Etsy QuickBooks Integration: How to Set it Up for Accounting

Integrating Etsy and QuickBooks Online is a great idea – especially if you’re looking to spend less time on accounting and bookkeeping, and you want to get more accurate numbers.

Whether you’re a quickly growing Etsy seller, or an accountant or bookkeeper who works with Etsy sellers, then you’ll understand that bookkeeping for Etsy isn’t as straightforward as it might seem.

Etsy deposits are made up of more than just sales. They also include fees, refunds, tax, and other transactions – and all of these different transactions need to be accounted for correctly.

The good news is that integrating Etsy and QuickBooks Online (QBO) with the right tool can help make Etsy accounting accurate and more efficient.

In this article, we’ll cover how to integrate Etsy and QBO with A2X.

Key takeaways:

- Integrating Etsy and QuickBooks Online means establishing a connection that enables your Etsy financial data to flow seamlessly into QuickBooks for easy accounting and bookkeeping.

- There are a couple of tools that allow you to integrate Etsy and QBO – you can read some of the details below to decide which is the right option for your business.

- Setting up an Etsy-QuickBooks integration with A2X is easy and just takes a few steps (outlined below).

Table of Contents

Integrate Etsy and QuickBooks Online for accurate accounting

A2X auto-categorizes your Etsy sales, fees, taxes, and more into accurate summaries that make reconciliation in QuickBooks Online a breeze.

Try A2X today

Does Etsy connect to QuickBooks?

Etsy can connect, or “integrate”, with QuickBooks Online using an app or a tool.

This means that you can automatically send Etsy transaction data from Etsy to QuickBooks. No more manual data entry!

There are a few different types of apps and tools that you can use to connect Etsy with QBO. The one you choose should best fit your unique business needs. We’ll provide a few considerations below.

Why you should connect Etsy to QuickBooks

Accounting for Etsy can be complicated.

The cause of much of the complication is the fact that Etsy deposits are not just sales – so you can’t just code them to a sales account in QuickBooks and call it a day.

Etsy deposits also consist of fees, refunds, taxes, and other transactions. It’s important to code them to the correct accounts so that you can get accurate numbers, and therefore an accurate understanding of how your Etsy store is performing.

But, manually entering all this data can take a ton of time and can be prone to error.

That’s where integrating Etsy and QuickBooks comes in handy – it can help Etsy accounting happen automatically, which can help save time and increase accuracy.

Accuracy matters for Etsy accounting

We’ve mentioned “accuracy” a few times in this article – why is it so important for Etsy sellers, in particular?

Again, given how Etsy deposits consist of more than just sales, recording them properly – and catching every type of transaction – is critical, and necessary for proper reconciliation.

Accurate accounting and bookkeeping can help Etsy sellers:

- Maintain tax compliance: Accurate financial records are essential for reporting income and expenses on tax returns.

- Understand business performance: By accurately tracking revenues, costs, and profits via accounting, Etsy sellers can understand which products are most profitable, seasonal trends, and other key business metrics.

- Manage inventory: For sellers who deal with physical goods, proper accounting helps in tracking inventory levels. This aids in understanding product turnover rates, the need for restocking, and the management of storage costs.

- Plan and budget: Accurate records enable Etsy sellers to forecast future revenues and expenses, aiding in budgeting and financial planning. This is essential for sustainable business growth and for making informed decisions about investments, pricing strategies, and cost control.

- Access to financing: If an Etsy seller seeks financing or investment, accurate financial records are critical. Banks and investors will require detailed financial statements to assess the health and viability of the business.

With this in mind, scaling Etsy sellers will likely want to prioritize accuracy when choosing an integration tool to connect Etsy with QuickBooks.

How to connect Etsy to QuickBooks

There are two primary options for integrating Etsy and QBO, and the one you choose will depend on your specific business needs.

- Data syncing apps – generic tools for getting Etsy data into QuickBooks

- An ecommerce accounting automation tool designed to organize Etsy financial data into summaries for accrual accounting, such as A2X

Use a data syncing app

There are a few free or low-cost apps that can help get Etsy data into QuickBooks.

These apps might be a decent option if you’re a smaller Etsy seller and you have a lower volume of sales each month. However, you might run into a few challenges:

- They might only post data for individual orders, which could clog QBO (especially if you grow and have a higher volume of orders).

- They might not identify every kind of transaction, which can make it challenging to achieve accurate financials.

- Sometimes, they’re not designed specifically for accounting and bookkeeping, so reconciliation can be time-consuming.

Use A2X to integrate Etsy and QuickBooks

If you are a larger Etsy seller with a higher volume of orders, and if you want accurate financials, then A2X is a great option for integrating Etsy and QuickBooks Online.

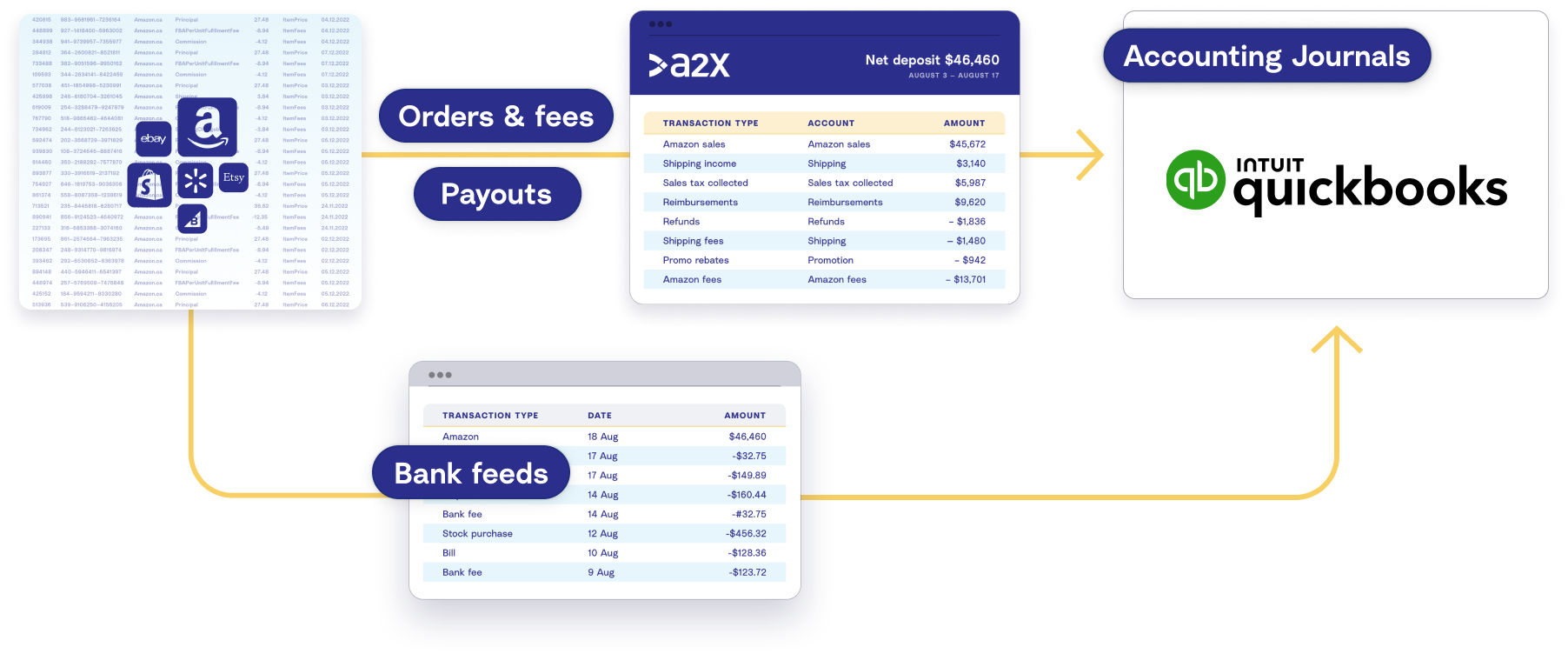

A2X enables settlement accounting

A2X batches your transactions based on settlement deposits so that your bank deposits can be easily matched to your Etsy orders.

A2X calculates all the income and expense lines that go into each bank deposit, posting these in neat journal summaries to QuickBooks Online.

Your books are recorded and organized based on settlements, rather than individual orders, which prevents your accounting software from getting clogged up and helps you keep track of your cash flow.

A2X enables accrual accounting

Just as settlement accounting is to do with how your finances are recorded, accrual accounting is focused on when your finances are recorded.

To understand how your business is performing, you need a handle on what income and expenses are coming up. Managing cash flow effectively is all about knowing the past, present, and future movements of your money.

And that’s what the accrual accounting method is all about. Only via the accrual method can you accurately forecast the peaks and troughs for your business throughout a financial year and plan for them accordingly.

A2X organizes your books for you based on the accrual method. So in one app, you have the best of accounting management sorted.

Watch the video below to learn more about how A2X works for Etsy accounting and bookkeeping.

Step-by-step: How to integrate Etsy and QuickBooks Online with A2X

Watch this video to learn how to integrate Etsy and QuickBooks Online with A2X, then follow the instructions below for more details.

1. Sign up for A2X

Sign up for an A2X account by clicking ‘Try A2X for free’ in the top right corner of the webpage.

You’ll be prompted to select which sales channel you’d like to connect to first – choose Etsy.

From there, follow the prompts to sign in to A2X and enter your necessary information.

You’ll end up on the A2X dashboard.

Note – Your A2X account will be in “free trial mode” until you decide to subscribe. This simply means that you can use A2X, but there will be some limitations on features and functionality.

2. Connect to QuickBooks Online

On the A2X dashboard, you’ll be prompted to connect to your accounting software.

Click on the QuickBooks logo, then click ‘Connect to QuickBooks’.

You’ll then be prompted to sign in to QuickBooks and enable permissions for A2X. You’ll also be prompted to select the accounts to which A2X sends deposit data.

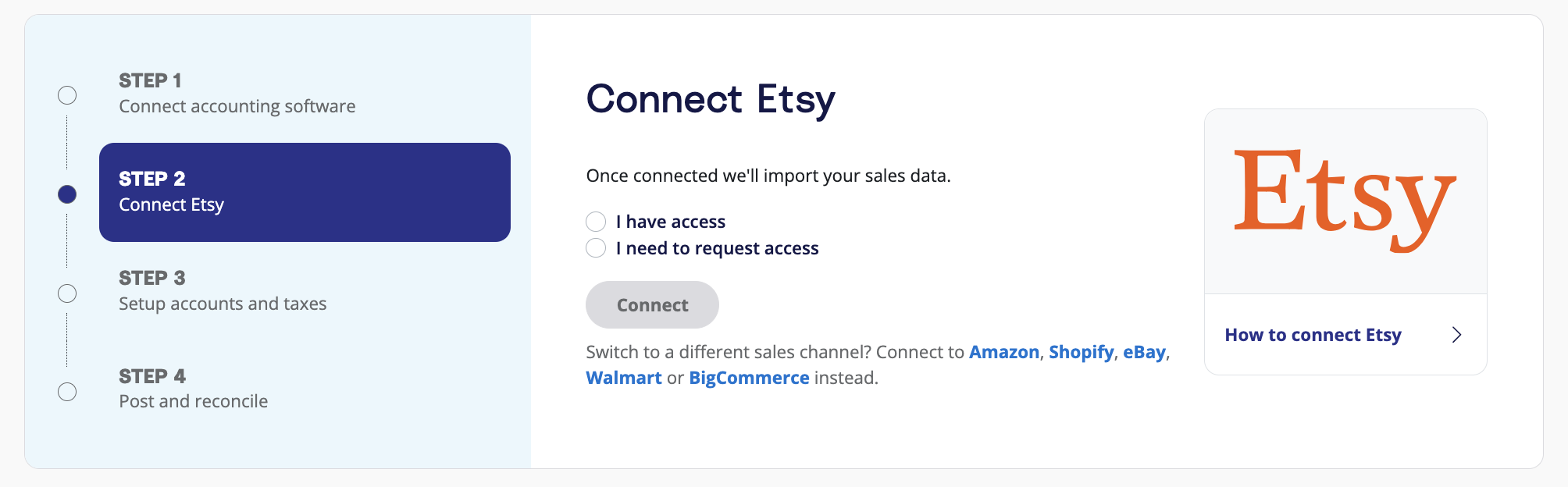

3. Connect to Etsy

Next, you’ll be prompted to connect to Etsy.

You have two options:

- Option 1: If you are the store owner or have access to the Etsy store you are connecting, select ‘I have access’. Follow the prompts to connect to Etsy.

- Option 2: If you are integrating A2X on behalf of a store owner, select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

After permission is granted, A2X will return you to your A2X dashboard, and your deposits data will automatically start to be fetched by A2X (which you can see in the ‘Deposits’ tab).

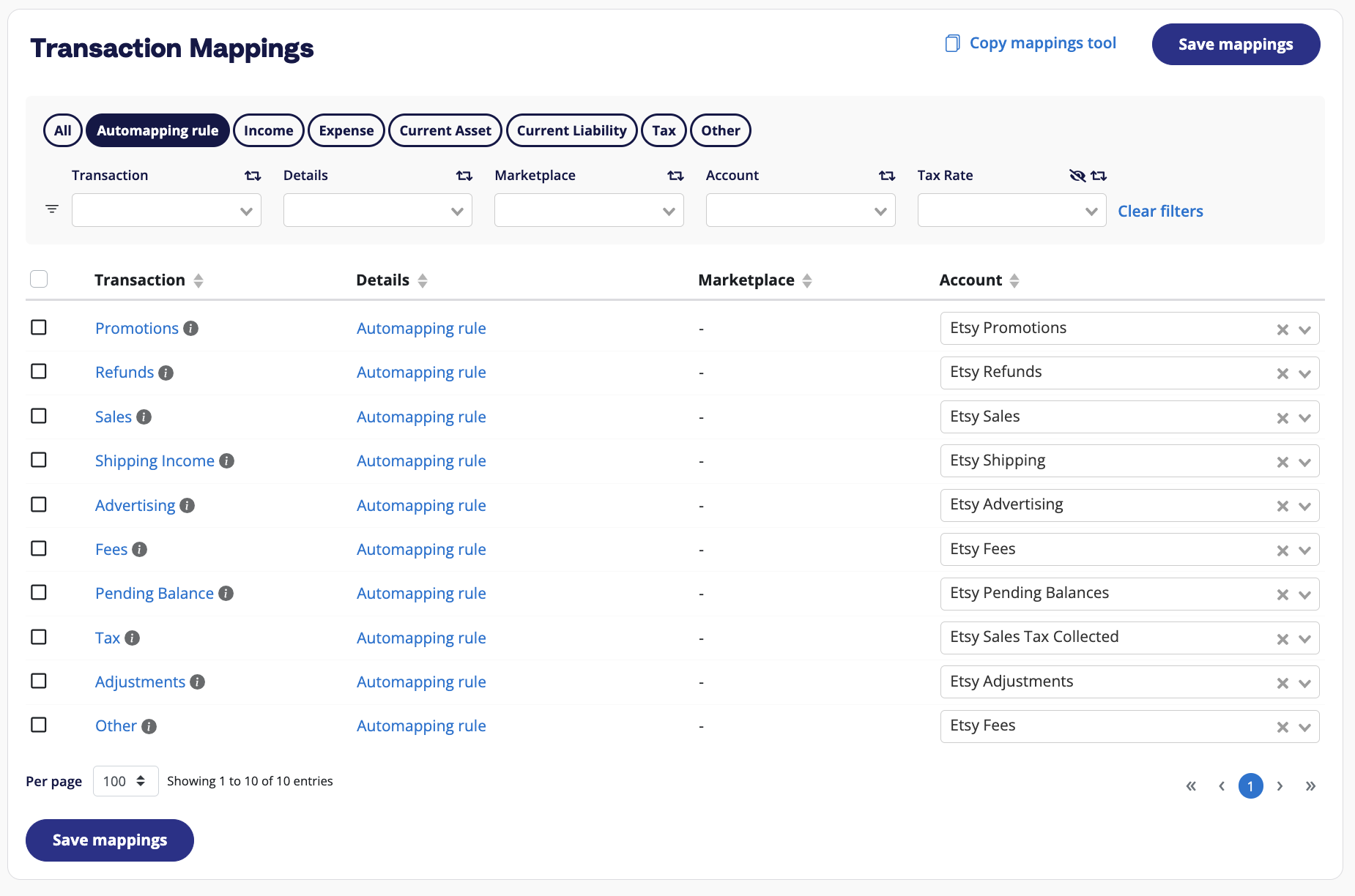

4. Map accounts and taxes

Next, it’s time to map your accounts and taxes.

We strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get it right for your specific business.

Mapping accounts and taxes is the process of selecting which account in the Chart of Accounts you want each transaction type to be posted to in QuickBooks Online for all deposits moving forward. For example, sales transactions will be posted to an Etsy Sales account.

A2X can automate this process for you, or you can map it yourself. Once you set this up, all Etsy deposits will be coded according to the settings you’ve selected moving forward.

- Click ‘Setup Account and Taxes’.

- The first time you visit the accounts and taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: Assisted setup or Custom setup.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in QuickBooks Online and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

5. Review and post to QuickBooks

At this stage, you’ve completed the key steps in your A2X setup!

This step (and the following step) outline how you can complete reconciliation for Etsy using A2X and QuickBooks Online.

Go to ‘Deposits’, and click ‘Review’ beside the settlement you wish to review and post.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to QuickBooks’ when you’re ready.

Note –

auto-posting is available to you when you’re ready to use this.

6. Reconcile in QuickBooks

Log in to QuickBooks.

Look for the Etsy deposit in the bank feed. You should also see the journal entry from A2X beside it, ready to be reconciled!

Click ‘Match’, and you’re done!

Ready to integrate Etsy and QuickBooks Online with A2X? Start a free trial today!

Integrate Etsy and QuickBooks Online for accurate accounting

A2X auto-categorizes your Etsy sales, fees, taxes, and more into accurate summaries that make reconciliation in QuickBooks Online a breeze.

Try A2X today