Ecommerce Accounting Explained: What Is A Cash Flow Forecast & Why Does It Matter?

Save time, money, and stress with our free ecommerce bookkeeping checklist. A step-by-step process that you can follow daily, weekly, monthly, and yearly, to ensure you cover all the essentials for your business. Download here.

Every business should have a cash flow forecast.

Whether you’re an ecommerce seller, an investor, or the owner of a large company, a cash flow forecast enables you to extract important information about the financial health of your operations.

You wouldn’t walk into an Aston Martin garage to buy a car without knowing how much money you have in your bank account today and whether the payment might decline.

Similarly, you shouldn’t make fundamental business decisions without understanding your cash flow both right now and in the future.

This article will take you through the basics of cash flow forecasts so you have everything you need to make one for your business.

In this guide to cash flow forecasting:

Table of Contents

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the flow of money in and out of a business over a certain period of time - often 1, 3 or 12 months.

In order to do this, you need to estimate upcoming income and expenses.

“Forward planning is vital to the health of any business. Everyday business decisions are tactical; long-term decisions are strategic. To succeed, a business needs good tactics and a good strategy.”

A cash flow forecast or cash flow projection helps to give you clarity about your business finances.

When you look at your forecast, you can see how much you’re likely to have in cash assets in any given month, and plan your spending accordingly.

This means the decisions you’re making around when to stock up, when to hire helping hands, when to ship your product, and the payment terms you offer to your customers, are all informed decisions.

You’ll be able to see when it’s smart to invest and when it’s best to sit tight. Having this comprehensive oversight is essential to the success of your business.

Why Is Cash Flow Forecasting Important?

Good question.

The purpose of a cash flow forecast is to see how much money is going to flow in or out of your business, and when.

This is not only useful for your planning and decision making, but it keeps you out of the danger zone.

Benefits of using a cash flow forecast

-

It gives you advanced warning of cash shortages.

-

It ensures that the business can pay employees and suppliers.

-

It gives you financial control.

-

It provides reassurance to investors that the organization is being managed prudently.

-

It helps you to avoid running into cash flow problems.

Why forecasting is especially important for ecommerce businesses

Product-based businesses (such as ecommerce stores) often need to buy a lot of inventory.

That means investing large sums of money into stock that will be returned as income from sales throughout the year.

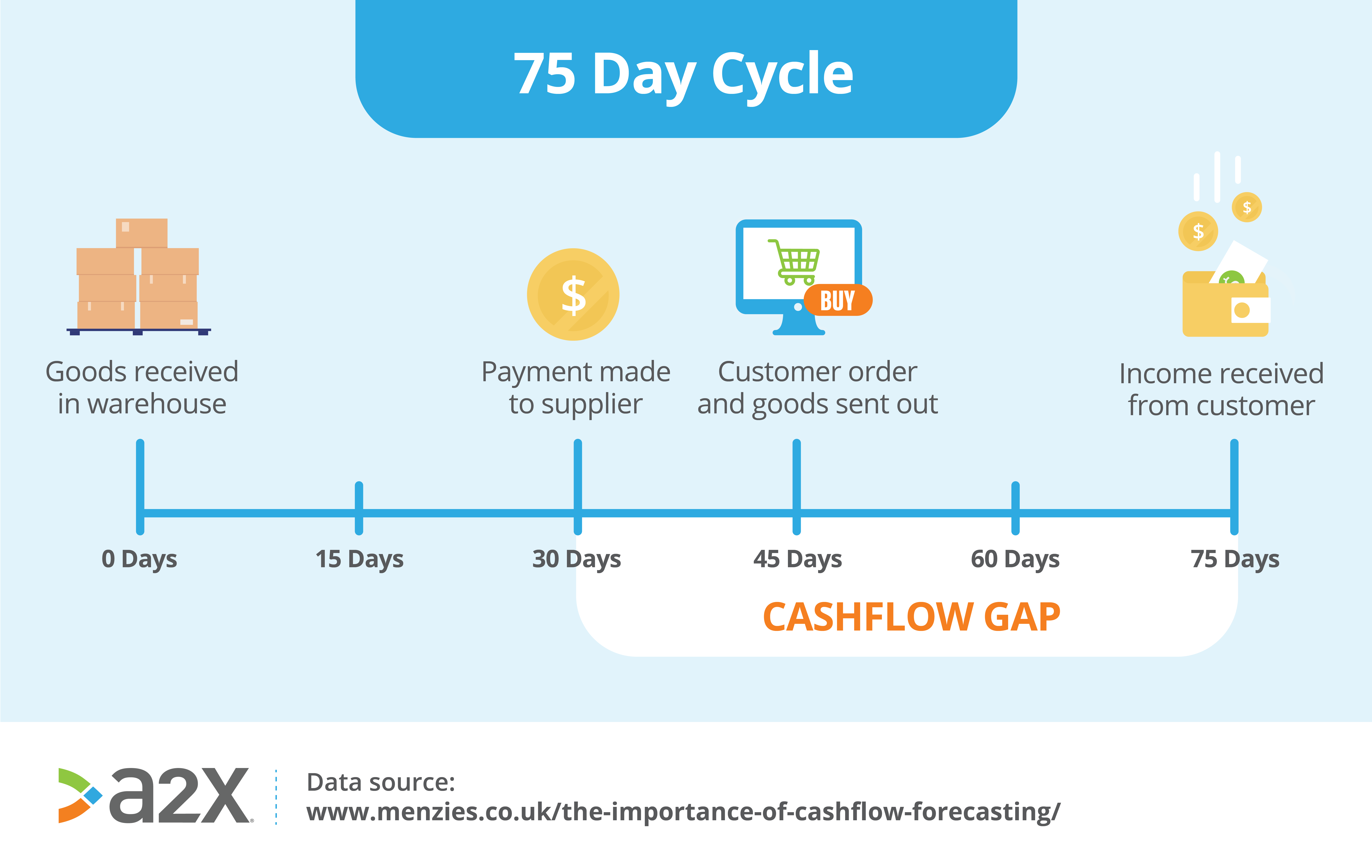

But often the stock is paid for well in advance of when you start selling it. It might be weeks or months before you see significant cash inflow from customers, which means that you can be left with a cash flow gap.

A cash flow gap occurs when there’s a delay between money going out, and money coming in. If you have planned for this, or around this, the gap shouldn’t be worrying.

It’s when you don’t have a forecast and a plan that the gap becomes a problem.

What happens if I don’t forecast?

“Somebody said to me the other day that when they think about their P&Ls they bleed from their eyeballs, and I think that sums it up for how a lot of people feel.”

It’s very easy to run into cash flow trouble, and there are a few common causes of it.

If these causes are predicted, they can be prevented. Sometimes pulling something forward and delaying something else is enough to keep your cash flow positive.

Remember: cash flow is all about timing!

“If I know that I’m going to run out of cash in six months I can make two important adjustments that I don’t have the luxury of making if I’m right on top of that shortfall… If I need to actually lower some overhead… I’ve got some internal leverage. The second thing is if I know I’m going to run out of cash in four to six months I’ve bought myself a bunch of time to go find the right kind of loan if I have to pick up some debt on the balance sheet.”

What causes cash flow problems and how to prevent them

-

Producing too much or holding too much stock. Instead, predict how much stock you’re likely to need in the near future, and invest when you have spare capital. Don’t over-order and dry up your other opportunities.

-

Low profits, or big losses. What’s your profit margin? Are you making enough from each item, and does it align with your plans? Prevent low returns by increasing your profit margin and analyzing where your biggest costs are coming from. Remember, lower margins are okay with higher turnover. You’ll want to ask the question: for every dollar I put in, how many will I get out and when?

-

Allowing customers too much time to pay for their orders. Make sure your payment terms aren’t compromising your business plans! Look at your forecast and determine if you need to change when you receive money from sales.

-

Seasonal demand. Predict when your sales might slow and when your suppliers might be unavailable. Planning around seasonal influences in advance means you can ride the wave and avoid the crunch.

-

Cash flow gaps. These can quickly turn into business failure! A simple way to avoid them is to make sure you’re not paying out for expenses before you’ve received cash from your customer orders. In many cases in ecommerce, this isn’t possible, so you’ll need to plan for the gap to happen at the right time when you’re cashed up. Or alternatively, you can tap into ecommerce funding sources such as ClearCo.

How to overcome cash flow problems by forecasting

Recently, a US bank study found that 82% of the time, cash flow management problems contribute to the failure of a small business.

The solution is often simple: forecast.

Forecasting means you’ll know the ins and outs of the finances of your business, and you’ll most likely make smarter decisions because of this.

Seeing as the first step to really understanding your cash flow is to calculate it, let’s look at that next.

How Do You Calculate Cash Flow?

You can easily calculate your cash flow by comparing how much money is coming in with how much money is going out.

What’s the difference? Is it positive, or negative?

The easiest way to find out is to produce a cash flow statement.

While a cash flow forecast predicts your future cash flow, a cash flow statement shows the previous months and your cash flow right now.

Here are some examples of cash inflows and outflows that would appear on your cash flow statement forecast.

Once you’ve collected the financial information for each category and recorded it correctly using the indirect method or direct method, you’ll be able to calculate your current cash flow.

What are the ‘indirect method’ and ‘direct method’ of preparing cash flow statements?

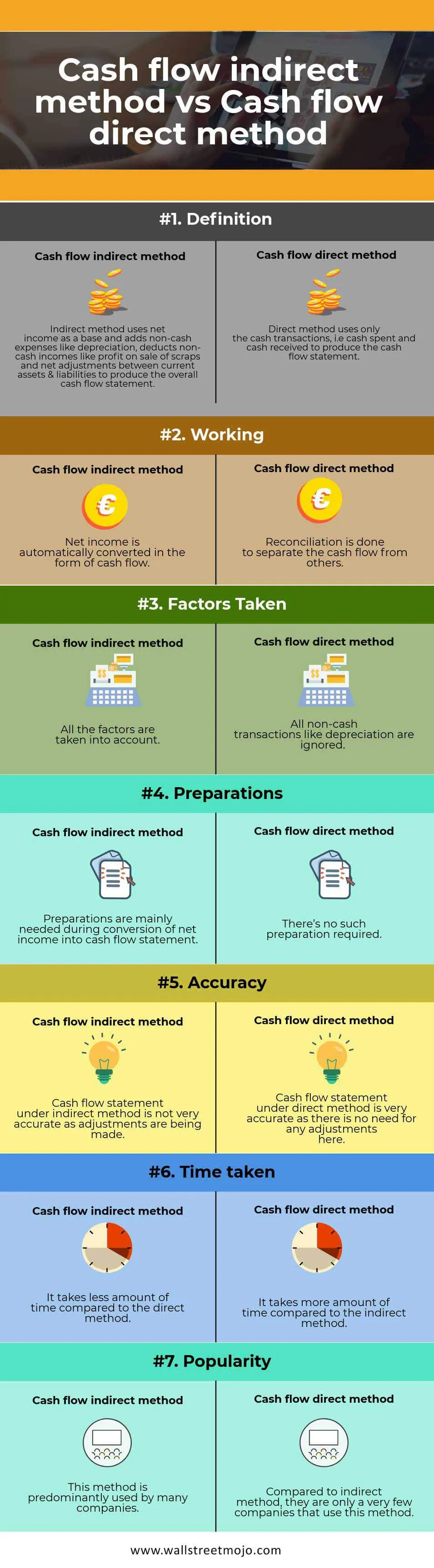

There are two accounting methods that can be used to create a cash flow statement.

Similar to cash accounting and accrual accounting, these methods are determined by when the movement of cash is recorded.

What’s more, they’re directly correlated with the accounting method you use.

“The direct method is based on cash accounting, while the indirect method is based on accrual accounting, which involves reporting income for the period in which it was earned rather than received. Both methods get the same result, but many accountants prefer the indirect method because they can prepare it more easily using information from existing financial documents.”

Source: WallStreetMojo.

Which method is better for ecommerce accounting?

Since the accrual accounting approach is highly recommended for ecommerce sellers, the indirect method of making a cash flow statement is the logical option.

The indirect method is better because accrual accounting is a more comprehensive measure of the ebbs and flows of business activity.

“Under the indirect method, the cash flow statement begins with net income on an accrual basis and subsequently adds and subtracts non-cash items to reconcile to actual cash flows from operations. The indirect method is often easier to use than the direct method since most larger businesses already use accrual accounting.”

Understanding Your Cash Flow Statement

Let’s recap. What is the purpose of a cash flow statement?

To check what your cash flow looks like right now.

“The cash flow statement paints a picture as to how a company’s operations are running, where its money comes from, and how money is being spent. Also known as the statement of cash flows, the CFS helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund its operating expenses and pay down its debts.”

Is a cash flow statement the same as a balance sheet?

No. While a balance sheet summarizes the assets and liabilities of a company, a cash flow statement shows how the amount of money received and paid in a particular period of time affects a company’s cash position.

How to read your cash flow statement

Your cash flow statement will show that you either have a positive cash flow or a negative cash flow.

A positive cash flow means that the company has more money flowing in than out. This is known as being “cash flow positive”. It doesn’t necessarily mean that you’re turning a profit, but you have excess cash that you can invest or spend.

A negative cash flow means the opposite: that the company has more money flowing out than in. This can be the result of inventory purchases, investments and expansion just as much as out of control expenditure and income mismanagement.

While a negative cash flow is not always bad, it’s important to identify why it’s negative.

This brings us back to cash flow forecasting - looking at the cash flow across multiple months and extending into the future.

How To Prepare A Cash Flow Forecast

“Most entrepreneurs are pretty good at building a forecast around what their operation is going to generate. We kind of know what our overhead is. We kind of know what our advertising budget is going to be. We know if our rent’s going to go up next year. And so you got to do that work but a lot of entrepreneurs stop there and you can’t stop there. Because of the impact of debt and the impact of inventory and the impact frankly of taxes you need to take that operational data and then work it into a full cash flow forecast for maybe the next year or the next six months.”

There are a few steps to making a cash flow forecast. Depending on your business, these might be relatively simple or require a bit more effort.

Let’s look at how to start.

1. Decide how far you want to plan out

A cash flow forecast typically includes 12 months, but this is up to you.

Just make sure it’s realistic. The further out you try to forecast, the less certainty you have.

Remember: You can, and should, adjust your forecast as time passes and circumstances change.

For now, use the information you have, and what you know is coming up.

2. List your expected income

This is where you write down everything that you expect to bring in money over the period of your forecast, and record the dollar values in the months that you expect to see the cash.

You can go back to the example of cash inflows above to prompt you, or to look at past sales data to help predict future revenues.

3. List your expected outgoings

Similar to income, write down your expected expenditure over the period of your forecast. Record the predicted amount in the months that you expect it to go out.

4. Work out your running cash flow

In this stage, you (or rather your spreadsheet!) can do the math and figure out whether you have a positive or negative cash flow.

You’ll be able to see how much cash you expect to have available at the end of the forecasted period.

If you need a little help imagining this, check out the table below.

Here’s A Cash Flow Forecast Example

This table shows a basic cash flow forecast.

The lines of cash inflows and outflows illustrate the movement of cash.

January | February | March | |

Sales receipts | 60,000 | 65,000 | 70,000 |

Payments to suppliers | (15,000) | (20,000) | (25,000) |

Wages and salaries | (20,000) | (20,000) | (20,000) |

Purchase of fixed assets | 0 | (40,000) | 0 |

Net cash flow | 25,000 | (15,000) | 25,000 |

Opening balance | 10,000 | 35,000 | 20,000 |

Closing balance | 35,000 | 20,000 | 45,000 |

Let’s take a closer look at what the last three rows mean.

-

Net cash flow = the incomings minus the outgoings.

-

Opening balance = the balance at the start of the month. This is equal to the closing balance of the previous month as you can see in the table.

-

Closing balance = the opening balance plus the net cash flow.

You can see in this example that the business has steadily increased both its sales and its payments to suppliers over this three month period. It has paid the same dollar amount of wages each month.

In February, it invested in fixed assets. Its positive cash flow allowed this to happen, and although the closing balance is lower that month as a result, it climbs up again in March.

To make your cash flow forecast, you can use this template from LedgerGurus.

How To Use Your Cash Flow Forecast

Your cash flow forecast is something you should be proud of.

It shows your investors and stakeholders that you have your ducks in a row - and if you don’t have any of those, it’s enough to give yourself (or your management team) peace of mind.

Aside from using your cash flow forecast to plan your year ahead (or chosen period), there’s one more thing you should do.

Review your actual cash flow against your forecast

As the months roll on, come back to your forecast and see if your actual business behavior is reflecting it.

Ask yourself:

-

Has your prediction of expenses been accurate?

-

Have you encountered any changes along the way?

-

Have any unexpected events impacted your cash flow? How can you account for these?

-

Do you have room for more investment than you thought?

-

How should you adjust your plans for the next period?

Always evaluate how it’s going throughout the period of your cash flow forecast. This is helpful not only for now, but for your next forecast too. You can learn from the experience of your first one and make your second one spectacular.

How often should you do a cash flow forecast?

While the typical forecasting period for cash flow is 12 months, you can revisit and adjust your cash flow forecast within that period.

A cash flow forecast is a living document that should be used, reviewed, and kept up-to-date on a regular basis. It’s useless if it starts gathering proverbial dust.

Changing the plan is part of the forecasting process - but in order to change a plan, first you need to have one!

So, a couple months before your predicted period runs out, draw up a new one and get planning ahead again as soon as possible.

Need An Ecommerce Bookkeeping Checklist?

The most successful ecommerce sellers and their bookkeepers use standardized processes to help scale up their business.

We have compiled a complete list of all the processes you need to implement every week, month, quarter and year so you can plug and play and get back to growth.

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here