eBay QuickBooks Integration: How to Set it Up for Accounting

Written by: Amy Crooymans

November 7, 2025 • 21 min read

Setting up an integration between eBay and QuickBooks Online is a great way to automate eBay accounting and bookkeeping.

High-volume eBay sellers and accountants/bookkeepers who work with eBay sellers will be all too familiar with the complexities of eBay accounting and trying to get transactions to match up with eBay payouts.

Fortunately, integrating eBay with QuickBooks Online can make eBay accounting and bookkeeping quick, easy, and accurate.

This guide will walk you through different methods for an eBay QuickBooks Online integration and how to set these up.

Key takeaways:

- Integrating eBay and QuickBooks means setting up a connection that allows your eBay data to flow seamlessly into QBO for easier accounting and bookkeeping.

- There are three ways to integrate eBay with QuickBooks, and it’s up to you to decide whether manual entry, a data-syncing app, or a specialized solution like A2X will be the most efficient way to manage your eBay accounting, now and as your business grows.

- Setting up a specialized eBay-QuickBooks integration with A2X is easy and takes just a few steps (outlined below).

Can eBay integrate with QuickBooks?

Yes, eBay can integrate with QuickBooks using an app or a tool. This simply means that you can connect eBay with QuickBooks so that the eBay financial data you need for accounting and bookkeeping can flow seamlessly into QuickBooks.

There are a few different apps and tools available for integrating eBay with QuickBooks – we dive into the options below.

Why integrate eBay with QuickBooks?

There are a number of complexities that can make eBay accounting confusing and time-consuming.

For example, eBay’s billing cycles – eBay sellers can schedule payouts to occur daily, weekly, fortnightly, or monthly, meaning you’re left to deal with payments that span across days or weeks. Additionally, payout periods can easily extend over two months, resulting in you needing to carefully split out which sales were made in each month to retain accurate records.

Plus, eBay payouts aren’t just made up of sales – they’re actually a combination of sales, eBay seller fees, refunds, and other transactions, and need to be coded correctly.

Using an accounting automation tool that will integrate eBay with QBO can help you avoid these headaches and experience the following benefits:

- Save time with automation – No more manual data entry and hours spent trying to get eBay payouts to match with bank deposits in QuickBooks Online – this can happen automatically when you use an integration tool like A2X.

- Get accurate books – Automation doesn’t only help save time – it also helps to increase accuracy by removing the chance for human error. Using an integration tool make sure that eBay sales, refunds, taxes, and all other transactions are coded to the correct accounts, so you can get the full picture when it comes to your business performance.

Accuracy is especially important if you’re seeking a loan or investment for your business, as potential lenders and investors want to see an accurate P&L and balance sheet.

How to integrate eBay with QuickBooks Online

When it comes to setting up an eBay QuickBooks Online integration, you have three main options:

- eBay QuickBooks Online integration with an ecommerce accounting automation tool like A2X that will categorize and reconcile payout data for you – saving hours and increasing financial accuracy.

- Integrate eBay and QuickBooks Online with a data syncing app that puts individual orders into your accounting software for manual categorization.

- Manually entering data from eBay reports into QuickBooks Online.

The option you ultimately choose will depend on the complexity of your business, and the level of time-saving and accuracy benefits that you wish to experience.

We’ll outline some pros and cons and how to set up each integration solution below.

Using A2X to integrate eBay and QuickBooks Online

A2X is an ecommerce accounting automation tool designed for businesses that operate on sales channels, including eBay, Amazon, Shopify, Etsy, and more. It also integrates with cloud accounting software like QuickBooks Online and Xero, acting as a facilitator between your sales channel and accounting system.

A2X integrates eBay and QBO by taking the raw sales data from your eBay account and organizing it into concise summaries. These summaries are then sent to QuickBooks Online, making eBay accounting a breeze.

What sets A2X apart is how well it matches these summaries to the lump sum payouts you receive in your bank account from eBay, enabling one-click reconciliation of your settlements.

As discussed above, eBay accounting and bookkeeping is complex and it’s cumbersome to accurately allocate sales and expenses to the correct time periods. A2X solves this by automatically splitting this data based on the exact days sales and expenses occurred, eliminating the manual labor usually required to get your books in order.

Setting up the eBay integration with QuickBooks Online via A2X is incredibly simple. You can either manually map your Chart of Accounts or opt for A2X’s recommended settings. Either way, the setup takes just a few minutes.

If you ever find yourself stuck or in need of assistance, A2X has you covered. There are various resources available to help you out, including an extensive support center, a chat service, and a dedicated support team ready to assist you.

How to integrate eBay QuickBooks Online with A2X

Watch this video to understand how to integrate eBay and QBO with A2X, then follow the steps below for more details.

Whether you're an eBay seller or an accountant or bookkeeper who works with eBay sellers, you know that accurate bookkeeping is important — but it can be challenging and time consuming. You might be using QuickBooks Online and you're looking for a way to easily get sales data from eBay into QuickBooks. Up until now, you might have been avoiding bookkeeping, entering the data manually, or maybe coding the entire eBay payout to a sales account. These options can work for a short time — you might run into some challenges as your eBay store begins to grow.

For example, eBay payouts are actually made up of more than just sales — they also include a combination of fees, shipping costs, eBay disputes, refunds, and discounts. To reconcile an eBay payout you need to know which transactions make up a payout. eBay provides reports that include this information, but manually going through these reports and getting them to balance with an eBay payout can take up a lot of time.

Fortunately, there's an easy solution — setting up an integration between eBay and QuickBooks Online will allow your eBay transaction data to flow seamlessly into QuickBooks. There are a couple of ways you could set this up. One option is to use a data-syncing app that sends every order individually. This could work if you're a smaller eBay seller, but it can cause issues for larger sellers, like overwhelming your accounting system. A better option is to use A2X. A2X connects eBay and QuickBooks so all your eBay transaction data can flow into QuickBooks.

With A2X, all your eBay transactions — including sales, fees, refunds, and other transaction types — are automatically organized into detailed summaries that reconcile perfectly with your payouts and QuickBooks. Integrating eBay and QuickBooks with A2X is easy — here's how you can set it up.

First, sign up for an A2X account at a2xaccounting.com. Next, you need to connect A2X to QuickBooks — all you need is your QuickBooks login. Then connect A2X to eBay Seller Hub — again, all you'll need is your login. After connecting A2X to QuickBooks and eBay, it's time to map your transactions to your Chart of Accounts. Go to the Accounts and Taxes page, where you can choose how to categorize your eBay transactions to your Chart of Accounts. A2X can help you automate this.

Once you've completed your accounts and tax mapping, go to the Payouts tab. This is where you can review and post payouts from A2X to QuickBooks. The final step is to reconcile in QuickBooks — log into QuickBooks and navigate to the bank feed. Find the payout from eBay. Next to the payout you will see the journal from A2X, ready to be matched. And there you go — eBay bookkeeping with A2X can be that easy. Integrating eBay and QuickBooks with A2X can help you save time on bookkeeping and get more accurate financials. For more information, visit a2xaccounting.com.

1. Sign up for an A2X free trial

First, you’ll need to set up your A2X account.

Start a free trial for A2X for eBay and QuickBooks by clicking ‘Try A2X for free’ in the top right of the A2X website. Select ‘eBay’ as the channel that you’d like to connect to first. Then, follow the prompts to sign up using your preferred sign in method, and enter the required information.

You’ll end up on the A2X dashboard.

Note – your A2X account will remain in ‘free trial mode’ until you decide to choose a plan and subscribe. In free trial mode, you’ll have access to limited data and A2X functionality.

2. Connect to QuickBooks Online

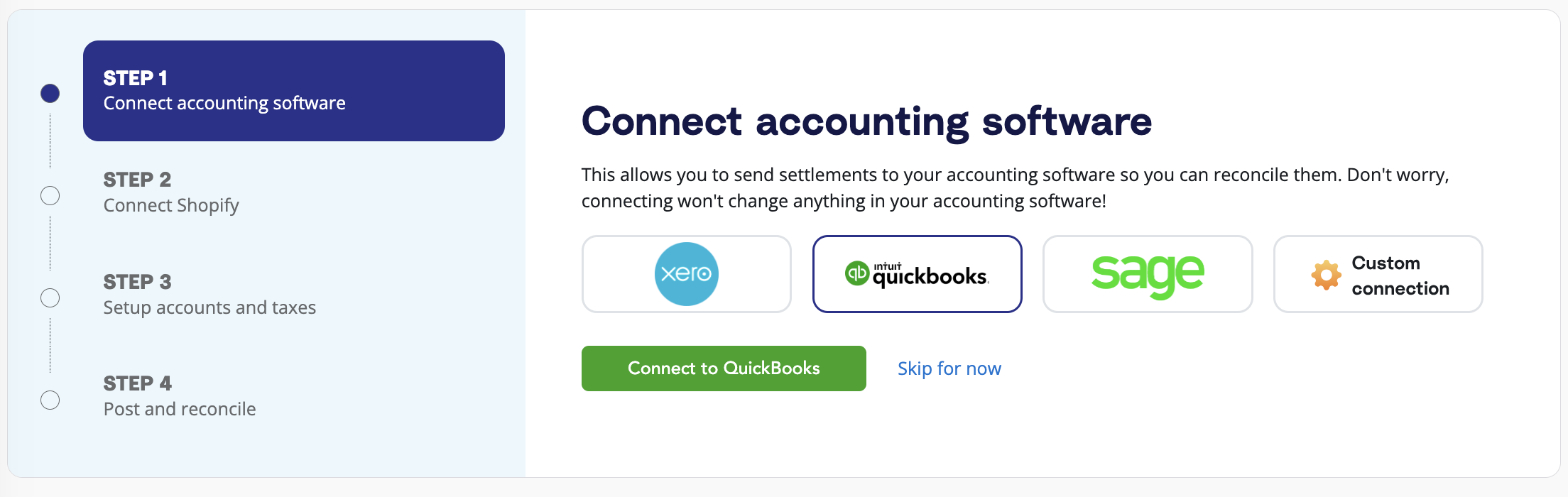

On the A2X dashboard, you’ll see a prompt to connect to your accounting software. Choose ‘QuickBooks’, then click ‘Connect to QuickBooks’.

You’ll be directed to enter your QuickBooks login information, and the bank accounts where you want A2X to post settlement details.

After connecting, you’ll return to the A2X dashboard.

3. Connect to eBay Seller Hub

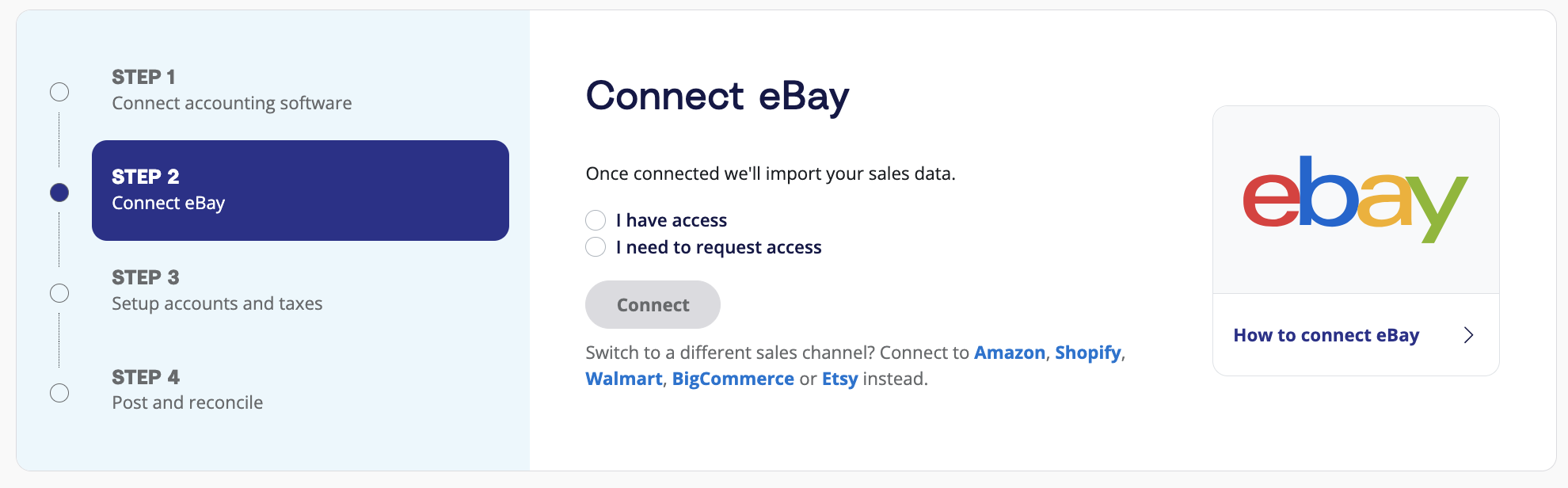

On the A2X dashboard, you’ll be prompted to connect to eBay.

You have two options:

- Option 1: If you are the store owner or have access to the eBay store you are connecting, select ‘I have access’. Log into eBay, and click I agree to grant permission for A2X to access your account.

- Option 2: If you are integrating A2X on behalf of a store owner (e.g., you’re an external accountant or bookkeeper), select ‘I need to request access’ to send an email to the seller with a link to authorize the connection. You will need to wait for them to authorize before proceeding any further.

After permission is granted, A2X will return you to the A2X dashboard, and your first payouts will automatically begin populating. This could take as little as 10-20 minutes for smaller stores and a few hours for larger ones.

4. Map accounts and taxes

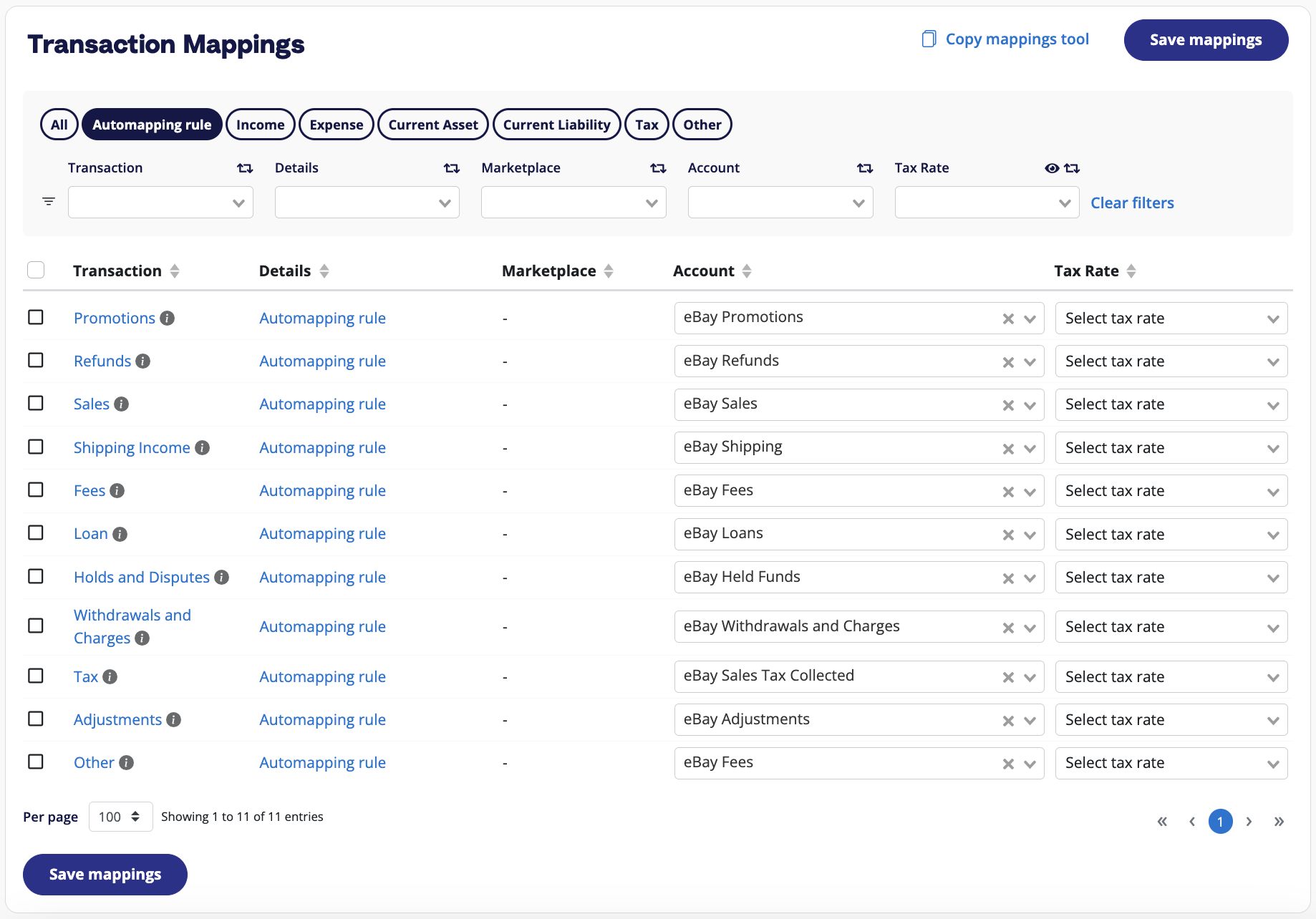

Next, you should set your accounts and taxes. This is your blueprint for where all eBay transactions will be categorized by A2X and sent to QuickBooks Online, so it is worth spending time on this part.

We also strongly recommend consulting with an accountant or bookkeeper who specializes in ecommerce to get it right for your specific business.

Mapping accounts and taxes is the process of selecting which General Ledger account you want each transaction type to be posted to in QuickBooks Online for all payouts moving forward. For example, sales transactions will be posted to an eBay Sales account.

A2X can automate this whole process for you or you can map it yourself.

- Click ‘Setup Account and Taxes’ on the dashboard, or click on the ‘Accounts and Taxes’ tab at the top of A2X.

- The first time you visit the accounts and taxes page, A2X will prompt you with a few questions about your business. Once you’ve answered these questions, you will be presented with two options: ‘Assisted Setup’ or ‘Custom Setup’.

- Assisted setup: A2X will automatically apply best practice recommendations to your new A2X account for accurate ecommerce accounting. These recommendations include applying the tax rate, and creating the Chart of Accounts in QuickBooks Online and mapping the transactions to these accounts.

- Custom setup: If you prefer to map your own transactions, you can choose your own accounts and taxes for each transaction type rather than an A2X generic default. To do this, click the down arrow next to a transaction type and find the account you want from your Chart of Accounts list.

- Save your mappings: Click the ‘Save mappings’ button at the bottom of the page. Your account mapping will now apply to your settlements consistently.

Note: If you create new accounts in your QuickBooks Online after connecting A2X, you will need to refresh your cache by going to ‘Settings’ **→ ‘**Connections’.

5. Review and post

The good news: most of your A2X setup tasks are done!

The even better news: You can now start posting A2X settlements for easy reconciliation in QuickBooks.

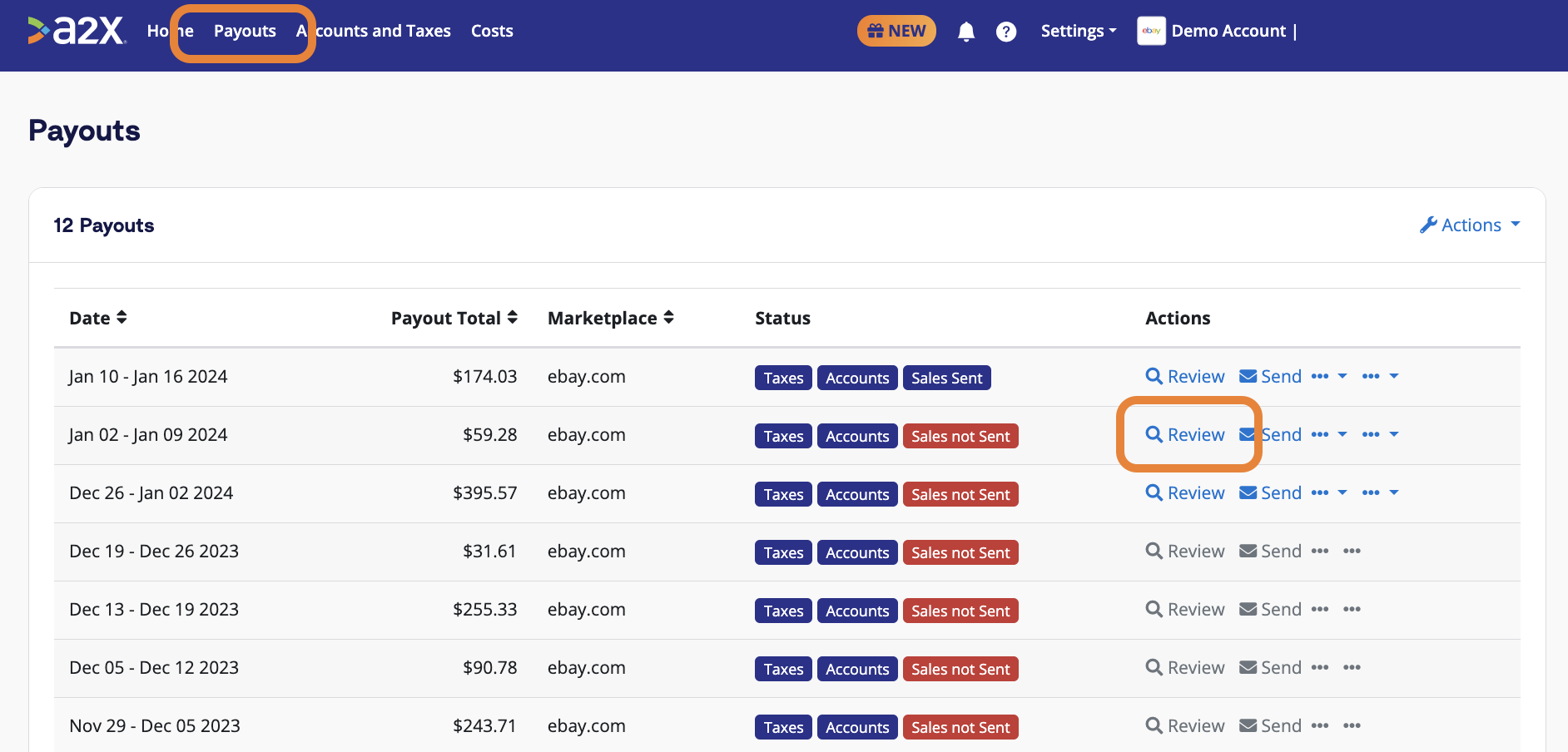

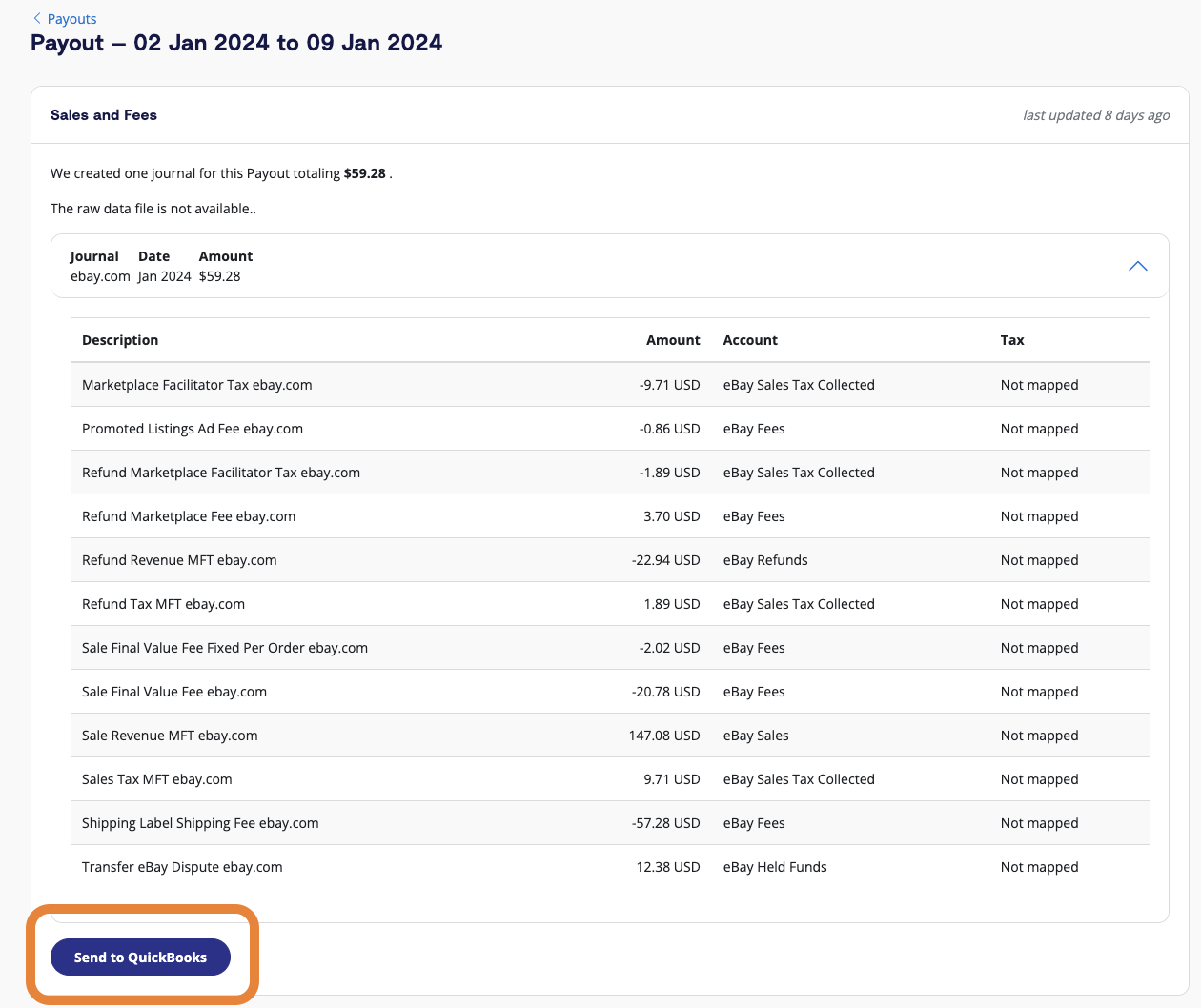

Go to ‘Payouts’ in A2X, and click ‘Review’ beside the settlement you wish to review and post.

Review how the transactions have been categorized to your Chart of Accounts, and click ‘Send to QuickBooks’ when you’re ready.

Note – auto-posting is available to you when you’re ready to use this.

6. Reconcile in QuickBooks Online

In QuickBooks Online, go to the bank account you selected to post transactions from A2X.

Find the payout from eBay. The A2X journal entry should be there beside it, ready to be matched!

You can click into the entry to find a settlement report that includes the transaction details identified from A2X.

Advantages of using A2X

Designed for eBay transactions

A2X is a specialist tool crafted for ecommerce businesses, including those selling on eBay. This ensures your unique eBay transaction types, such as sales marketplaces fees, sales shipping fees, eBay disputes, and refunds are accurately identified and categorized by A2X before they’re sent to QuickBooks Online for one-click reconciliation.

Time-saving and error-reducing automation

Automation is where A2X truly shines. It not only cuts down on manual data entry, which can be prone to errors, but also saves you invaluable time. You can use those extra hours to focus on other areas of your eBay business that need your attention.

Attach only what’s needed

Order details are essential but can be bulky. A2X strategically attaches the necessary order details to each entry, ensuring that you can look up individual orders without overwhelming your QuickBooks Online account with unnecessary data.

Customizable to your needs

Every eBay business is unique, and A2X understands that. While it offers recommended settings for ease of use, it also allows you to customize your account mappings to better align with your specific business requirements.

Top-notch support

Whether you’ve hit a snag or just have a quick question, A2X’s support team is there for you. With a wealth of helpful articles, a comprehensive ecommerce accounting hub, and a team that really knows their stuff, you’re never alone on your journey to streamlined accounting.

A2X challenges

Initial setup time

A2X offers advanced capabilities beyond simple data-syncing, which means it might take a bit longer to set up—especially if you’re customizing account mappings. However, the bright side is that A2X provides guided setup and an always-on support team to make the process as smooth as possible. Once you’ve finished setting it up, A2X takes over with its automation, ensuring your books are in tip-top shape.

The detail can be daunting

If you’re new to detailed accounting, the level of detail that A2X provides might feel overwhelming initially. That said, all that detail is there for a good reason: it offers a thorough picture of your eBay business performance. If you’re not sure how to interpret the numbers, consulting with an accounting professional can offer valuable insights.

End-of-month timing

eBay offers either weekly or bi-weekly payouts, which could impact your ability to finalize your books at the end of the month. If a payout cycle starts at the end of one month and extends into the next, you might experience delays in your monthly close-off. But once the payout period is complete, A2X helps you reconcile everything accurately, ensuring your financial reporting is accurate down to the last penny.

Integrating eBay and QuickBooks Online with a data-syncing app

If you’re an eBay merchant looking to integrate with QuickBooks Online, data syncing apps like eBay Connector could be your go-to option. Various apps in this category can be found in the QuickBooks Online app store.

While these data-syncing apps can be a fitting solution for new or smaller businesses, they might not scale well with your growth. They often import large volumes of sales data, which can slow down your QuickBooks Online account.

Plus, their lack of customization options and limited support for international businesses may leave you wanting more, especially when it comes to in-depth financial analysis.

How to integrate eBay with QuickBooks Online using a data syncing app

Just like with other platforms, an eBay integration with QuickBooks Online through a data-syncing app is a straightforward process. However, keep in mind that these apps offer fewer customization options compared to specialized tools like A2X.

Setup for these apps will vary depending on which app you use, but here’s a general overview:

- Create an account: Choose a data syncing app that works for you and create an account.

- Connect eBay: Navigate to the section where you can add platforms and choose to connect eBay. This is where your sales data will come from.

- Connect QuickBooks Online: In the same app, look for the option to add an accounting platform and select QuickBooks Online. This is where your eBay sales data will go. Double-check to make sure that data won’t start syncing automatically, as you’ll want to have everything properly configured before you turn the app on.

- Set up data transfer: Now, configure what exactly you want the app to transfer. This might be as simple as setting up prompts that map sales data to your QuickBooks Online account when a sale is made, but some apps may offer more advanced settings.

- Test the action and turn it on: After setting up the actions, run a test to ensure that everything’s working as expected. Since these apps may have limited control over the types of data you can sync, make sure you’re comfortable with the settings before you turn on the automation.

Note: Once the app is up and running for your QuickBooks Online integration with eBay, reversing its actions can be tricky. So, take the time to test and make sure it’s doing exactly what you need before letting it run on its own.

Advantages of using a data syncing app

Cost-effective

Data-syncing apps are often less expensive, and many offer free or low-cost plans. This makes them a good entry-level option for eBay sellers who are looking to integrate with QuickBooks Online without breaking the bank.

Convenient order lookup

With most data-syncing apps, your eBay sales data will be directly imported into QuickBooks Online. This means you can look up orders right within your accounting software, avoiding the need to log into eBay separately to find this information.

Speedy month-end close

Unlike dealing with settlement cycles, using a data-syncing app can help you close your books faster at the end of the month. Just be cautious – this convenience can sometimes come at the cost of financial accuracy.

Ideal for smaller operations

If you’re running a small eBay store with less transaction volume, a data syncing app can be a sufficient and cost-efficient choice to handle your basic accounting needs without all the bells and whistles you might not yet need.

Data syncing app challenges

Missing transaction types

eBay has its unique transaction types, and there’s always a chance that they may add new types. These transaction types might not get picked up by a generic data-syncing app. This can make reconciliation a headache, forcing you to spend extra time figuring out what’s what in your QuickBooks Online.

Tax functionality gaps

These apps usually have a basic grasp of tax, but they often miss the finer points. For example, they might not track if a sale included tax or was tax exclusive, or they might not accurately track VAT or GST for international sales. This would leave you scrambling come tax time.

Reconciliation roadblocks

Data-syncing apps often have set transaction cut-off times, which could be daily, hourly, or weekly. This can make it tough to reconcile your eBay sales with your QuickBooks Online records. It’s not ideal when you have to manually match entries to settlement payments, which is exactly the opposite of why you chose to integrate the app in the first place.

Not great for growth

These apps often have a one-country, one-tax, one-currency focus (most likely US sales tax). So, if your eBay business starts branching out into new markets, the app might not be up to the task, making expansion complicated.

Clearing account confusion

A common issue with these apps is the use of clearing accounts that don’t actually clear. If you discover that you have an uncleared balance, you’ll have to put on your detective hat and find out where that money came from, which is time you could have spent on more important tasks.

Data overload

These apps can flood QuickBooks Online with so much data that it can slow down the software, making it difficult to sift through the information you actually need. In some cases, you might even have to start fresh with an entirely new QuickBooks Online account, which is extra time, effort, and stress no one wants.

Support shortcomings

Depending on the app you opt for, customer support might not be reliable. Sometimes the support team might not fully understand the challenges you’re facing with your QuickBooks Online integration with eBay. If you’re on a free or low-tier plan, this could make getting help even more difficult, defeating the purpose of using the app altogether.

Manually enter eBay transactions into QuickBooks Online

If you’re an eBay seller who prefers a hands-on approach or if you’re just starting out and are budget-conscious, manually entering your eBay sales data into QuickBooks Online is another option.

This option isn’t really an “integration”, but it can help get the accounting done. It might take a bit more time and attention to detail, but for many sellers, the tradeoff is worth it.

How to enter eBay data into QuickBooks Online manually

- Log into eBay: First off, log into your eBay Seller Hub. This is where you’ll find all your sales data.

- Download your sales report: eBay offers various types of reports, but for accounting purposes, you’ll want the most comprehensive one.

- Monthly Financial Statement: This report gives you an overview of all your transactions, fees, and other financial details for the month. Navigate to ‘Seller Hub’ **→ ‘**Payments’ **→ ‘**Reports’, then adjust the time period to the month you want to record and click ‘Download Report’.

- Download the report: Usually, you can download these reports in CSV or Excel formats, making it easier to manipulate the data later.

- Consolidate the data: Once you’ve got the report, you’ll need to prep the data for entry into QuickBooks Online.

- Sift through transactions: Look at the various transaction types like sales, fees, and refunds.

- Create a summary: Sum up the transactions in a way that aligns with your QuickBooks Online accounts. Be meticulous; you want this to match your actual deposits.

- Open QuickBooks Online:

- Create a new journal entry: Head over to QuickBooks Online, click on ‘New’ in the top left corner, and then choose ‘Journal Entry’.

- Map the data: Take your summarized eBay transactions and start entering them into the appropriate accounts in QuickBooks Online. If you haven’t set up your Chart of Accounts yet, do it now.

- Review and import: Before you hit that ‘Save’ button, give everything one last look to make sure your journal entry matches your eBay deposit. Check, double-check, and then, when you’re sure, go ahead and save.

Advantages of manual data entry

Free, mostly

Just like other platforms, the big advantage of manually inputting your eBay sales into QuickBooks Online is that it’s basically free, apart from the time you invest and the cost of your QuickBooks Online plan. So if you’re just dipping your toes into ecommerce or running a small eBay shop, manual data entry can be cost-effective.

Full control over data

You get to decide what goes into QuickBooks Online and what doesn’t. Unlike automated solutions, where you might get a deluge of data you don’t need (especially if you’re using a generic data syncing app), manual entry ensures that only the necessary data lands in your accounts.

Customize as you go

Doing it yourself means you can make journal entries that fit your specific business model. You can tweak the categorization, take account of unique transactions, and set things up exactly how you want them.

Challenges with manual data entry

Volume of data

eBay transactions can add up quickly, especially if your store takes off. The more transactions, the more data to sift through, sort, summarize, and enter into QuickBooks Online. Over time this might become overwhelming and burdensome.

Transaction types galore

eBay also has various types of transactions like sales, returns, and shipping fees. Keeping track of these different categories and entering them correctly can be time-consuming and a source of errors.

Month-end crossover

eBay settles payments at different intervals, meaning you could have transactions that span the end of one month and the beginning of another. This adds an extra layer of complexity when you’re trying to reconcile your books at the end of the month.

Tax responsibility

Just like any business, you have to be accurate with your tax information. Manually entering data increases the risk of errors, which could cause problems down the line, especially during tax season.

Multiple sales channels

If eBay is not your only sales channel, then the challenge of manual data entry increases exponentially. You’ll have to download and manually enter data from other platforms too, which could get overwhelming really quickly.

Time-intensive and error-prone

Manual data entry takes a lot of time, and it’s easy to make a mistake (especially with eBay accounting). All it takes is one typo or misplaced decimal to throw off your financials. Correcting these errors later on can be a real headache.

Not ideal for scaling

If your eBay store grows, the demands of manual accounting will grow with it. The method might work when you’re small, but it could become a roadblock as you expand.

Ready to integrate eBay and QuickBooks with A2X? Start a free trial today!

Frequently Asked Questions

FAQs about integrating eBay with QuickBooks

Integrate eBay and QuickBooks Online for accurate accounting

A2X accurately and automatically categorizes the sales data that makes up each eBay payment, saving you time.

Try A2X today