How Keeping Your Financial Reports Separate Leads to More Opportunity for Growth and Profitability

This article is a guest post from our friends at MerchantSpring, a leading reporting suite for ecommerce accountants, aggregators and brands.

To achieve success in ecommerce, it’s crucial to analyze the performance of individual products and capitalize on the ones that are thriving while scaling back on those that are not.

While many business owners assume that accounting software is the ideal source for this information, attempting to force accounting software to serve as a complete analytics solution can actually result in a chaotic and complicated situation.

Read on to learn why keeping traditional accounting and ecommerce-specific reports separate is so important, especially for companies in growth.

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

Why can’t my accounting software act as an inventory tool?

As ecommerce businesses continue to grow and expand, it becomes increasingly essential for them to separate traditional financial reports from ecommerce-specific financial reporting. This is because the data from marketplaces and ecommerce channels such as Amazon and Shopify is complex and constantly changing. Therefore, it’s crucial for business owners to have access to accurate and up-to-date financial information in order to make informed decisions.

Accounting systems such as Xero and QuickBooks Online, when used with A2X, are fantastic tools for traditional financial reporting, which includes things such as your profit and loss statement or balance sheet. However, these accounting systems are not designed to have the functionality to effectively build detailed ecommerce reports (and it’s unlikely they will ever natively).

Here are a few examples of financial-related information that can’t efficiently be built in Xero or QuickBooks:

-

Profit and Loss statements by:

- Brand

- Category

- Channel

- Region

- Product

- Net PPM (Vendor Central)

- Custom Ratios

- Target return on ad spend (TROAS)

- Total Advertising Cost of Sale (TACOS)

What happens if I build reports in my accounting system?

Talking to MerchantSpring customers who have tried to build reports in their accounting systems, it’s clear that doing so is more trouble than it’s worth. They say the reports are unclear, incomplete, and ultimately meaningless, wasting time and money that could have been spent on other tasks.

For example, how do you attribute advertising expenses to a specific product in an accounting system-based report? Getting down to the product level and managing cost attribution is nearly impossible—even with the best reporting plugins. Instead, the solution is to use an ecommerce reporting suite that can get into the details while keeping traditional financial reports totally separate from ecommerce-specific reports.

Not to mention that when a retailer sells across multiple channels, attributing advertising expenses becomes even more complex. The complexities of dealing with different revenue and expense items and frequent changes can quickly become overwhelming. That is why keeping your reporting simple, but domain-specific is essential to stay informed when running an ecommerce business.

How do I choose a good ecommerce reporting suite?

To make the most of ecommerce financial reporting, choose an ecommerce reporting suite that meets your specific needs. When looking for such a suite, consider the following:

- What channels does it connect to? Be wary of single-channel reporting tools

- How does it present information? What is the UI like?

- How easy is it to set up? Ideally, you want a suite that a non-technical person can set up.

- Do you need an expert to manage it?

- Does it provide the granularity you need, such as profit by product for a specific point in time?

- How does it capture all the financial data from the ecommerce channels you are selling on, including advertising data, refunds, rebates, reimbursements, and fulfillment costs?

- How much data does it store? 12 months? 48 months? Is there a limit?

- Does it allow you to create your own reports or set them up to be generated periodically?

- How often does it retrieve data?

- Bonus Question: How often do you need it to retrieve data?

- Does it allow for multiple users? Can you control visibility permissions?

When researching your options, be cautious of complex reporting suites that try to show too much information but are too difficult to understand or interpret meaningfully. The risk of using a product like this is that it may require significant maintenance, with the user potentially responsible for managing channel-level API degradation.

While generalist applications like Google Data Studio may work for some businesses, they often come with a hidden cost in the need for someone to maintain the reports. Also, when using Google Data Studio, you may need to pay for a third-party connector. These connectors pipe the data from Amazon or Walmart into Google Data Studio at an average cost of $74.95 per month—so think carefully when choosing the ‘free’ option.

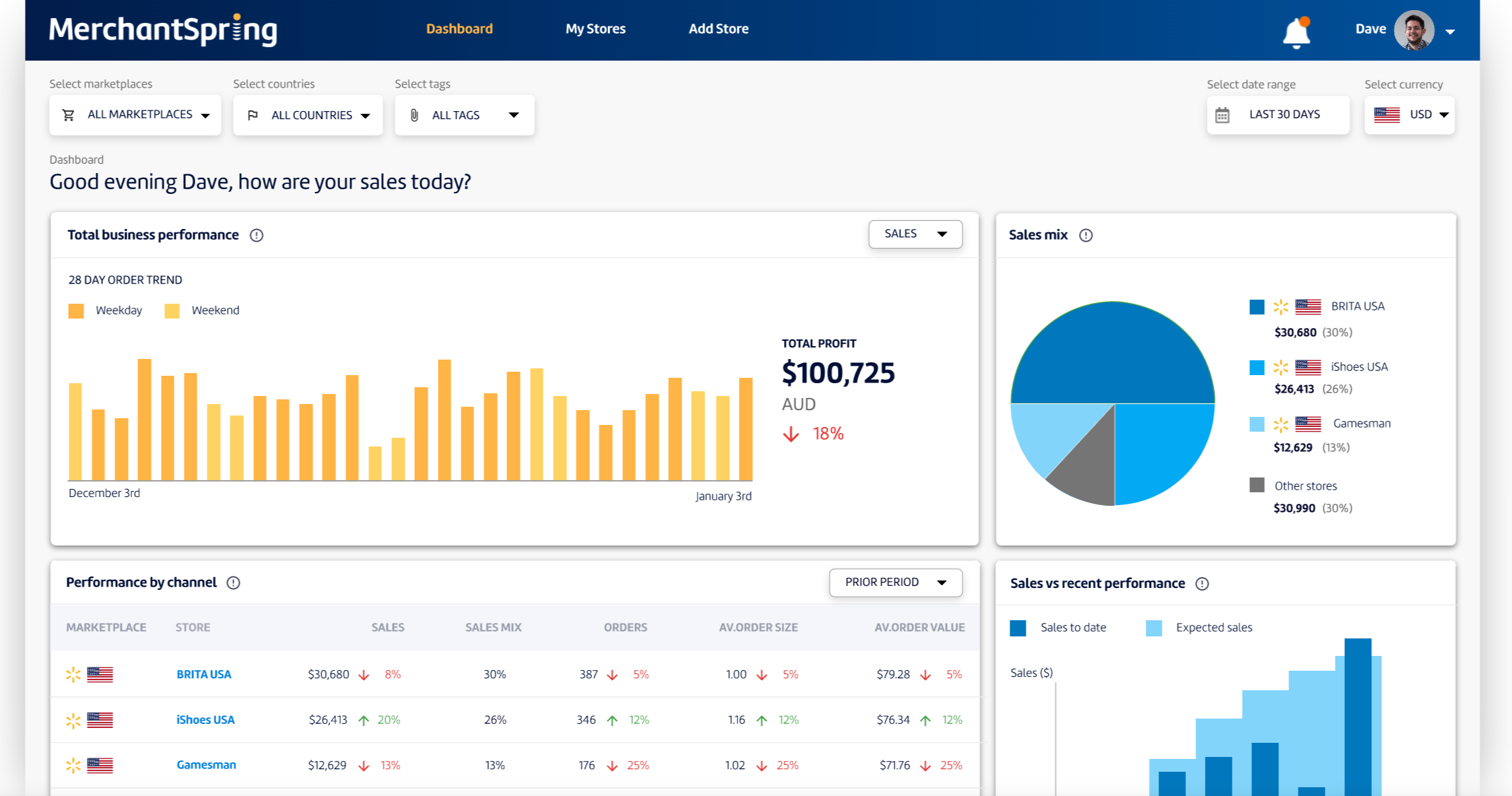

On the other hand, SaaS options like MerchantSpring provide real-time and historical financial data about ecommerce channels via a user-friendly interface. It’s also a proven tool with leading aggregators such as Moonshot Brands, Unybrands, and ecommerce accountants like Dolman Bateman using MerchantSpring alongside their accounting systems to get a complete picture of their financials.

In today’s ecommerce technology stack, reporting suites like MerchantSpring are an essential tool for ecommerce businesses looking for specific, detailed reports. While it may be tempting to try and manipulate your accounting software into producing these reports, it may not be able to provide the level of detail your business needs to thrive. And worse yet, it could mess up your financials, which should always stay neat, tidy, and accurate.

The good news is with the right tools in place, ecommerce businesses can make informed decisions based on accurate and up-to-date financial information.

The takeaways

-

Separating traditional financial reports from ecommerce-specific financial reporting is becoming increasingly important for ecommerce businesses.

-

While accounting systems like Xero and QuickBooks Online are great for traditional financial reporting, they do not provide the functionality needed to build detailed ecommerce reports.

-

Businesses can access accurate and up-to-date financials by choosing the right ecommerce reporting suite, helping propel long-term growth and profitability.

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here