Ecommerce Income Statement: What to Include & How to Get Insights

How profitable is your ecommerce business?

If you’re not sure how to answer that question, you need to look at your income statement.

If you don’t have an income statement – it’s time to build one. Or, maybe you find your current income statement difficult to read, or you don’t find it useful for your ecommerce business, so you don’t review it at all.

This guide is here to help! We’ll cover the basics of an income statement for ecommerce, including how to build one that you’ll actually want to review (including an example), and how to generate insights, with expertise from Jason Snider, Managing Director at Summit eCommerce Advisors.

Key takeaways:

- A P&L (Profit & Loss statement, or income statement) shows your revenue, expenses, and profit, helping track financial performance. It’s essential for making informed business decisions, securing investment, managing taxes, and optimizing costs.

- Ecommerce businesses can use an activity-based model to categorize financial data on the P&L. Key ecommerce-specific items to include are: sales breakdown, direct costs (COGS, 3PL, shipping), ad spend by channel, website expenses, and shipping income.

- It’s important to be able to trust your data on the P&L by ensuring accuracy. Automate data collection using accounting integrations (e.g., A2X) to ensure accurate transaction tracking. Work with an ecommerce accountant and use accounting software (QuickBooks, Xero) for real-time financial insights.

Table of Contents

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there

What is an income statement?

An income statement, also known as a Profit and Loss (P&L) statement, is a financial document that provides a summary of a company’s revenues, expenses, and profits over a specific period, helping to assess the financial performance of a business.

For ecommerce businesses, your P&L is crucial as it reveals profitability, informs decision-making, and aids in managing costs effectively while planning for growth.

It’s important to note that you should look at your income statement alongside two other important financial reports – your Balance Sheet and your cash flow forecast – to get a complete picture of how your ecommerce business is performing. You can learn more about the differences between an income statement vs. a balance sheet vs. a cash flow forecast here.

In this article, we’ll focus on the income statement, because it’s a report that can be full of interesting and important information on its own – especially when set up properly for ecommerce.

Why do I need an income statement for my ecommerce business?

This is like asking, “Why do I need an overview of how much money I’m making?”

Income statements are essential for ecommerce businesses to create and maintain for several reasons:

Financial performance tracking

It allows businesses to track their revenues, expenses, and profits over time, helping to understand the financial health and operational efficiency of the company.

Decision-making support

By examining the details of financial outcomes, ecommerce sellers can make informed decisions about where to allocate resources, how to adjust pricing, or when to expand product offerings.

Investor and lender communication

An income statement is an essential part of building “investor-ready” financials (along with practicing proper accrual accounting). An accurate and up-to-date P&L will provide potential investors and lenders with a clear picture of the business’s profitability and viability.

Tax preparation and compliance

Income statements are necessary for accurately preparing tax returns and ensuring compliance with financial regulations. But, you don’t necessarily need to format your P&L solely for tax reporting purposes – more on that below.

Cost management and optimization

By identifying trends in expenses (e.g., advertising spend) and revenue streams, ecommerce businesses can find opportunities to cut costs and optimize their spending, ultimately boosting profitability.

Best practice P&L for ecommerce: Use an activity-based model

Ecommerce businesses differ from traditional brick-and-mortar businesses in a number of ways. Given that almost 100% of ecommerce business activity happens online, there is a lot of data that can be included in an income statement.

It’s important for ecommerce sellers to figure out what’s important to your business, and ensure that those items are included on your P&L.

This income statement configuration is known as an activity-based costing model setup.

Jason Snider, Managing Director at Summit eCommerce Advisors, explains:

Our recommendation is using an activity-based costing model setup, which is assigning a line item on your P&L based on the action behind it, not just because it fits in a box for the tax reporting purposes.

Read on for an example of what an activity-based ecommerce P&L looks like (and how the numbers can tell a story about your business).

You can also watch Jason walk through an activity-based P&L and Balance Sheet in this webinar recording:

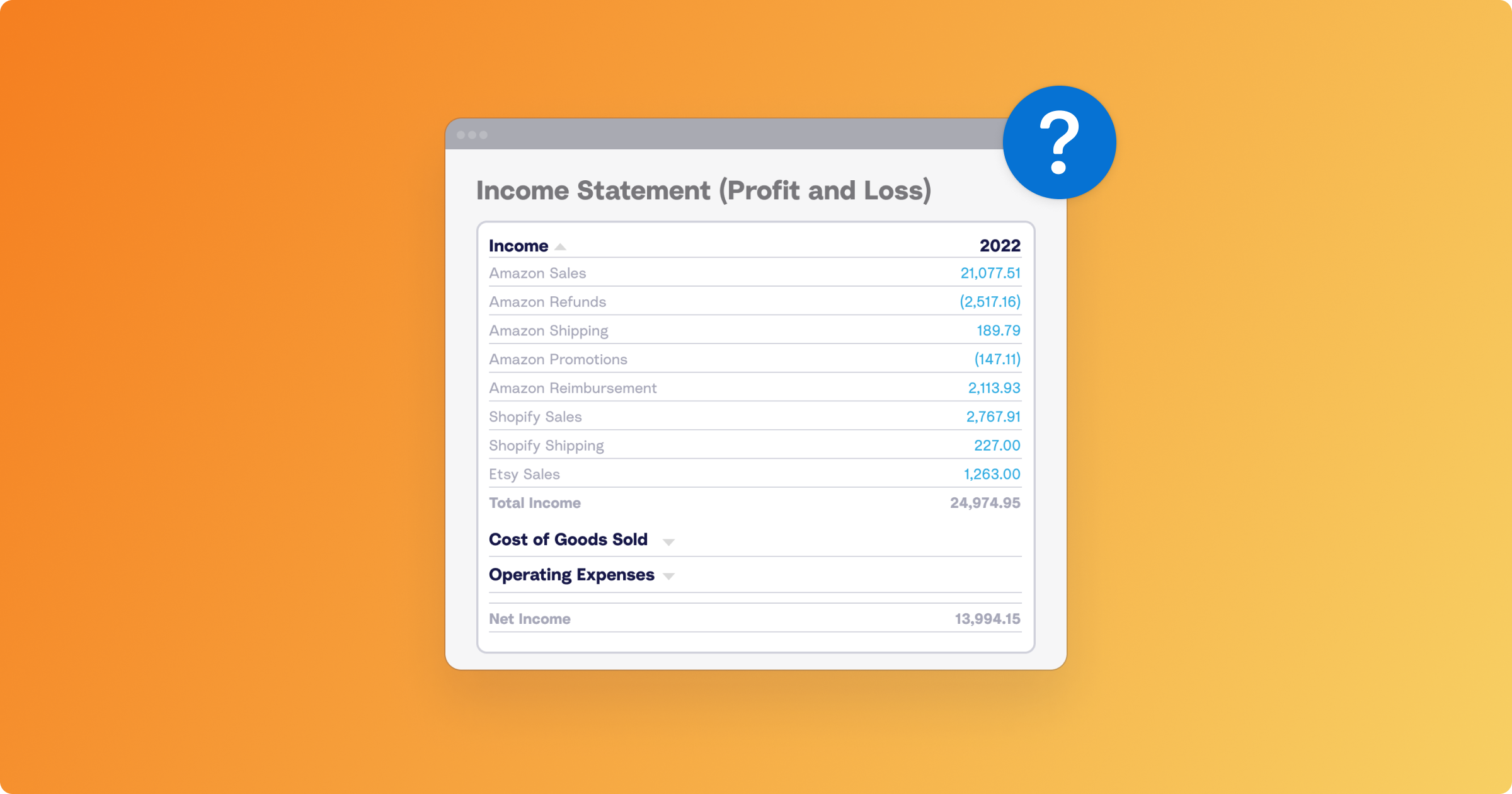

What does an activity-based ecommerce income statement look like? Here’s an example

Here’s an example of an activity-based income statement for a Shopify store.

The key line items are built around activities that the merchant has decided are important for them to accurately track on a regular basis.

Source: Summit eCommerce Advisors

Let’s break down some of the activity-based line items in this example to understand why they might be important to an ecommerce seller.

Income

On an ecommerce P&L, you can customize this bucket to include all of your different income streams – for this example, we align with the Shopify backend setup: Sales, Sales Discounts, Sales Returns, and Shipping Income.

Direct costs

This category might show up as Cost of Goods Sold. In this example, however, they intentionally simplified the language to fit with their definition of ‘direct cost’, which is: Every expense and item that goes into delivering the product to your customer.

If your business follows a similar definition, some other items you could include under ‘Direct costs’ would be: 3PL costs, warehouse costs, warehouse staff costs, etc.

Sales and marketing

For the business in this example, it’s important for them to track ad spend by channel, so they have it broken down accordingly in their income statement. (This also makes it easier for them to track return on ad spend, or ROAS.)

Website and technology

For an ecommerce business, your website is your storefront – and therefore, visibility into the numbers associated with your website, technology, maintenance (including salaries) is important.

General & administrative

In this example, the P&L captures anything that doesn’t fit into other categories in this bucket.

Discretionary income & earnings

In this example, this is the earnings of the business prior to any owners compensation decisions that are made. You could also include an ‘owners’ compensation’ bucket, which captures the owners paying themselves a salary.

Operating income and earnings

Operating income represents the profit earned from a company’s core business operations before subtracting interest and taxes. This figure is critical for calculating the amount of taxable income, which will determine the company’s tax liability.

Other income

In this bucket, this is where the ecommerce store captures incidental income that’s not related to the general operations of the business (e.g., credit card points, consulting for other ecommerce businesses, etc.).

Important numbers for ecommerce businesses to pay attention to on their P&L

The example above illustrates the power of customization with an activity-based P&L – you can change the language and categories as you see fit to ease your understanding of what’s going on in your ecommerce business based on the financial data.

Your numbers, now accurate and readily accessible in your P&L, will tell a story. Let’s look at a few examples.

Sales discounts

Looking at ‘sales discounts’ on the P&L will provide clear visibility into the impact of promotional strategies on the overall financial health. For example, if a product is listed at $100 but sells for $95 after a discount, categorizing this $5 reduction under a specific ‘sales discounts’ line ensures it is not misleadingly counted as full revenue.

Having this number readily available will allow ecommerce sellers to assess the effectiveness of different marketing campaigns, identifying which discounts drive sales and which do not, thereby informing future promotional and pricing strategies.

Shipping income

Reviewing ‘shipping income’ as its own line item on the P&L allows for clearer financial analysis and decision-making by distinguishing shipping income from general sales revenue.

This separation is crucial, particularly for businesses that encounter significant shipping costs, as it enables them to directly measure and compare these costs against the shipping income.

For example, in cases where products involve high shipping expenses (e.g., large, expensive items requiring specialized delivery services), identifying and adjusting shipping fees based on geographical challenges can help recapture margins and improve overall profitability.

Direct costs

Understanding direct costs is directly associated with understanding gross margin (and resolving any issues that might be impacting gross margin). For example, understanding how software costs contribute to overall shipping and handling can highlight areas for efficiency improvement and cost management.

Freelancers, sales and marketing

Many ecommerce businesses rely on freelancers or agencies for specialized tasks like SEO and paid advertising, rather than employing full-time staff for these roles.

Reviewing these costs on the P&L provides clarity on the financial impact of sales and marketing efforts and allows for better analysis of expenditure trends, such as fluctuations in costs related to changes in advertising platforms like Google AdWords.

Discretionary income and earnings

In this example, this number includes earnings of the business prior to any owners compensation decisions that are made. Reviewing discretionary income and earnings on an ecommerce P&L is crucial for valuation purposes, particularly for business owners planning to exit.

Breaking out these numbers on the P&L not only streamlines the process of preparing for a sale or evaluation, but also enables business owners to effectively collaborate with advisors and enhance their readiness for potential transactions.

How to prepare an activity-based income statement for ecommerce

1. Make sure your transaction data is accurate and up-to-date

Your income statement will only be as good as the data you consistently put into it.

Ecommerce sellers who sell on platforms such as Shopify, Amazon, Etsy, eBay, Walmart, etc. might be familiar with the fact that getting sales and transaction data from these platforms into your accounting software to reconcile payouts can be painful and error-prone.

Fortunately, there are integration tools such as A2X that can help improve data integrity from your sales channels by a) capturing all transactions, and then b) automatically sending that data to your accounting software for easy and accurate reconciliation.

If you’re not confident that your books are accurate and up-to-date, then you can’t be confident in your P&L and the story it’s telling you. Use tools that can help you with this.

2. Work with an advisor to decide on the activities that you want to track in your P&L

If you were looking at the income statement example above and wondering, “Are those activities important for my business to track? How do I set up a P&L that’s right for me?” – there’s an easy answer to those questions, too!

Working with an accountant or bookkeeper who specializes in ecommerce (like Jason from Summit eCommerce Advisors) can help you understand what activities are important for you to capture in your income statement, and empower you to get more from your numbers.

Every ecommerce business is different, but an expert who regularly works with sellers on Amazon and Shopify will be able to ask you the right questions and cut to what’s most important for you and your business goals – and ultimately reflect that in your P&L.

3. Use accounting software that can automatically generate your income statement

The great news for ecommerce sellers is that your accounting software can automatically generate a P&L for your business.

If you are confident in your data, and you’ve worked with an advisor to build out the activities you wish to see included in your P&L, then you’re just a few clicks away from understanding your ecommerce business’s profitability.

- Get instructions for how to run a Profit and Loss by bank account in QuickBooks Online here

- Get instructions for how to run a Profit and Loss report in Xero here

- Get instructions for how to run a Profit and Loss report in Sage here

A2X can integrate with QuickBooks Online, Xero, Sage, and Netsuite to help you get an accurate and up-to-date income statement.

Try A2X for free!

Find an ecommerce accountant

The A2X Directory is a global network of expert ecommerce accountants ready to help businesses like yours.

Take me there