Amazon Seller Central and Sage Integration: How to Set it Up for Accurate Accounting

Written by Amy Crooymans, Product Marketing Manager at A2X

Updated on February 4, 2025

Integrating Amazon Seller Central with Sage is a great idea, especially if you want to spend less time on bookkeeping, and get more accurate numbers.

Any Amazon seller (or accountant/bookkeeper who works with Amazon sellers) will be all too familiar with the process of trying to reconcile an Amazon payout. You can see the lump sum settlement in your bank feed in Sage, but trying to reconcile it with the Amazon sales, fees, taxes, and other transactions can be a huge headache.

Fortunately, that’s exactly how an integration between Sage and Amazon Seller Central can help. By connecting Amazon and Sage, you’ll be able to seamlessly get your Amazon sales data into Sage, and reconcile your accounts in just a few clicks.

Read on for a step-by-step guide on how to integrate Sage and Amazon Seller Central using A2X.

Key takeaways:

- Integrating Amazon Seller Central and Sage means establishing a connection that enables your Amazon data to flow seamlessly into Sage for easy accounting and bookkeeping.

- Sage does not support a direct integration with Amazon, so you can use A2X to set up the integration.

- Setting up an Amazon-Sage integration with A2X is easy and just takes a few steps (outlined below).

Table of Contents

Integrate Amazon and Sage for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in Sage a breeze.

Try A2X today

Can you link Amazon to Sage?

You can link Amazon Seller Central to Sage accounting software by using an integration tool or app.

Integrating Amazon and Sage simply means connecting these tools together, so that the accounting data you need from Amazon Seller Central flows into Sage.

Your bank deposits – i.e., your payouts from Amazon – represent a number of line items. Your Amazon seller statement doesn’t always break these down for you in a clear, usable way.

Because of the way Amazon’s settlement summaries are presented to sellers, accounting software requires a little help when it comes to translating sales and tax data into a digestible format.

That’s where setting up an integration comes into play – it will help you get your Amazon seller data into Sage.

Once your Amazon accounting data is in Sage, you’ll be able to reconcile your accounts quickly and easily, and create accurate reports. Amazon bookkeeping becomes much easier, less time-consuming, and more accurate.

Why should I integrate Amazon and Sage?

There are a number of reasons why integrating your Amazon store with Sage is a great idea. We’ll start with these two:

1. Save time with automation

If you currently do not have Amazon and Sage connected and you’re transitioning (or already practicing) accrual accounting, then you’re probably manually downloading and analyzing spreadsheets from Amazon to try to make sense of the transactions that make up your Amazon deposits. This can take a ton of time.

Integrating Amazon and Sage means that you’ll save time on transferring data over from your ecommerce store and attempting to match it to a payout because your integrator tool (a.k.a., A2X!) will do it for you.

2. Get accurate books

Worry less about the risks of human error as most of the number crunching is done automatically when you integrate Amazon and Sage.

Accurate books are hugely important for Amazon sellers for a few reasons, including:

- Tax compliance – Marketplace Facilitator Tax rules (if applicable in the region where you sell) mean that Amazon must collect and remit tax for sellers. However, this doesn’t remove your obligations to report on tax correctly. You must be able to accurately understand how much tax Amazon is collecting and remitting on your behalf (and check for errors).

- Understanding business performance – Picture this situation: You make $30,000 in sales, but Amazon fees, taxes, and other expenses paid to Amazon mean that your payout is only $20,000. If you record $20,000 as “sales” in your bookkeeping, you’re missing the complete picture of business earnings and expenses (not to mention potentially over or under-stating revenue). This could cause you to make misinformed decisions about how to run your Amazon store.

- Securing a loan, investment, or acquisition – If you have big ambitions for your Amazon store, most loan providers, investors, and acquirers will require an accurate P&L and Balance sheet – or, “investor ready” financials.

Note – A2X does not provide tax advice. Make sure you consult a tax professional in your region to understand your obligations.

How can I set up an integration between Amazon and Sage?

Sage currently does not support a direct integration with Amazon Seller Central – meaning, you must use a third-party tool to connect Amazon with Sage.

There are two popular options to set up an integration between Amazon and Sage:

- Data syncing apps

- Apps designed specifically for ecommerce accounting and bookkeeping, like A2X

Use a data syncing app

Some data syncing apps offer capabilities to bring Amazon Seller Central data into Sage. Using a tool like Zapier, for example, you could set up a new sale on Amazon to trigger the creation of a new invoice in Sage.

While data syncing apps are versatile (and often free or low-cost), they can have a few shortcomings when setting up data syncing between Amazon and Sage. For example:

- They may not be able to support complex or specific needs that an app designed specifically to integrate Amazon and Sage may offer.

- They may only be able to post data for individual orders, which might work well for smaller Amazon sellers, but will overload Sage and cause difficulties for sellers with a high volume of orders.

- They may not be able to identify all transaction types.

- They may have limited capability when capturing tax details (e.g., tax collected vs. tax paid via Marketplace Facilitator Tax).

- They may only offer limited, unspecialized support, which can be frustrating if you need to resolve a specific accounting or bookkeeping data syncing issue.

Use A2X to integrate Amazon and Sage

The other option to integrate Amazon and Sage is to use an ecommerce accounting automation app, such as A2X.

A2X is an integration tool specifically designed to bring data from Amazon Seller Central into Sage seamlessly.

A2X currently integrates with Sage Business Cloud UK (Plus plan), and Sage One UK (Plus plan).

A2X breaks down Amazon bank deposits in invoice summaries which are posted to Sage. This prevents it becoming clogged up with individual orders, and helps you understand exactly where your bank deposits came from.

A2X also organizes your books via the accrual method for more accurate forecasting, has a COGS function for you to keep track of inventory, and can map your Chart of Accounts over from Sage, making integration simple, easy and effective.

Like Sage, A2X is also designed to scale alongside your business. Once you’ve set up your business with A2X, you won’t need to worry about automating your accounts, no matter how large you grow.

No more stressful nights laying awake, dreading another day of manually slogging through your accounts one-by-one. With A2X, you’ll have fully automated your Sage Amazon integration so that there’s nothing left to worry about.

In short, using A2X to integrate Amazon and Sage will:

- Free up more hours in your day

- Accurately record complete transaction details from Amazon

- Automatically lump your ecommerce transactions into neat and tidy summaries that match up with Amazon settlements

- Keep up with your business as it continues to grow

Step-by-step guide: Sage integration with Amazon and A2X

Using A2X to set up an integration with Amazon and Sage is easy.

Before we begin, make sure you’ve already set up your accounts with Sage and Amazon. You’ll just need your login information for each.

It’s also important to note that the steps below apply only if you’re on one of the following Sage plans:

- Sage Business Cloud UK (Plus plan)

- Sage One UK (Plus plan)

You can still use A2X if you use any of these other Sage plans; however, you’ll need to get in touch with our Customer Success team at contact@a2xaccounting.com to get set up:

- Sage Business Cloud Start plan

- Sage50

- Sage US/CA (all versions)

- Sage EU (all versions)

Ready to connect Amazon and Sage via A2X? Watch the video below, then follow the steps in this article for more detail.

Let’s get started.

Step 1: Get your free A2X trial

Head on over to a2xaccounting.com and click ‘Try A2X for free’ in the top right.

You’ll then be asked which sales channel you’d like to connect to first. Select ‘Amazon’.

Select your preferred sign in method, then follow the prompts to create your account.

You’ll then be directed to the A2X dashboard.

(Note – Your A2X account will remain in “free trial mode” until you decide to subscribe to a plan. In free trial mode, you’ll have access to a limited amount of settlement data.)

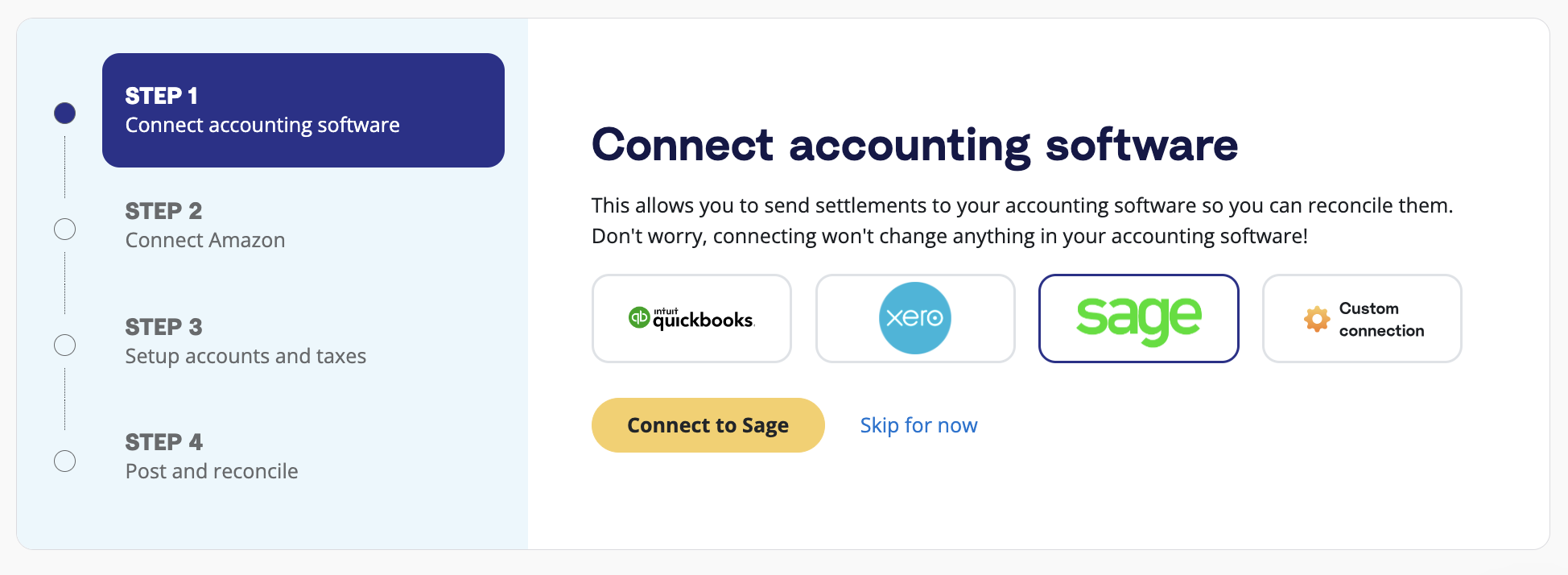

Step 2: Sage integration with A2X

In the A2X dashboard, you’ll see a prompt to connect to your accounting software. Select the Sage logo, then click ‘Connect to Sage’.

Follow the prompts to establish a connection with Sage. (All you’ll need is your Sage login information.)

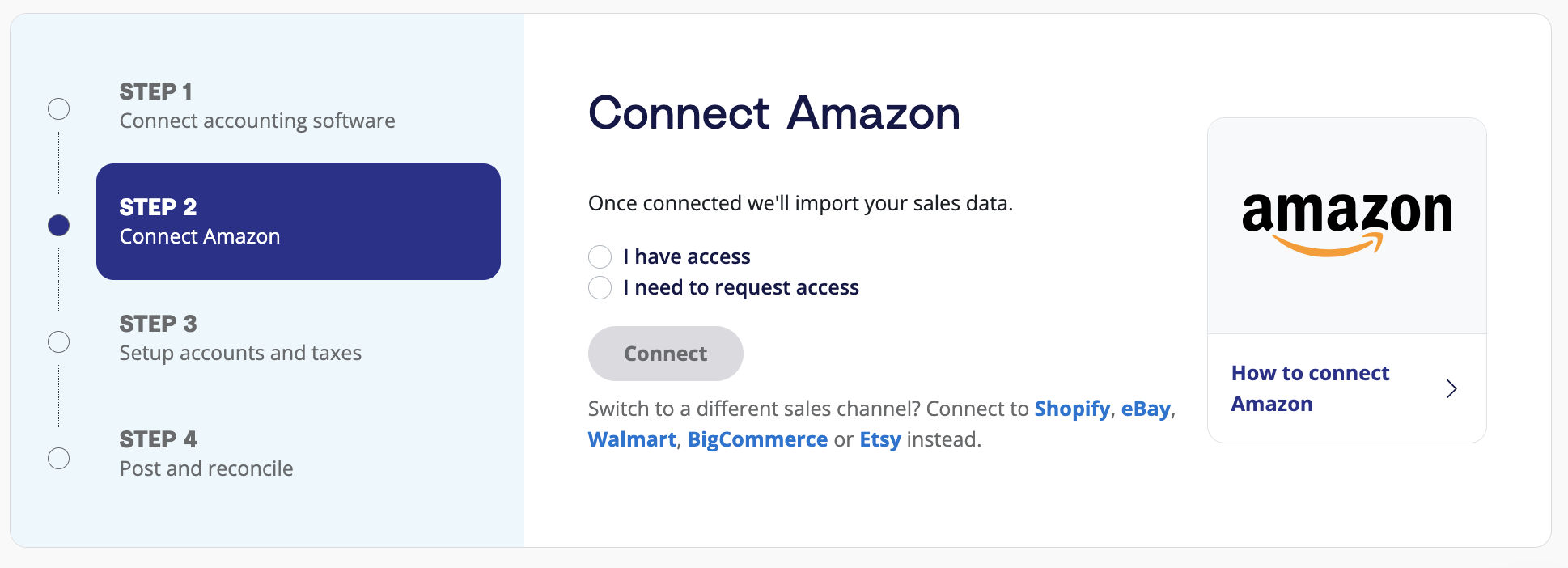

Step 3: Amazon integration with A2X

Now it’s time to get your A2X account hooked up with your Amazon seller account so you can begin importing your settlements.

On the A2X dashboard, click ‘Connect Amazon’.

If you do not have access to the Amazon account you wish to connect to (e.g., you are an external accountant or bookkeeper), click ‘I need to request access’ and follow the prompts.

If you have access, click ‘I have access’, then ‘Connect’, and follow the prompts.

Step 4: Accounts and tax mapping

Here’s where the real magic of A2X comes in: accounts and tax mapping.

Note – we strongly recommend working with an Amazon accountant or bookkeeper to help out with this step.

In this step, you’ll assign Amazon transactions to your Chart of Accounts. A2X will access your Chart of Accounts in Sage. Moving forward, whenever a settlement comes in, each transaction will be automatically mapped to the correct account.

To set this up, click ‘Set up accounts and Taxes’ on the dashboard. Or, click on the ‘Accounts and Taxes’ tab near the top.

The first time you land on the Accounts and Taxes page, you’ll be prompted to go through an Assisted Setup questionnaire, which asks you to provide basic information about your business, such as where it operates.

At the end of the questionnaire, you’ll be asked if you’d like to move forward with an ‘Assisted Setup’ or ‘Custom Setup’. We recommend you choose Assisted Setup to save time – you can always update your account and tax mappings later.

A2X will automatically map your Amazon transactions as follows.

Transaction Type | Category | Default Account Name | Account Type |

Other | Amazon Seller Fees and Charges | Expense | |

Advertising | Expense | Amazon Advertising | Expense |

Expense | Amazon FBA Fees | Direct Costs | |

Expense | Amazon Seller Fees and Charges | Expense | |

Expense | Amazon FBA Fees | Direct Costs | |

Lending | Current Liability | Amazon Loans | Current Liability |

Other | Other | Amazon Seller Fees and Charges | Expense |

Pending Balance | Current Asset | Amazon Pending Balances | Current Asset |

Promotions | Income | Amazon Promotions | Sales |

Refund and Return Fees | Expense | Amazon Seller Fees and Charges | Expense |

Income | Amazon Sales | Sales | |

Refunds | Income | Amazon Refunds | Sales |

Reimbursements | Income | Amazon Reimbursement | Revenue |

Income | Amazon Shipping | Revenue | |

Current Asset | Amazon Reserved Balances | Current Asset | |

Expense | Amazon Shipping Fees | Expense | |

Expense | Amazon Seller Fees and Charges | Expense | |

Tax | Tax | Amazon Sales Tax Collected | Current Liability |

Sales Tax | Tax | Amazon Sales Tax Collected | Current Liability |

Refunds Tax | Tax | Amazon Sales Tax Collected | Current Liability |

Promotions Tax | Tax | Amazon Sales Tax Collected | Current Liability |

Shipping Tax | Tax | Amazon Sales Tax Collected | Current Liability |

Other Taxes | Tax | Amazon Sales Tax Collected | Current Liability |

MFV Taxes | Tax | Amazon Sales Tax Collected | Current Liability |

Watch this video to learn more about how the Accounts and Tax Mapping page works:

When you’re all done checking out your mappings, remember to click ‘Save’.

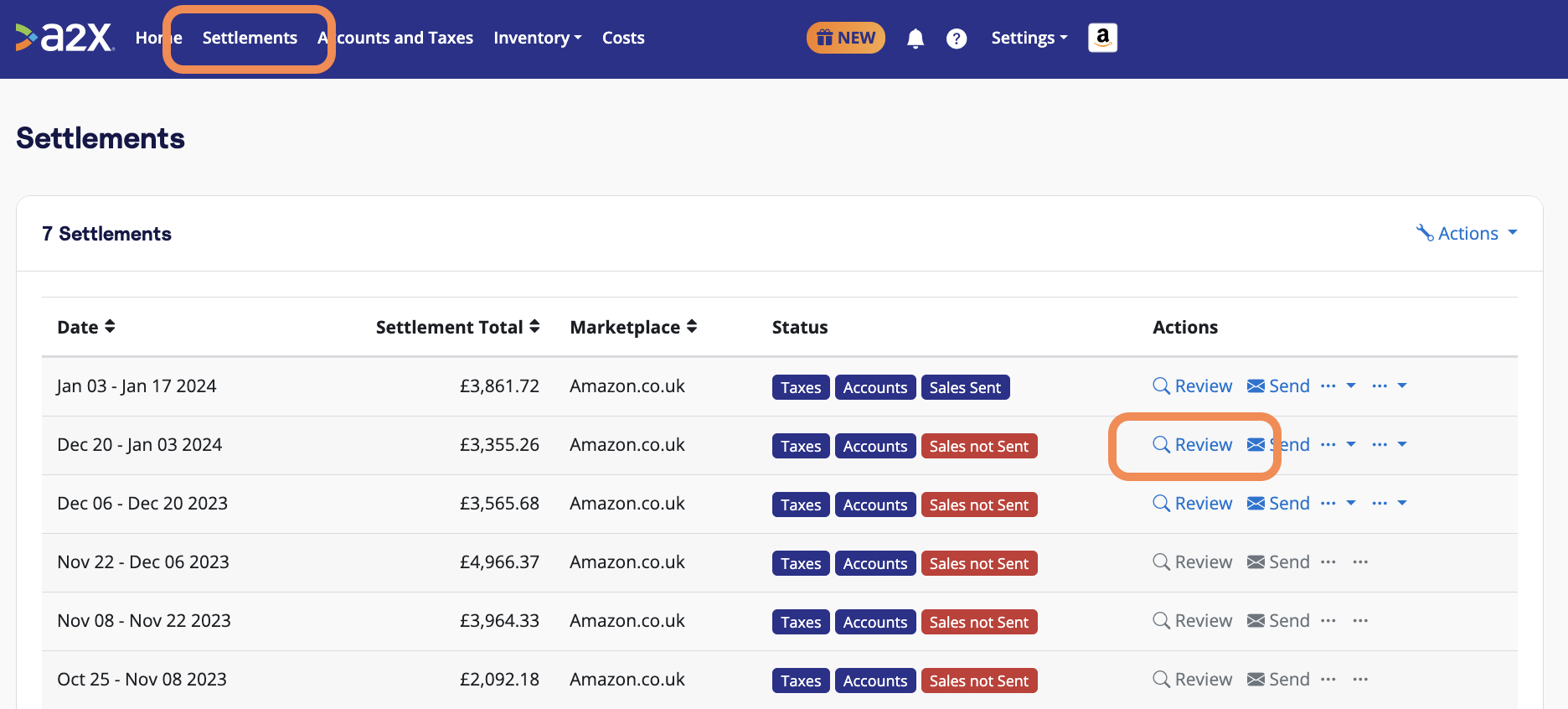

Step 5: Review and post to Sage

Most of your A2X setup tasks are complete! Now, you can move onto routine bookkeeping. Here’s how you can send settlement data from A2X to Sage.

Click on the ‘Settlements’ tab in A2X. Here, you’ll see the recent settlements that A2X has fetched from Amazon. (If you’re in free trial mode, you’ll see three settlements available.)

Click ‘Review’ to the right of a settlement to see the transactions that make up that settlement, and how A2X has mapped them to the Chart of Accounts.

If all looks good, scroll to the bottom and click ‘Send to Sage’.

A2X will then send the settlement data over to Sage, where it will be matched to the corresponding deposit in the bank account.

Note: You can also use A2X’s Auto-Posting feature to automatically send settlements to Sage as they become available.

Step 6: Reconcile in Sage

Log in to Sage and navigate to the relevant bank account. Click on ‘Imported Transactions’.

Find the deposit from Amazon for the settlement for that you just posted. You should see the corresponding A2X invoice there, too – ready to be reconciled!

And there you go – bookkeeping for Amazon with Sage has never been easier!

The Amazon Summary Report: A2X’s commitment to accuracy

Once you’ve integrated Sage and Amazon using A2X, a key feature to explore is A2X’s Amazon Summary Report.

As noted earlier, Amazon bookkeeping is complicated and can be time-consuming.

A2X is designed to make it easier and faster. However, given that Amazon data is flowing through multiple systems, discrepancies can occasionally occur between A2X summaries and reports in Amazon Seller Central.

The good news is that if a discrepancy occurs and your numbers aren’t matching up, you can use the Amazon Summary Report to easily compare A2X summaries to data in Amazon Seller Central.

Without this tool, it could take hours of manual work to identify what might be causing your numbers not to balance.

No integration tool can be 100% precise – but A2X is committed to making it easier, faster, and, most importantly, accurate.

Ready to integrate Amazon and Sage with A2X? Start your free trial today!

Frequently asked questions about Amazon, Sage, and A2X

What is Sage Business Cloud Accounting?

Sage Business Cloud Accounting allows business owners, bookkeepers, and accountants to manage their finances more efficiently, giving them more time to focus on growing their business.

Is Sage the right accounting software for my Amazon store?

As software that enables business owners to see cash flow and updated financial reports instantly, Sage can benefit accountants and ecommerce sellers alike.

Whether you’re managing your books manually or outsourcing them, having reliable accounting software is crucial.

By using Sage, you’ll have:

- Secure books, updated instantly when integrated with your Amazon account.

- Financial reports and analytics available any time, anywhere.

- Remote access that you can open to others, with controlled levels.

- Automated records so that nothing gets missed.

- The ability to create invoices and manage payroll if needed.

- Access to a wider ecosystem of products and Sage partners.

How much does it cost to sell on Amazon?

The cost of selling on Amazon will be different for every business due to Amazon’s variable fee structure.

Learn more here:

- Amazon Seller Fees: Everything You Need to Know [Guide]

- Amazon Seller Fees & Transactions: A Comprehensive List

How much does A2X cost?

A2X offers a variety of plans based on which channel(s) you sell on, your monthly order volume, and more. Find a plan that suits your business here.

Is A2X really the best Amazon Sage integration solution?

A2X was launched in 2014, and since then we have been committed to making ecommerce accounting easy. We know you’ll love A2X for your Sage-Amazon integration.

But, we also know how important it is to know that for yourself before you sign up.

That’s why we’re going to let some of our amazing customers speak on our behalf:

“A2X is an absolute no-brainer for anyone selling on Amazon marketplace.”

- Dustin R., Capterra

“This software is magical. What used to take my team hours to do each billing cycle now takes a few seconds. Accounting for Amazon is a nightmare, but A2X turns it into a dream.”

- Monil K., Capterra

“A total godsend. Saves us hours of accounting reconciliation.”

- Daniel R., Capterra

For more testimonials, here’s a link to our case studies, plus some more reviews on our website.

How do I find an accountant or bookkeeper to help me with Amazon and Sage?

There’s no better place to outsource your accounting needs than our trusted directory of ecommerce accountants.

Experienced accountants will tackle all your accounting automation needs, offer helpful guidance for financing, and give you more time to focus on the other areas of your business that need attention.

Integrate Amazon and Sage for accurate accounting

A2X auto-categorizes your Amazon sales, fees, taxes, and more into accurate summaries that make reconciliation in Sage a breeze.

Try A2X today