest in your balance sheet might be superseded by your interest in your Profit and Loss.

However, balance sheets are just as important for running a healthy ecommerce business (and helping you reach your business goals) – here are a few reasons why.

- Compliance

Balance sheets ensure ecommerce businesses adhere to financial standards and legal requirements, providing an accurate snapshot of the financial position for tax filings, audits, and disclosures. They help prevent legal issues by demonstrating compliance with accounting principles, maintaining trust and accountability with stakeholders.

- Financial decision-making

Your balance sheet provides a snapshot of assets, liabilities, and equity, informing current financial status and future decisions by highlighting strengths and opportunities (more on this below). By comparing balance sheets over time, they can also help you allocate resources, track growth, and evaluate strategies.

- Lending and investment

A well-prepared balance sheet boosts investor confidence by showing financial stability and profitability potential, helping investors assess liquidity, debt, and asset management. It also helps lenders and creditors evaluate creditworthiness, secure loans, and obtain favorable terms, whereas a weak balance sheet can indicate instability and lead to higher borrowing costs.

Assets, liabilities, and equity for ecommerce

Let’s break down what we mean by “assets”, “liabilities”, and “equity” further.

Assets are resources owned by the company that are expected to generate future economic benefits. A key example of an asset for an ecommerce business is inventory. Assets can be categorized into:

- Current assets, which could include cash and cash equivalents, accounts receivable, and prepaid expenses.

- Non-current assets, which could include property and equipment, intangible assets (e.g., trademarks, patents, domain names), and goodwill.

Liabilities are obligations the company must settle in the future, such as credit card debt. Liabilities can be further categorized as:

- Current liabilities, such as accounts payable, short-term loans, accrued expenses, and deferred revenue.

- Non-current liabilities, such as long-term debt, lease obligations, and deferred tax liabilities.

Equity represents the owner’s residual interest in the company after liabilities have been deducted from assets. For an ecommerce business, equity could include retained earnings, additional paid-in capital, and treasury stock.

With these definitions in mind, you can see how the balance sheet can help you understand your financial position and net worth, as it provides a snapshot of what you own (assets) and what you owe (liabilities) – the difference between the two is what your business is worth.

What to include in an ecommerce balance sheet [with examples]

Ecommerce businesses differ from traditional brick-and-mortar businesses in their reliance on digital operations, complex payment processing, and variable sales tax regulations, leading to unique considerations for their balance sheets.

Below are some important items that ecommerce businesses should include and pay attention to on their balance sheet.

For more details, you can also watch Jason walk through these examples in our webinar recording:

Credit card debt

In an ecommerce business, typical liabilities on a balance sheet include credit card debt, which is often used to finance inventory purchases (especially for dropshipping operations).

Liabilities may also include factoring or inventory financing, which are loans or credit arrangements utilized to manage inventory costs.

These liabilities are essential to include on the balance sheet because they represent the company’s financial obligations and provide a clear picture of how inventory purchases and operational costs are funded.

Inventory

In an ecommerce business, inventory can show up on the balance sheet in different categories, including “Inventory in Transit”. “Inventory in Transit” can be used to track funds sent to suppliers in advance of receiving inventory. For instance, if a business makes a 30% deposit to a supplier overseas before an order is started, this payment is recorded as inventory in transit.

This ensures that all prepayments for inventory are accounted for, providing a clear and detailed view of the business’s financial commitments. Depending on the business’s needs and the volume of transactions, this category can be further detailed to reflect more specific information.

Pending payments and clearing accounts

In an ecommerce business, assets on a balance sheet should include typical items such as cash and cash equivalents, but can also include other payments, clearing accounts, and pending payments (all of which are often necessary in ecommerce operations).

Clearing accounts track funds from payment processors such as “buy now, pay later” services (e.g., Affirm), reflecting sales where cash hasn’t yet been received. Clearing accounts are not considered receivables because they track funds that have already been earned from sales but are temporarily held by payment processors until they are transferred to the business’s bank account.

Unlike receivables, which represent money owed by customers for goods or services delivered on credit, clearing accounts reflect sales where the transaction is complete, but the cash is still in transit through the payment processing system. Similarly, pending payments from platforms like PayPal, which take a few days to process, can be recorded here.

These assets are important for accurately reflecting the business’s financial status because they provide an accurate representation of the company’s cash flow and financial position by accounting for funds that have been earned but are still in transit.

Sales tax

With ecommerce platforms, the amount deposited in the bank account often includes funds meant for sales tax, so it’s crucial to separate and account for these correctly. This is particularly important for businesses using platforms like Shopify, as discrepancies can arise if sales tax liabilities are not properly tracked.

Given the complexity of sales tax regulations in the U.S., which vary by state, county, and even zip code, properly accounting for sales tax ensures that the business sets aside the correct funds. This visibility helps avoid unexpected tax notices and ensures the business has sufficient cash for sales tax payments.

Get insights from your balance sheet

There are a number of ways you can review your balance sheet and generate insights – here are a few ideas recommended by Jason:

- Regularly review your business assets – Monitor inventory levels to manage stock efficiently and avoid overstocking or stockouts. Assess turnover rates to gauge sales effectiveness.

- Analyze your liabilities – Make sure to especially review long-term debts and obligations to understand the company’s financial commitments and leverage.

- Analyze trends – Compare balance sheets over different periods to track financial performance, growth, and changes in the company’s financial position. Doing so will give you the information you need to identify trends in asset accumulation, debt levels, and equity changes so you can make informed strategic decisions.

How to prepare an accurate balance sheet for your ecommerce business

If you’re using accounting software (such as QuickBooks Online or Xero), putting together a balance sheet is easy:

- Get instructions for how to run a balance sheet report in QuickBooks Online here

- Get instructions for how to run a balance sheet report in Xero here

- Get instructions for how to run a balance sheet report in Sage here

The bigger challenge is ensuring that the data in your balance sheet is accurate – which requires consistent and accurate bookkeeping.

Use the right tools to ensure your data is accurate

Ecommerce sellers might already be aware that getting sales and transaction data from channels such as Shopify and Amazon into their accounting software isn’t easy – and errors caused by this process (such as missing and incorrect data) can cause huge discrepancies on the balance sheet.

Fortunately, integration tools like A2X can enhance data integrity from your sales channels by capturing all transactions and automatically sending that data to your accounting software for seamless and accurate reconciliation.

Work with an expert advisor to generate insights

If you want to understand your business’s financial position, but you just know that analyzing trends in your balance sheet(s) isn’t something you want or have time to do – no worries!

That’s exactly what working with an accountant or bookkeeper who specializes in ecommerce (like Jason from Summit eCommerce Advisors) can help you with.

Every ecommerce business is unique, but an advisor experienced with Amazon and Shopify sellers has valuable context that can help you make better sense of your numbers – and enable you to get more out of your balance sheet, whether that’s peace of mind, more decision-making power, or an investment or loan.

A2X can help you get the data you need for an investor-ready balance sheet.

Try A2X for free!