How to Integrate Walmart and Xero

Integrating Walmart Seller Center with Xero is a great way to increase efficiency and accuracy for Walmart seller bookkeeping.

Walmart marketplace sellers – and accountants and bookkeepers who work with Walmart sellers – will understand that bookkeeping for Walmart can be complex.

One key challenge that makes Walmart bookkeeping complicated is that Walmart settlements are not just made up of sales – they’re actually a combination of sales, fees, refunds, and other transactions. Coding a Walmart settlement to a ‘Sales’ account is incorrect, and can lead to a number of issues.

The good news? Setting up an integration between Walmart and Xero can help. An integration will allow Walmart data to be summarized and categorized according to your Chart of Accounts in Xero for easy and accurate reconciliation.

In this article, we’ll cover how to integrate Walmart Seller Center with Xero.

Key takeaways:

- Setting up an integration between Walmart and Xero simply means connecting these two tools so that your Walmart transaction data can flow automatically into Xero.

- There are a couple of options available for integrating Walmart with Xero (outlined below). The option you choose should ensure you get the most accurate data into Xero.

- Setting up an integration between Walmart and Xero with A2X is easy and takes just a few steps.

Table of Contents

Integrate Walmart and Xero for accurate accounting

A2X auto-categorizes your Walmart sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today

Does Xero integrate with Walmart?

Xero can integrate with Walmart Seller Center using an app or a tool – and it can make Walmart bookkeeping quick and easy.

Integrating Walmart with Xero means setting up a connection between these two tools so that Walmart transaction data can be accurately reconciled in Xero.

It’s important to note that Xero does not support a direct integration with Walmart, which means that you’ll need an additional tool to set up the integration.

How to integrate Walmart with Xero

There are two primary options when it comes to tools that can integrate Walmart with Xero:

- Data syncing apps

- An accounting automation tool designed specifically to reconcile Walmart settlements in Xero, such as A2X

The tool you choose will depend on your Walmart business’s volume of orders and unique needs.

Choose an integration tool

A key (but frequently overlooked) factor in selecting an integration solution for Walmart and Xero is accuracy.

As noted, Walmart’s bookkeeping complexities usually stem from its settlements, which include various fees, refunds, taxes, and other financial activities. Properly tracking each transaction type is crucial.

Accurate bookkeeping can benefit Walmart sellers in several ways:

- Tax compliance: Reliable financial records are critical for accurate income and expense reporting on tax filings.

- Clear business insight: Through meticulous revenue, cost, and profit tracking, Walmart vendors can understand their most lucrative products, identify seasonal patterns, and other critical metrics.

- Identify risks: Reliable financial information will help you understand if something doesn’t seem quite right and you need to take action.

- Financial forecasting: Accurate books enable Walmart vendors to project future earnings and expenses, which is required for strategic budgeting and financial planning.

- Financing opportunities: For Walmart vendors seeking loans or investors, accurate financial statements are important. These documents are necessary for lenders and investors to evaluate the business’s health and potential.

Manual record-keeping and/or selecting an unsuitable integration tool can make it difficult to get the accurate numbers you need to accomplish all of the items listed above.

With this in mind, Walmart sellers will likely want to prioritize accuracy when choosing an integration tool to connect with Xero.

Use a data syncing app

Data syncing applications are designed to transfer data between different platforms. For instance, in the context of Walmart and Xero, you could establish a process where each order triggers an invoice in Xero.

These apps are generally a good, affordable choice for businesses handling a modest number of sales. However, as sales volume grows, challenges may arise, particularly concerning accuracy and reconciliation.

Consider the following when deciding whether or not to use a data syncing app:

- They may only process data for individual orders, potentially overloading your accounting system.

- They might fail to capture every transaction type, which could complicate your ability to achieve accurate financial records (and get a clear picture of your income or expenses).

- Occasionally, these apps aren’t tailored specifically for accounting and bookkeeping, leading to laborious reconciliation processes.

Use A2X to integrate Walmart and Xero

A2X is a specialized accounting automation solution created for streamlined and accurate ecommerce reconciliation.

A2X seamlessly links Walmart with Xero and can cater to sellers operating across multiple channels, offering integrations for platforms like Amazon, Shopify, Etsy, and eBay.

Here’s how it works:

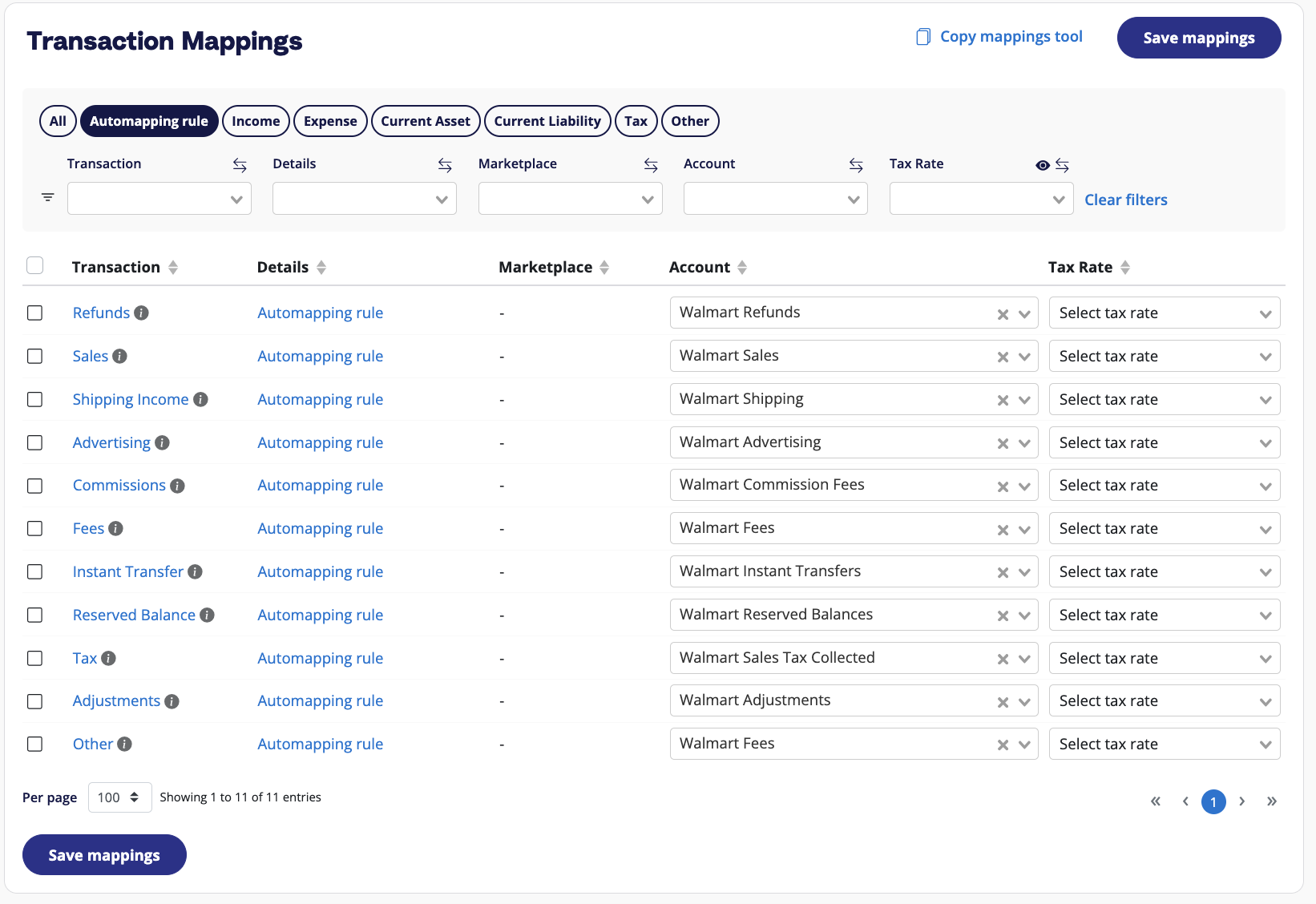

- After connecting A2X to both Xero and Walmart, you “map” Walmart transactions to the relevant accounts in your Xero Chart of Accounts.

- Subsequently, A2X will assign each transaction based on your preferences. A2X can identify all types of Walmart transactions, ensuring detailed accounting and bookkeeping.

- A2X compiles settlement information into consolidated reports that are then transferred to Xero, aligning perfectly with the settlement deposits in your bank.

Efficient and accurate Walmart bookkeeping is just a few steps away with A2X. Below are the instructions to get started.

Step-by-step guide: How to integrate Walmart and Xero with A2X

Watch this video to understand how to integrate Walmart and Xero with A2X, then follow the instructions below for more details.

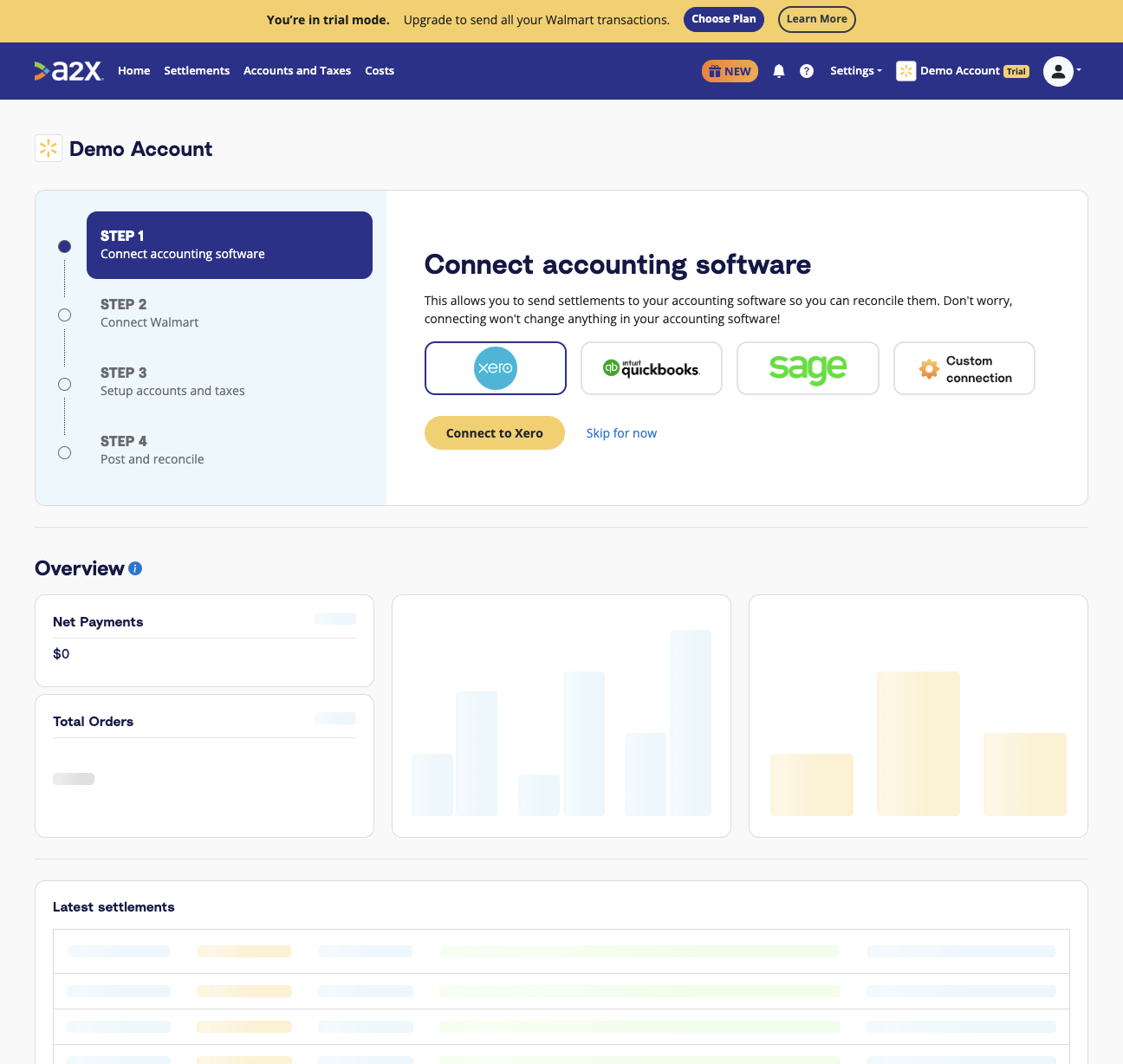

Step 1: Sign up for A2X

Sign up for an A2X free trial here – click ‘Try A2X for free’ in the top right corner.

You’ll be prompted to select which sales channel you’d like to connect to first. Select ‘Walmart’.

Sign up via your preferred sign in method (e.g., Gmail or Xero), then follow the rest of the prompts and provide the necessary information to set up your A2X account.

You’ll land on the A2X dashboard.

Note – Your account will be in ‘free trial mode’ until you choose to subscribe. In ‘free trial mode’, you’ll have access to try out most of A2X’s features and functionality, with a few limitations.

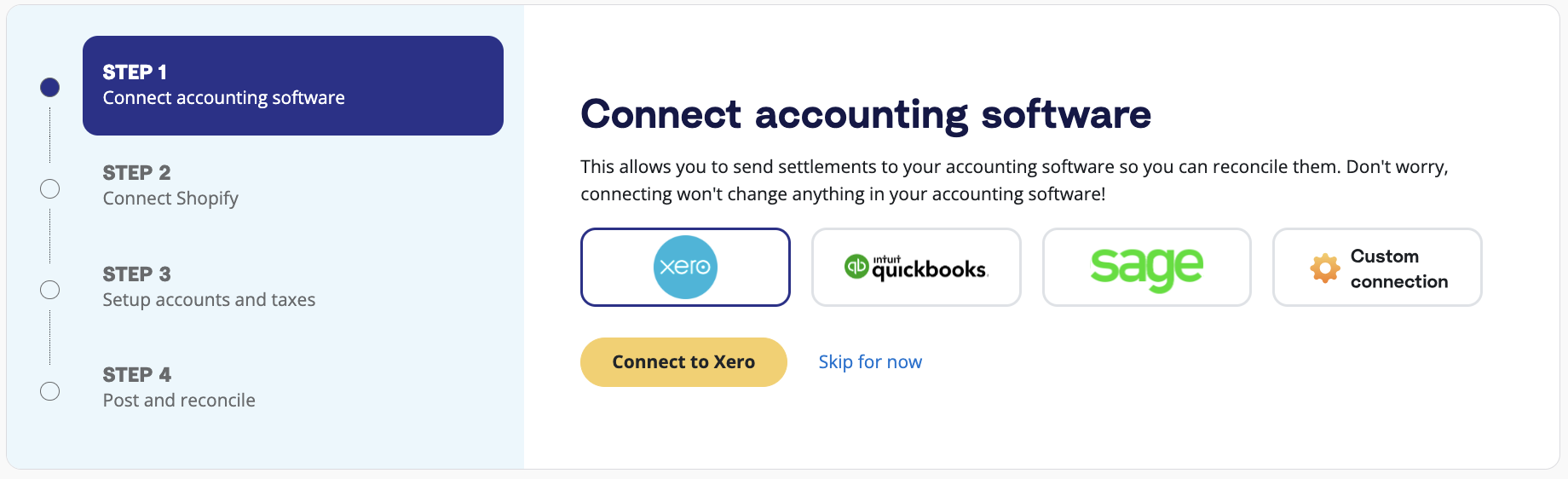

Step 2: Connect to Xero

On the A2X dashboard, you’ll see a prompt to connect to your accounting software.

To connect to Xero: Click on the Xero logo, then click ‘Connect to Xero’.

You may be prompted to sign in to Xero and enable permissions for A2X to post to Xero (don’t worry – A2X won’t post anything until you’re ready).

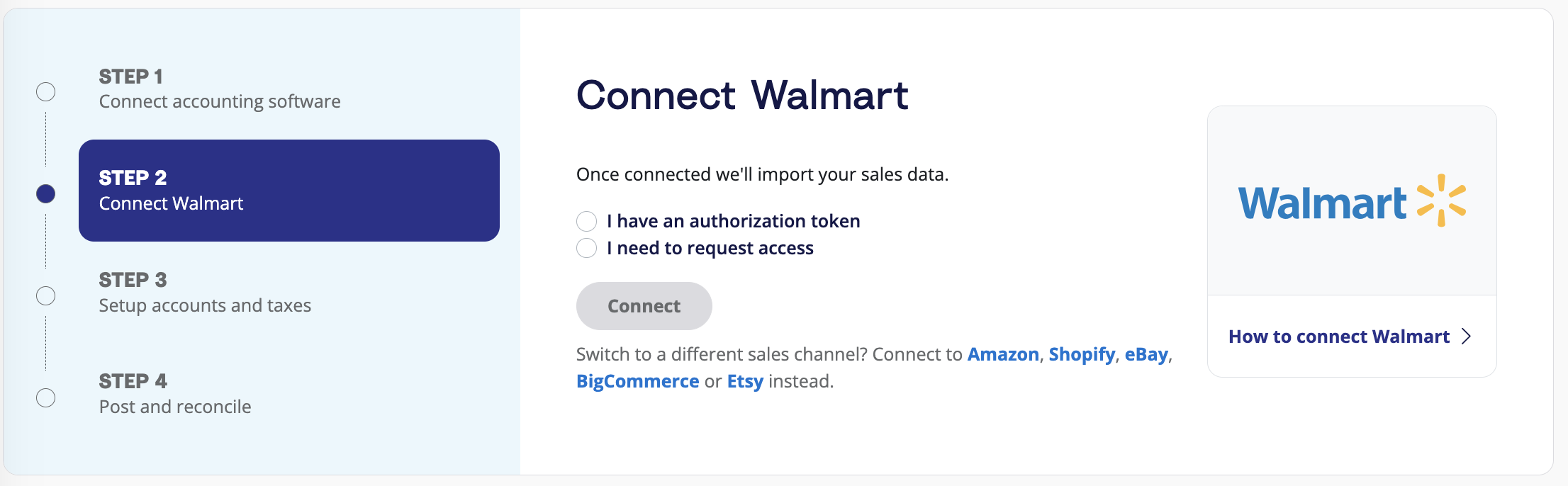

Step 3: Connect to Walmart

Next, connect to Walmart.

You have two options:

- Option 1: If you are the store owner or have access to the Walmart store you are connecting, select ‘I have an authorization token’. Follow the prompts to connect to Walmart. Note – you’ll need your Walmart Client ID and Client Secret to complete this step.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

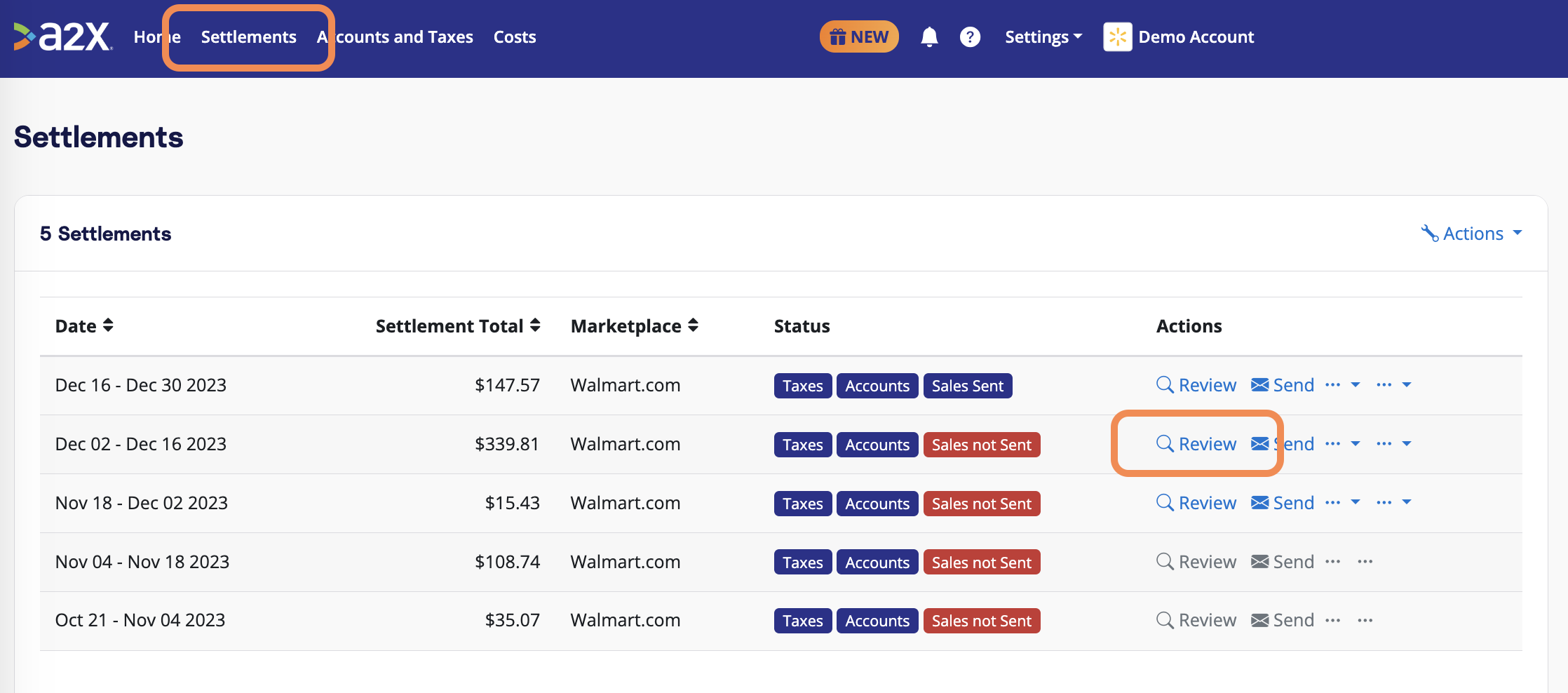

After permission is granted, A2X will return you to the A2X dashboard, and your settlement data will automatically start to be fetched by A2X (which you can see in the ‘Settlements’ tab).

Step 4: Map accounts and taxes

Mapping accounts and taxes is the process of selecting which account in the Chart of Accounts you want each transaction type to be posted to in Xero for all settlements moving forward. For example, sales transactions will be posted to an Walmart Sales account.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get it right for your specific business.

A2X can automate this process for you, or you can map it yourself.

- Click ‘Setup Account and Taxes’ on the A2X dashboard.

- The first time you visit the Accounts and Taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted setup or Custom setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in Xero and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to Walmart settlements moving forward.

Step 5: Review and post to Xero

Congrats – you’re done the majority of your A2X setup!

You can now move on to routine bookkeeping for Walmart and Xero with A2X.

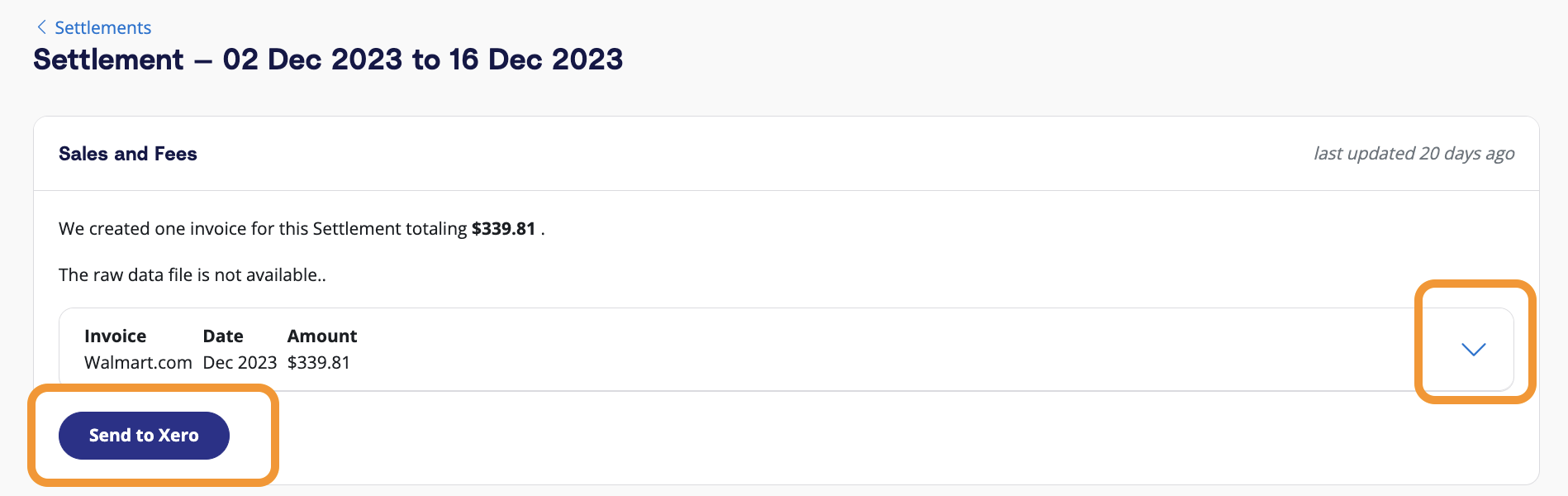

To send your first invoice from A2X to Xero, go to the ‘Settlements’ tab.

Click ‘Review’ beside the settlement that you wish to review and post to Xero.

Review how the transactions have been categorized to your Chart of Accounts by clicking the dropdown arrow next to the settlement, and click ‘Send to Xero’ when you’re ready.

Note – auto-posting is available when you’re ready to use this.

Step 6: Reconcile in Xero

Log in to Xero.

Look for the Walmart deposit in the bank feed. You should also see the invoice from A2X beside it, ready to be reconciled!

Click ‘OK’, and the transaction will be reconciled.

And there you go! Walmart bookkeeping can be completed in just a few clicks.

Ready to integrate Walmart and Xero with A2X? Start a free trial today!

Integrate Walmart and Xero for accurate accounting

A2X auto-categorizes your Walmart sales, fees, taxes, and more into accurate summaries that make reconciliation in Xero a breeze.

Try A2X today