VAT on Amazon Seller Fees [Guide]

Written by: Elspeth Cordray

August 19, 2024 • 7 min read

Most Amazon sellers will be familiar with the wide variety of fees and transactions that come along with selling on Amazon. But, is VAT applied to these fees? And can you reclaim VAT charged on Amazon fees?

Designed for UK-based Amazon sellers who need to understand and manage VAT on the fees charged by Amazon, this guide covers which Amazon fees are subject to VAT, how Amazon charges VAT, and how you can reclaim it. It also explains how tools like A2X can streamline your VAT management processes.

Please note that the information in this guide is general. We strongly recommend that you consult a VAT advisor to ensure you are fully compliant with current laws and to receive personalised advice tailored to your specific business circumstances.

Quick review: What is VAT?

Value Added Tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution. In the UK, VAT is administered by HM Revenue & Customs (HMRC). It is a significant source of revenue for the government and is ultimately paid by the end consumer, although businesses collect and remit the tax on behalf of HMRC.

Does Amazon charge VAT on seller fees?

Yes, Amazon charges VAT on seller fees. It’s important for sellers to correctly record the VAT charged by Amazon on relevant seller fees so that they can potentially claim it back on their VAT return.

Prior to 1 August 2024, VAT on seller fees was typically subject to the reverse charge mechanism because it was billed from Luxembourg. However, Amazon made changes to their treatment of VAT on seller fees which mean that sellers in the UK will be charged VAT.

With these changes, VAT will be deducted from Amazon fees for companies established in the UK, Germany, France, Italy, Spain, Netherlands, Poland, Belgium, or Sweden.

For companies established outside the above countries, there will be no change in VAT application. Note that these changes do not impact sellers who sell in the UK/EU but are registered in a country outside of the UK/EU.

These changes will likely have an impact on Amazon sellers’ cash flow – here are some tips for how to be prepared.

Which Amazon fees are subject to VAT?

Several types of fees charged by Amazon may be subject to VAT. These may include:

- FBA fees

- Merchant seller fees

- Subscription fees

- Amazon shipping fees

If you are a seller in the UK, Amazon will charge you 20% VAT on some or all of these fees. If you are VAT registered, you can then reclaim this VAT as input tax on your VAT return, provided you have proper documentation and meet all necessary conditions (more on this below).

Important note: For UK VAT registered sellers, UK Advertising will be 20% VAT on Expenses, but EU Advertising will remain a Reverse Charge Expense.

How Amazon charges VAT on fees

Amazon applies VAT to your seller fees based on your VAT registration status and the location of your business.

For VAT-registered sellers in the UK, Amazon applies VAT at the UK standard rate of 20% to applicable fees. You must provide your VAT registration number to Amazon to ensure the correct application of VAT.

If you are not VAT-registered, Amazon will still charge VAT on applicable fees, which will be included in your overall costs.

For example, if you incur £100 in merchant seller fees, Amazon will charge an additional £20 (20% VAT), making the total fee £120. (If you are VAT-registered, you can then reclaim the £20 VAT if it qualifies as input tax.)

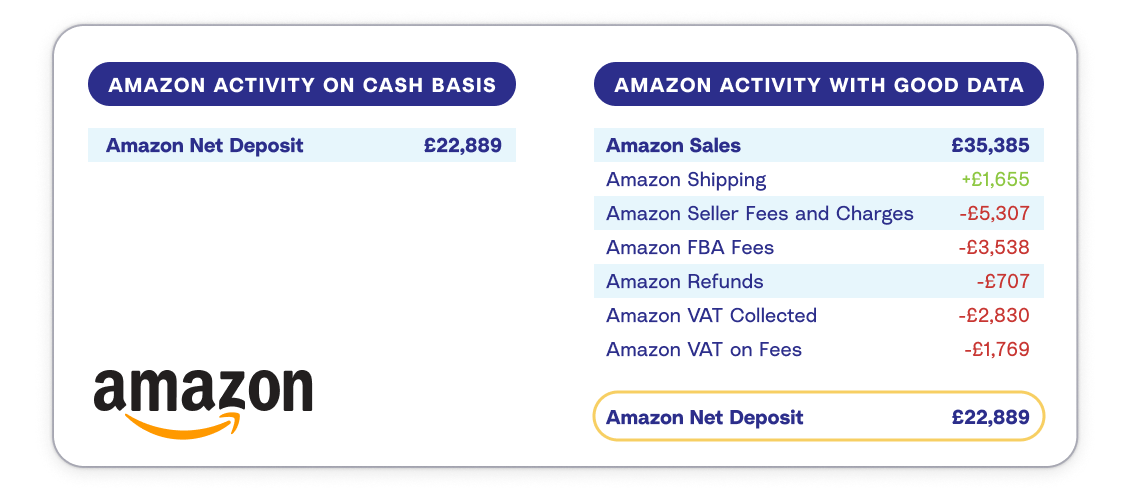

Amazon sellers will be aware that Amazon provides payments via biweekly settlements. Selling fees and VAT on selling fees are deducted from the sales amount before the settlement is deposited in your bank account.

With this in mind, it can be challenging to track and record VAT charged by Amazon as that information can be difficult to extract from your seller statement. The good news is that A2X can help! (Read on for more information.)

Viewing and downloading VAT invoices

To access VAT invoices issued by Amazon (for record-keeping purposes):

- Log in to your Amazon Seller Central account.

- Click on ‘Reports’ in the main menu.

- Select ‘Tax Document Library’. In the Tax Document Library, you will find your VAT invoices.

- Select and download the invoices you need for your records and VAT filings.

Reclaiming VAT on Amazon fees

If you’re eligible, you can reclaim VAT paid on Amazon seller fees. Here’s an overview of what’s required and how to do so.

Important note: The information in this guide is meant to be general. A2X does not provide VAT advice. Consult a local VAT advisor to make sure you understand your specific obligations.

VAT registration & VAT number

The primary requirement for reclaiming VAT on Amazon seller fees is being VAT registered in your country. Here’s what you need to know about VAT registration:

- UK-based sellers must register for VAT if your annual turnover exceeds £90,000 over a rolling 12-month period.

- UK-based sellers selling into the EU may need to register for VAT in the EU, regardless of whether or not you exceed the sales threshold in the EU countries in which you sell.

- Even if your turnover is below the threshold, you can choose to register for VAT voluntarily. This can be beneficial if you incur significant VAT on your business expenses.

Once registered, you will be issued a VAT number by HMRC. This number is crucial for reclaiming VAT.

Make sure your VAT number is correctly entered in your Amazon account settings. This ensures that VAT is correctly calculated and documented on your invoices.

Business expenses

The VAT you wish to reclaim must be related to business expenses. For Amazon sellers, this includes various fees charged by Amazon, such as referral fees, fulfillment fees, monthly subscription fees, advertising fees, and storage fees.

Accurate record-keeping

To reclaim VAT, you must maintain accurate records of all your business expenses, including Amazon fees. Here’s what you need to do:

- Ensure you keep all invoices provided by Amazon. These invoices should detail the fees charged and the VAT applied.

- Utilise accounting software (such as Xero or QuickBooks) to record and categorise your expenses accurately. Tools like A2X can automate this process by pulling data directly from your Amazon account.

Compliance with local VAT regulations

Ensure that you comply with VAT regulations in the UK. This includes:

- Regularly filing VAT returns. Be sure to include the VAT paid on Amazon fees in your VAT returns to HMRC.

- Keeping detailed records to support your VAT reclaim. This includes all invoices, receipts, and accounting records related to your Amazon fees.

By following these steps and ensuring compliance with VAT regulations, you can effectively manage and reclaim any VAT charged on your Amazon seller fees.

How A2X can help you manage Amazon VAT

A2X is an accounting automation tool that can simplify the process of managing your Amazon finances, particularly when handling VAT on seller fees.

If you’re eligible to reclaim VAT on Amazon fees, you will need to report the VAT amount paid on applicable Amazon fees in your VAT return. For example, if you paid £200 in VAT on Amazon fees over a quarter, you would include this amount in your VAT return to HMRC, which could reduce your overall VAT liability or increase your VAT refund.

A2X will automatically import your Amazon sales and transaction data, categorizing all transactions to the correct account in your general ledger. A2X will also automatically pull VAT paid on Amazon fees and assign them to an expense account, which can help make your VAT returns easier and more accurate.

Here’s an overview of how A2X works to integrate Amazon and Xero:

By knowing which fees are subject to VAT, how Amazon charges VAT, and how to reclaim it, you can optimise your business operations. Tools like A2X further streamline this process, providing valuable support in handling the complexities of VAT in ecommerce.

Frequently Asked Questions

FAQs about VAT on Amazon seller fees (general guidance)

Integrate Amazon and your accounting software for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in your general ledger a breeze.

Try A2X today