![[Webinar] Income Tax Preparation for Ecommerce: How Bookkeepers and CPAs Can Work Better, Together](/img/blog/webinar-income-tax-preparation-blog-header.png)

[Webinar] Income Tax Preparation for Ecommerce: How Bookkeepers and CPAs Can Work Better, Together

Bookkeepers and CPAs are two important professionals in the accounting field who often work closely together. However, there are ways that these two groups can work even better together in order to provide more efficient and accurate financial services to their clients.

This webinar explores strategies for improving collaboration between bookkeepers and CPAs to better serve clients and advance careers. By understanding each profession’s unique roles and responsibilities and finding ways to support one another, bookkeepers and CPAs can work more effectively as a team.

Table of Contents

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here

Transcript begins

Ellen: In today’s webinar, we’re discussing income tax preparation for ecommerce, and in particular, how bookkeepers and CPAs can work better together during a time that we can all agree is a trying time.

I’m really excited about this topic as I see questions in accountant and bookkeeper communities about how to manage this relationship.

I am Ellen, and I will be your host today. I run partner marketing at A2X. I’ve been at A2X for four years, and during this time, I’ve had the pleasure of working with lots of accountants and bookkeepers at all stages of their ecommerce accounting journey. I look after the partner program. This is a program for accountants and bookkeepers; There are currently over a thousand in this program.

Are you an accountant or bookkeeper? Join the A2X partner program now.

We’ve also got Jeremy Allen, our expert on today’s topic. Jeremy is the CEO and founder of Ecom CPA, and has lots of experience working with internal and external bookkeepers, so he’s lots of great insight to offer us. We also have Sarah Burns, who is an accounting manager at Ecom CPA, and Jared Randall, who’s the partner consultant at Xero.

Today we’ll be discussing why ecommerce bookkeeping and tax is unique. We’ll be discussing the bookkeeper and CPA relationship during tax time. And we’ll also be discussing how bookkeepers and CPAs can work better together. And then we’ll have questions and answers at the end.

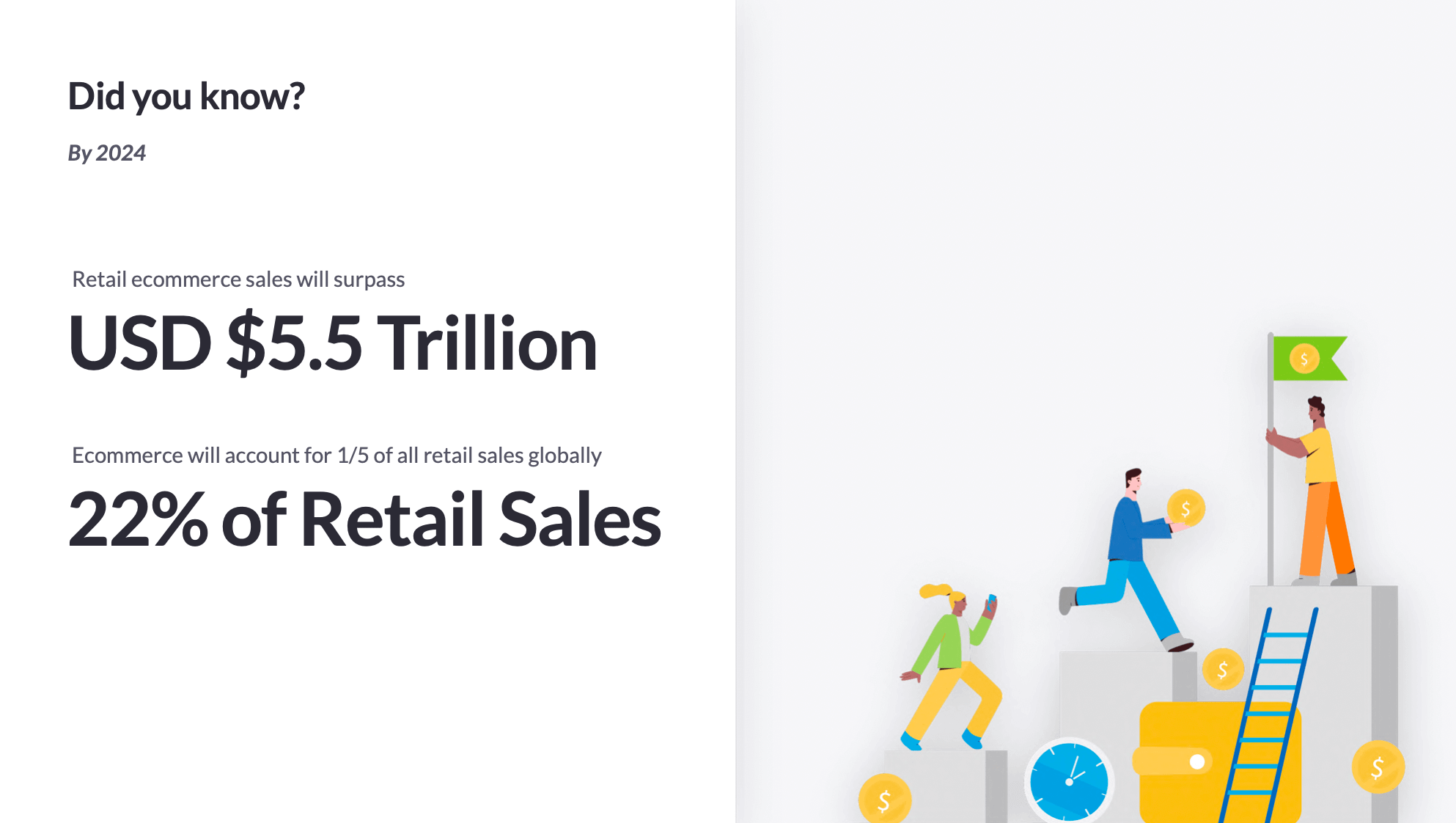

Ecommerce is growing, and so is ecommerce accounting

Ecommerce is growing. It’s an industry that we’ve seen growing for the past few years quite rapidly, and by 2024, retail ecommerce sales will surpass $5.5 trillion US dollars and account for 22% of retail sales.

Ecommerce bookkeeping and tax will likely become the fastest growing niche for many practices, and I’m sure Jeremy, you can add here. Have you seen a lot of growth in the ecommerce space in your company?

Jeremy: Yeah, we’ve consistently more than doubled since we started. And most of my other peers in the space are also experiencing tremendous growth. So it’s an exciting time to be in ecommerce, and I think it will be going forward as well.

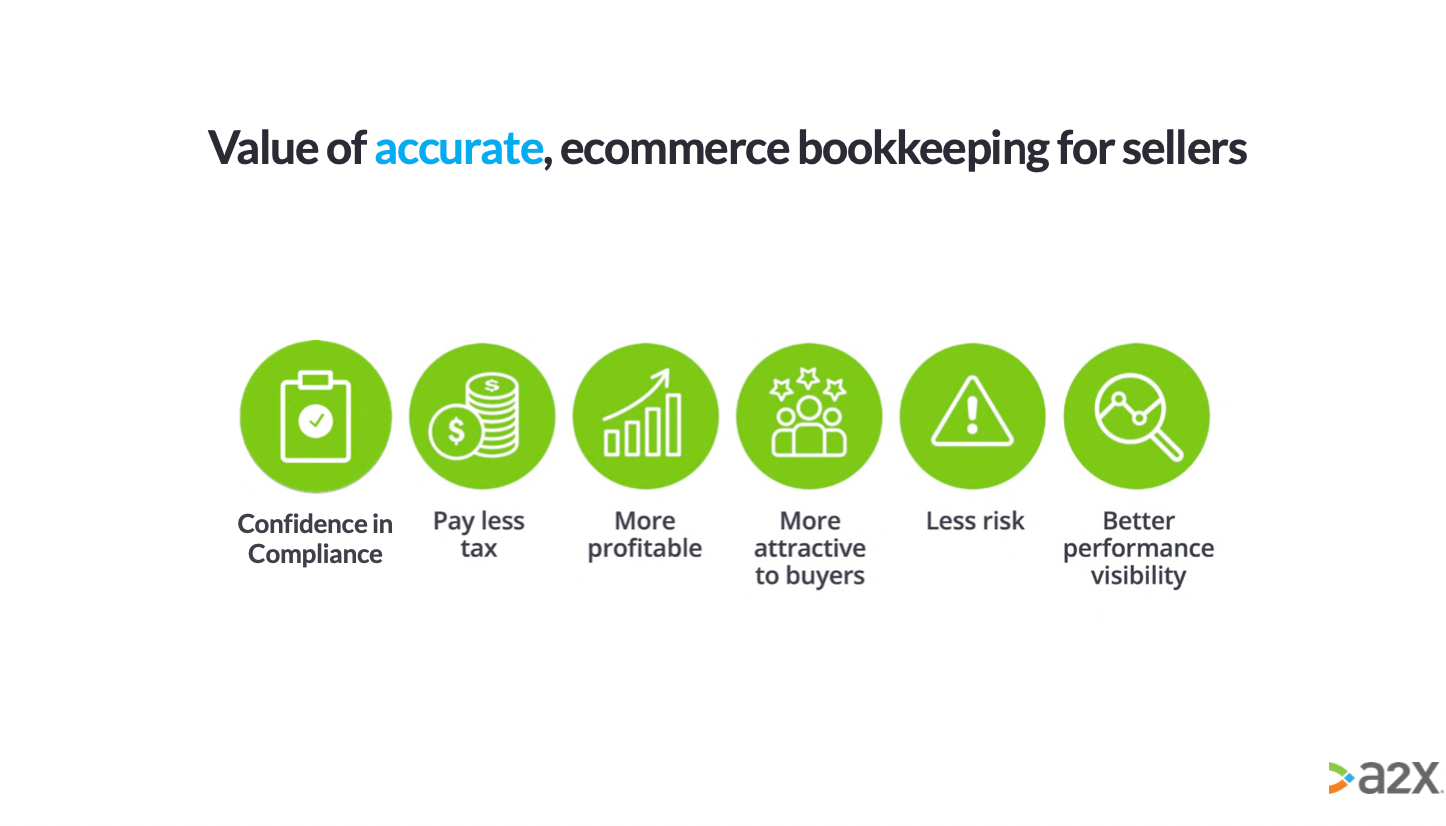

What accurate ecommerce accounting offers for business owners

Accurate ecommerce accounting is super valuable for sellers, over and above compliance. This value includes:

- Business owners finding confidence in having compliant books

- Making sure they’re paying the right tax

- Knowing if they’re profitable

- Making them more attractive to buyers (in fact, if an ecommerce business owner is even thinking about selling their business, they need to have accurate accrual accounting).

- Taking on less risk if a business has accurate books

- Business owners have insight into how they’re performing

What do you think here, Jeremy? What do you think accurate ecommerce

accounting can do for sellers?

Jeremy: Yeah, I think you talked about the sell side: So if you’re going to sell your business, most ecommerce businesses go between 3x and 10x EBIDTA or seller’s discretionary earnings. So, if there’s an error in your books, you’re talking about a three to ten times impact from not having your books in order.

On that front, I’ve seen a lot of money missed out because the books weren’t accurate. And as you know, we’re expected to be headed into a recession. If you don’t know your numbers, then I think it will be a very trying time for ecommerce businesses who don’t know how they’re doing financially.

What makes ecommerce bookkeeping so complex?

Ecommerce bookkeeping and tax are complex, and the more that these ecommerce businesses are selling, just increases in complexity. It doesn’t get any easier. So why is this?

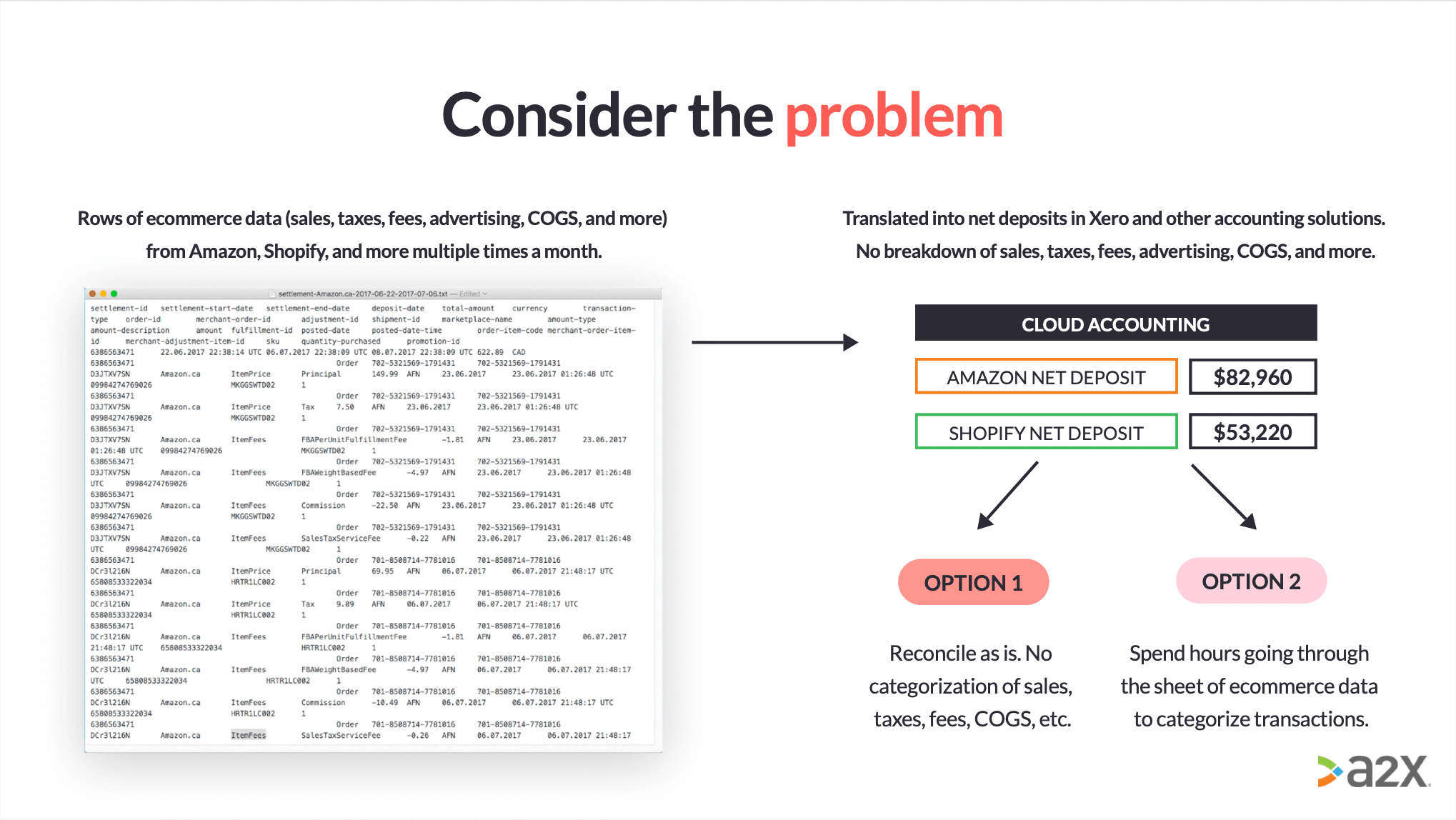

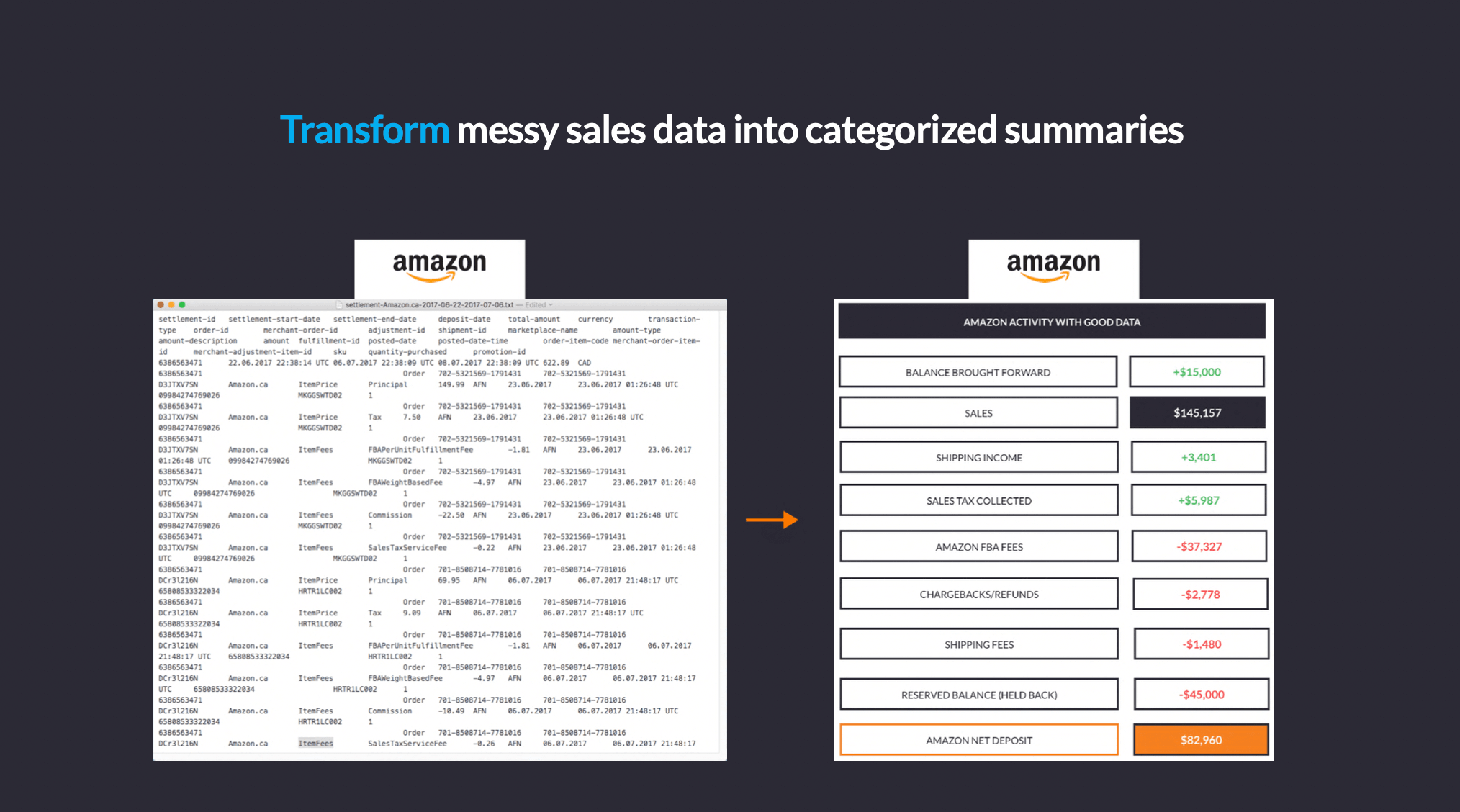

If you have clients who are ecommerce businesses, you will recognize this diagram on the left here—just rows and rows and rows of transactions. What happens is that ecommerce businesses receive these net deposits into their bank account, and they can’t see any breakdown of what is happening. Often, these deposits span over two months, so it becomes a guessing game.

Businesses have two options: they can reconcile this net deposit as is, meaning they’ve got no categorization of what’s happening, or they can spend hours combing through this data to try and make sense of it. This leaves space for error and is super, super time-consuming.

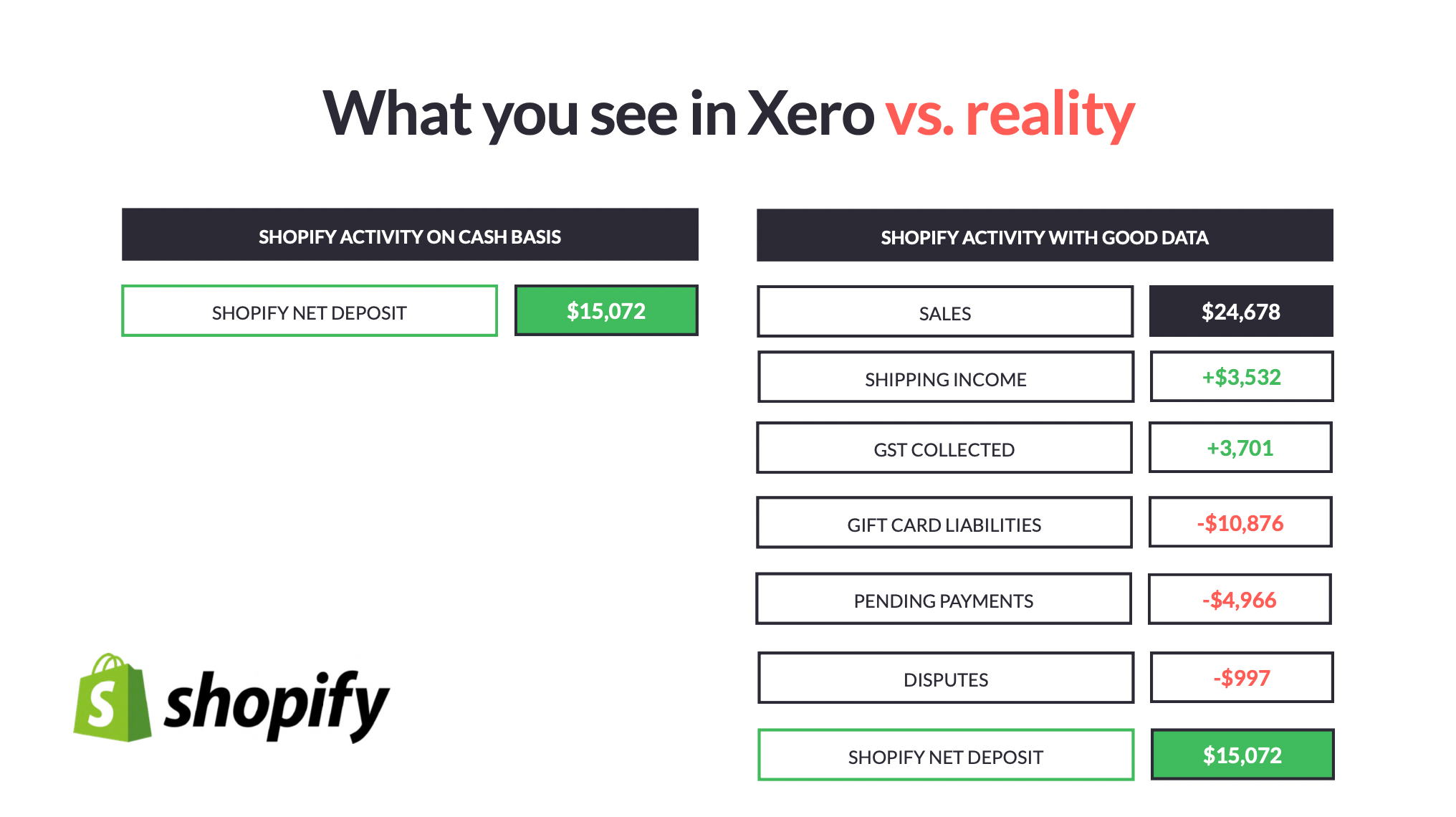

This is an example of what you would see in Xero versus what is actually happening behind the scenes.

A Shopify seller might receive this net deposit of $15,072; if they were to reconcile as-is, they would miss out on all this information on the right side.

And also, as you can see, they’ll be getting their income figures very, very wrong, as well as lumping in liabilities, which shouldn’t even be in the Profit and Loss—it should be well over into the balance sheet. A2X finds this information and breaks down all of those line items.

This is the same with Amazon—in fact, Amazon is even crazier as they have over 400 different events that they’re tracking, and sellers need to know what these are.

With all this, it gets even more complex. You’ve got bookkeeping and CPA relationships that are hard to manage. Then you add ecommerce into the mix and tax into the mix, and there comes a greater need for processes, technology, and collaboration.

So having your processes right is incredibly important.

We’ll be touching on processes specific to income tax in this webinar, but each month the A2X content team produces checklists and other resources that are super important and can be really helpful for your accounting and bookkeeping practice.

But as well as having your processes straight, technology is also super important. I will hand it over to Jared now, who will cover the technology piece.

Using Xero and A2X for ecommerce accounting

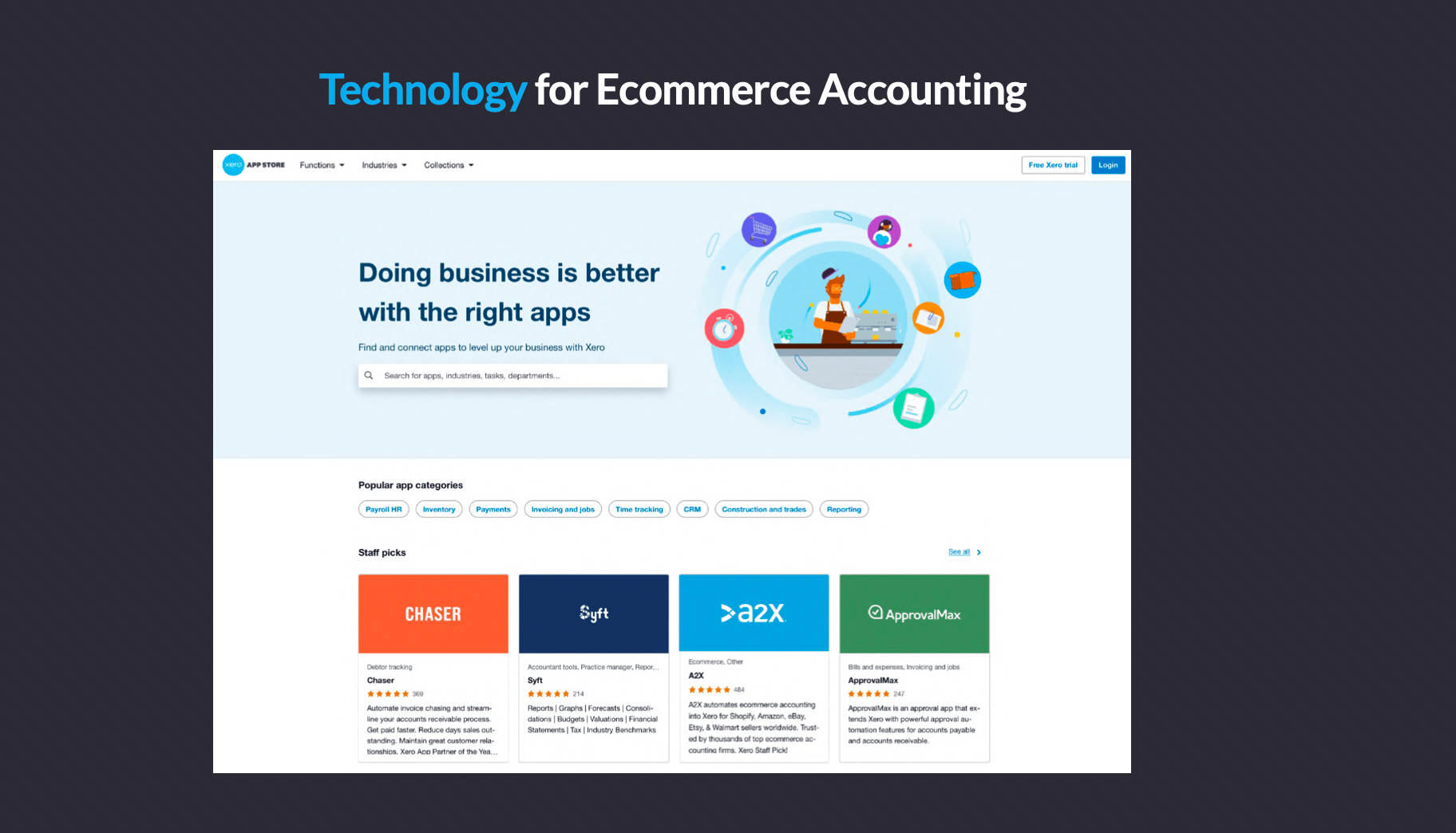

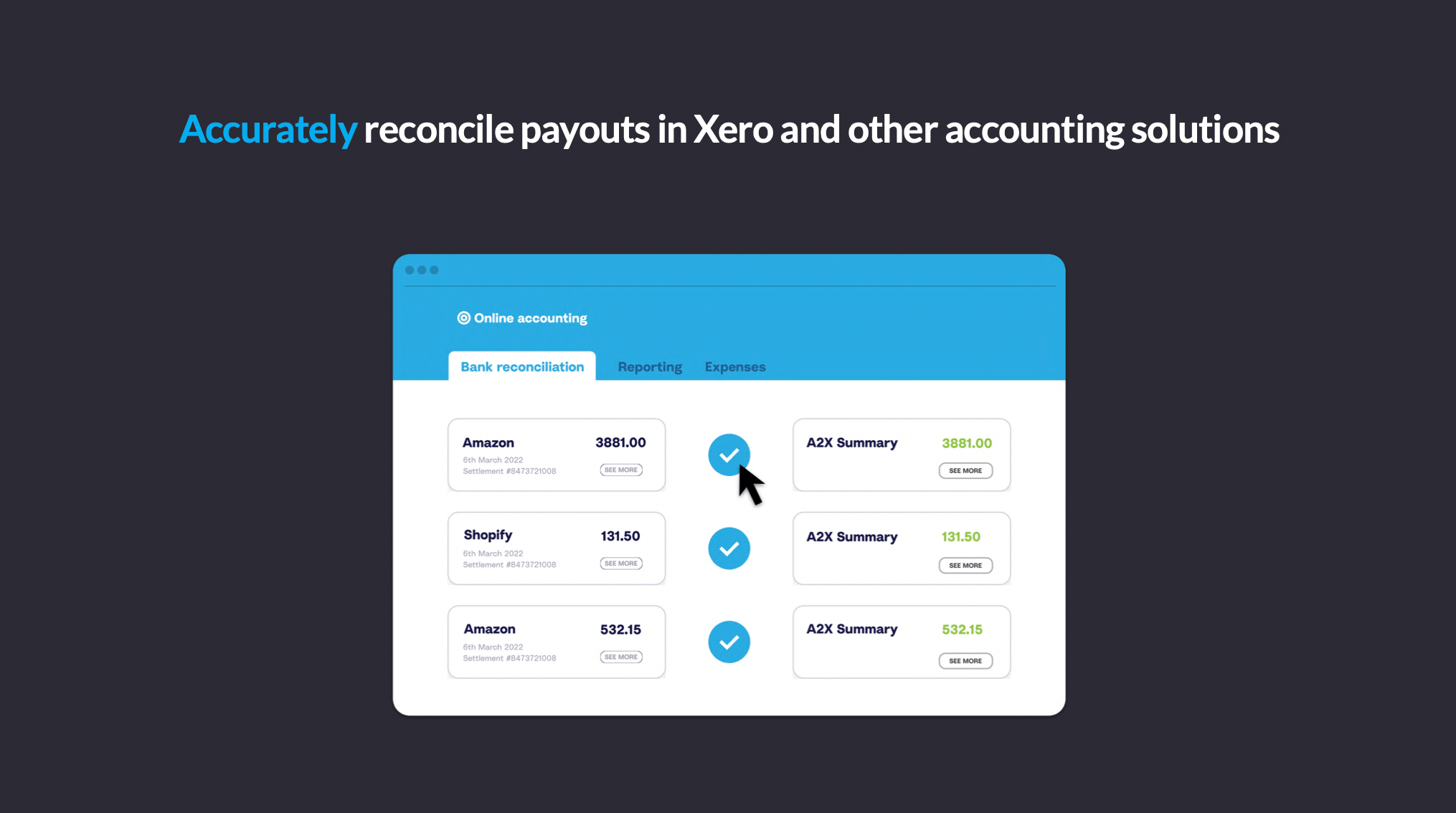

Jared: Hello, everyone. I’m Jared from Xero. I’m so stoked to be here today with our counterparts, A2X. As you know, technology keeps changing, and everyone on here probably knows what it means to integrate with other apps. If you’re in ecommerce, you’re probably thinking about this.

The screenshot above is the Xero app store, and this is something that really sets Xero apart as an accounting solution for ecommerce businesses and the accountants and bookkeepers that serve them.

If you use Xero for your clients, you have access to this app store, and here you can choose from over a thousand third-party apps that integrate with Xero. You can search by a specific app, browse by function, or the industry. Today we’re talking about ecommerce, and A2X is one of our top-rated apps for the ecommerce business—and you’ve already probably seen a little bit why: taking the complex and the messy into a format that can be digested and used in an accounting solution.

With Xero, we don’t try to be all things. We see ourselves—and want to be—the hub of a business’s workflow. We want to focus on being the most beautiful accounting solution, and that’s where our attention will go. By having an open API and integrating with the best apps for ecommerce, we can empower the accountants and bookkeepers beyond being that accounting solution. That’s part of who we are and what we want to do.

We’re looking to reinforce the value you bring to your clients and to give you access to the full suite of workflow automation tools. Xero even has an app advisory certification for our partners, which helps further support and position you to your clients. So again, you are in the driver’s seat, accountants and bookkeepers. You’re the ones that can help take the stress and complexity out of the equation of ecommerce accounting, and that’s what we’re here to do.

At Xero, we show up and support the accountant and bookkeeper collaboration because we know that when that happens, the more engaged the small businesses can be with those, and everyone will win. The businesses are going to succeed, and the firms are going to succeed.

Ellen: Further to this technology piece—and there are some amazing apps in the app store—we are going to discuss the A2X to Xero integration and how this can solve the difficult issues that ecommerce businesses face. But before we get into that, I would love to hear from you, Jeremy, about your world pre-A2X and how you managed that before technology came along to simplify this all.

Jeremy: Sure, I started on my ecommerce accounting journey in 2015, and at the time, I was just trying to figure out how ecommerce accounting worked. I saw the writing on the wall that ecommerce was going to be one of the fastest-growing industries, so I figured I’d double down on it and figure out how this works.

Back then, there was an integration, I think it was Bold integration, between Shopify and Xero, and it would push every single order over into Xero. I had a client that was growing really fast—it was an apparel company—so I thought I would try and hook this integration up, and it pushed hundreds of thousands of invoices into Xero and made a huge mess of my client’s books.

The strategy when I didn’t know about A2X was to plug the difference into a clearing account or just hope that our numbers would tie out once we reconciled everything. The level of precision was lacking, and thankfully I stumbled upon A2X for Shopify. I think I only had a few clients at that time, so using the automation of A2X, I was able to take on a bunch more clients as well. It really changed the game for me as far as being precise in the accounting, as well as not spending hours trying to figure out whether this order was a return or whatever of those 10,000 invoices where it belonged on my financials. So, that’s kind of some backstory on how A2X has impacted our practice

Ellen: Amazing, so A2X takes what was a guessing game into confidence, which is what we’re all after. I’ll pass it over to you now, Jeremy.

Turning messy data into categorized summaries you can rely on

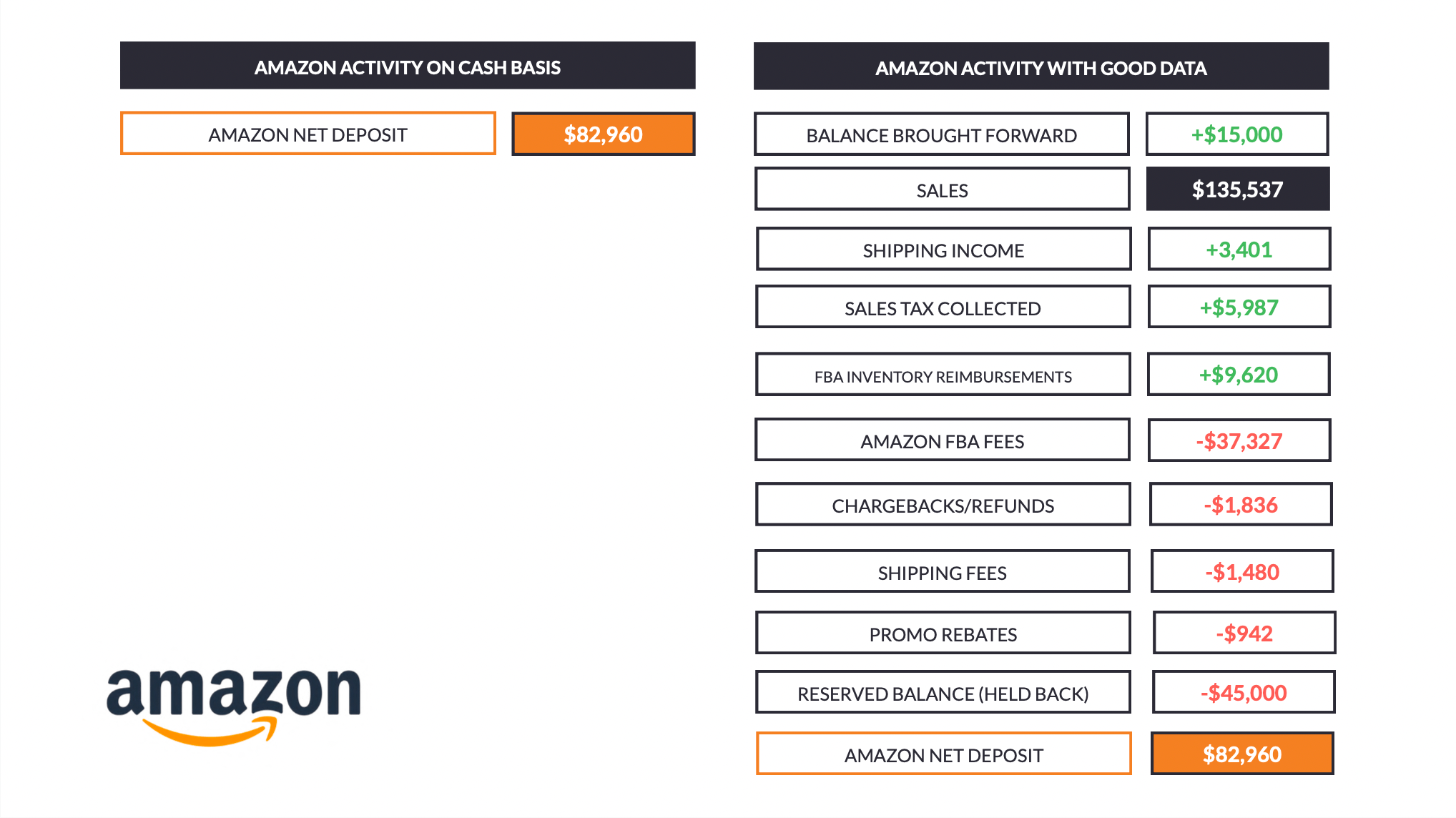

Jeremy: Ellen you talked about this pretty well. For taxes, it’s really important that your sales get grossed up. So in this example, Amazon will deposit roughly $83,000 into your bank. If you just code that to your sales line, then essentially, you’re under-reporting your gross sales. And as everyone knows who does taxes, the IRS loves 1099-K matching to the sales, especially in an audit they will do that.

We’ve had some clients that have automated notices sent by the IRS saying, “you’ve under-reported your total sales,” and then they just outright assess additional taxes on that amount.

So in this example, the gross sales is $145 000, so if you just booked your net deposit, you will be $50,000+ short on your gross sales.

So, ideally, as tax preparers, we want to limit our interaction with IRS as much as possible and hedge any risk. If there was an audit, I think you could still justify it, but who wants to incur that cost and time? So that’s why reporting the gross sales and associated expenses is important from the tax side of it.

I love this part because before, as I mentioned, each deposit might be 5,000 invoices, so in the old days, you’d have to somehow match that deposit up to all those invoices. Once you approve the A2X invoice, it matches right up to the bank side so that you can speed right through that.

Nuances of income taxes for ecommerce businesses.

I wanted to get more into the tax side of it, talking about the collaboration between bookkeepers and CPAs during tax time. First, let’s start with what are some of the nuances of income taxes for ecommerce businesses.

State income tax nexus

The first one on which there’s a ton of confusion is the state income tax nexus. If you’ve been in ecommerce, you know the sales tax side of it with the Wayfair decision made it overly complicated and cumbersome for businesses, especially outside of Amazon. For example, brands that have Shopify stores that don’t have third-party marketplaces to collect the tax. The state income tax side is also complex in that each state has its own nexus thresholds. Some states are adopting economic nexus, so over a certain dollar amount of sales into that state [means you have economic nexus]. You have the state of California that is being overly aggressive and saying, “you sell one piece of inventory into my state, I’m going to charge you with the franchise tax.” So you got a wide practice of things happening on the state side regarding nexus.

So the clients always ask, “I’m a $5 million business, I’m in my state, I use a 3PL, what states should I file in?” And if you look across CPAs, you might get a bunch of different answers, especially if someone specializes in something other than ecommerce. As we have a possible recession, the states will be looking for income, and I think the states will heavily scrutinize the income tax compliance side.

The complexities of inventory

Inventory is a big pain point for ecommerce businesses. And on the tax side, it impacts the bottom line significantly through Cost of Goods Sold, so if a client’s inventory is overstated or understated, then the net income, which is subject to taxation, will vary. So, we’re always looking at the accuracy of inventory and the accounting for that.

Cash vs. accrual accounting

And then, finally, cash versus accrual accounting. A lot of our clients are doing accrual accounting, and then for tax purposes, they could use the cash basis up to $25 million in annual gross revenue. For book purposes, you could be on accrual, and then for tax purposes, you could be on cash, so there are some decisions to be made on what’s most favorable for the client.

Those are some of the nuances of ecommerce income taxes.

Bookkeepers and CPAs: how we can work together harmoniously

So, I wanted to talk head-on about why there’s always this beef between bookkeepers and CPAs that I see—when I say CPAs, I mean EAs, anyone who’s doing the taxes—there’s this little battle that I feel happens.

We [Ecom CPA, Jeremy’s company] do the accounting and taxes for clients, but we also have partners outside that we work with. We had some of these collaboration problems within our own team, so I’ll share some things we’ve used to work through those.

Everyone’s very busy with their work, so I think that sometimes the clients feel the pressure to manage their bookkeeper and CPA. I’ve had clients say things like, “why do I even have the two of you—you guys should be working together!” The last thing we want to do is have our clients manage us; we want to be serving them and managing them, and saving them time, which is what they engage with us for.

On the bookkeeper side, they’re often frustrated with CPAs for making top-level adjustments, for example, booking journal entries without really inquiring with the bookkeeper as to why they’re making these adjustments. And then on the CPA’s side (or tax preparer’s side), they’re frustrated because bookkeepers made changes to the prior year’s books without letting them know. Or something on the balance sheet may not make sense. And the CPA, because they’re time-strapped, is forced to book top-level adjustments.

So, those are some of the challenges that come up. And if you’re in one of those roles, you’ve probably faced something like that.

As with most things in business, clear, open, and consistent communication is the answer. As accountants, not everyone is well-versed in communication, so we [at Ecom CPA] try to be purposeful with our communication. Let’s talk about that.

I’m going to talk about some of our best practices. Things we’ve had a lot of success with that solve some of these pain points.

On the bookkeeper side, they’re often frustrated with CPAs for making top-level adjustments, for example, booking journal entries without really inquiring with the bookkeeper as to why they’re making these adjustments. And then on the CPA’s side (or tax preparer’s side), they’re frustrated because bookkeepers made changes to the prior year’s books without letting them know. Or something on the balance sheet may not make sense. And the CPA, because they’re time-strapped, is forced to book top-level adjustments.

So, those are some of the challenges that come up. And if you’re in one of those roles, you’ve probably faced something like that.

As with most things in business, clear, open, and consistent communication is the answer. As accountants, not everyone is well-versed in communication, so we [at Ecom CPA] try to be purposeful with our communication. Let’s talk about that.

I’m going to talk about some of our best practices. Things we’ve had a lot of success with that solve some of these pain points.

Using checklists to align and prevent friction

One thing I forgot to mention is that at Ecom CPA we work with more external bookkeepers than we do internal accounting teams. So before tax time, either through tax planning or once the books are closed, we’ve found it’s really good to connect with the CPA and the bookkeeper and talk about key events. And sometimes, having the client there is also beneficial since the bookkeeper may not know the ins and outs or one-off things that happened during the year. Make the time to have a quick discussion on what happened during the year and whether any issues might impact the tax return.

A quick conversation before the taxes started usually prevents the headache and back and forth that can happen during tax time.

One area we’ve definitely focused on is that whoever prepares the taxes should work with the bookkeeper to align on the journal entries being made and why they’re being made.

If you’re making a top-side entry to the books, it’s usually correcting some sort of error or some account that doesn’t line up. Working with the bookkeeper to make sure that doesn’t happen again has been one of the keys to saving us time and the bookkeeper time. And it makes the bookkeeper look good too, because we’re not fixing any mistakes we see.

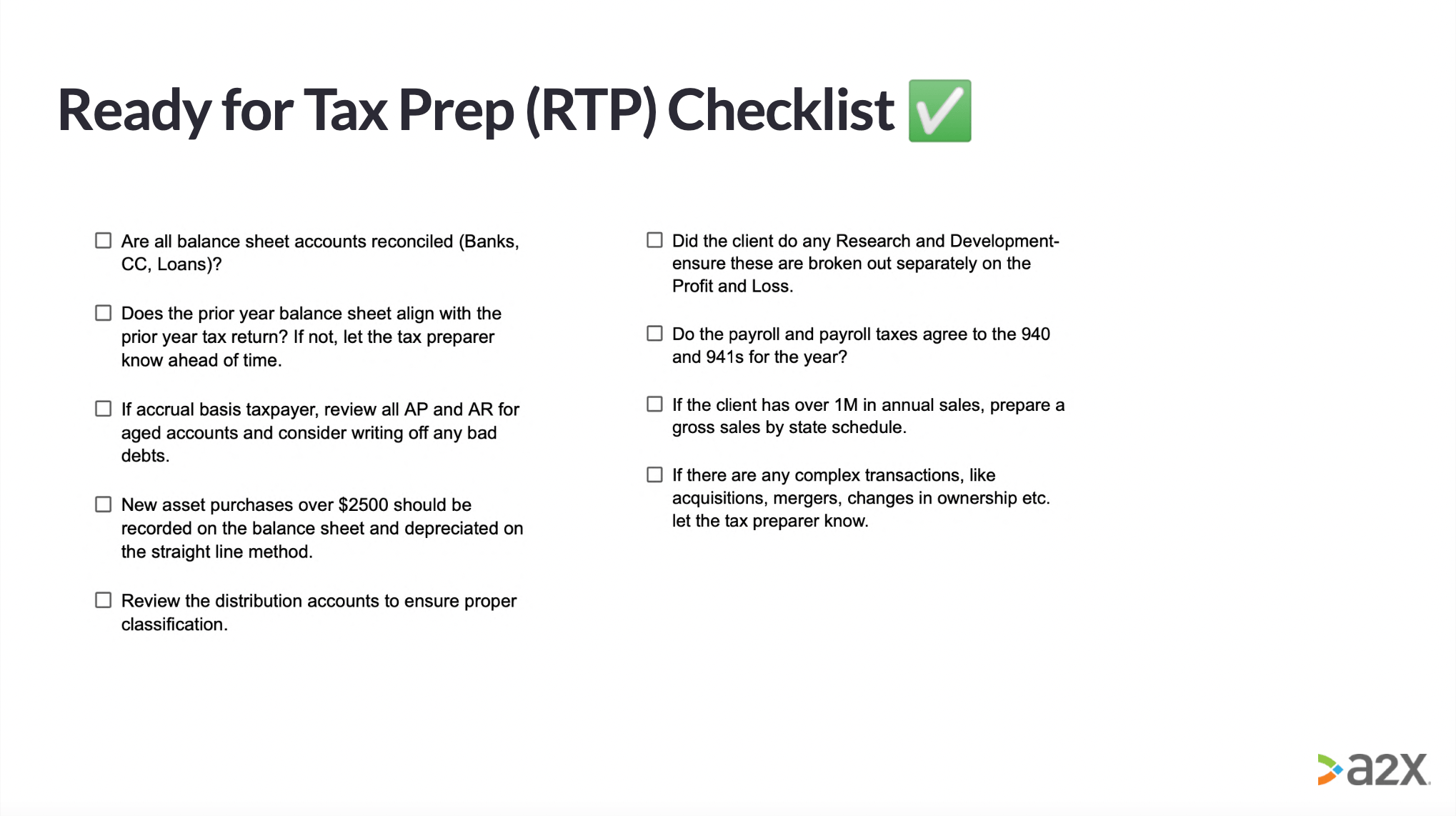

We’ve put together and been rolling out a “Ready for Tax” prep checklist to our external bookkeeping accounting partners. It’s a really nice tool, it’s simple, and it ensures that the bookkeeper and the CPA are on the same page and marching towards providing a great seamless experience for the client.

➡️ Get your copy of the checklist

So I’ll run through a couple of those questions right here next. Some of them seem like common sense to some of you, but you never know what you can get on the book side, so I’ll just run through a couple of these. The first is “are all balance sheet accounts reconciled?” which is important. You not only want the bank accounts, but if you have credit cards, any loans, or anything on the balance sheet, that should all be tied out to some supporting documentation. This really ensures that the financials have a high level of accuracy.

The second one is where a lot of back and forth can happen between bookkeepers and CPAs. So the prior year, the balance sheet is reported to the IRS for tax purposes—depending on the type of entity. For tax, we always make sure that the balance sheet rolls between one year to the next, so if there’s a change on the books and our prior year’s balance sheets and retained earnings don’t line up, then we’re typically going to have to make an adjustment to make sure it flows on the tax return. So, I’m not saying that the bookkeeper needs to make an entry to make it line up but working with the tax preparer to record that entry and agree on it together is usually the best practice.

I think the last point on there: If there are any complex transactions like they acquired a new brand or they acquired a new business, there’s a merger, changes in ownership, any insight or information that you as a bookkeeper has, it’s always helpful to translate that to the tax preparers, so they don’t miss out on anything.

This is a quick checklist that we give to our external partners to help the tax prep process be smooth and facilitate good communication between the bookkeeper and the CPA.

Ellen: How do you find the bookkeepers receive this kind of checklist?

Jeremy: I think most people like it because it’s tangible, it’s easy, and it’s just nine quick questions to ask yourself, ensuring that we, as a tax team, don’t have to come back and ask for more information.

Ellen: Thank you so much, Jeremy, it’s super helpful.

➡️ Get your copy of the Ready for Tax Prep checklist

Question and answer session

We have a few questions that have come through the Q&A, and I also have some questions that I’ve gathered from the community—as I mentioned, I see this topic come up a lot.

I can see Jared, you’ve answered that there is a certification for bookkeepers for Xero, but a question for Jeremy is: how many QuickBooks Online bookkeeping-certified people do you have on the team? And how many Xero-certified people do you have on your team?

Jeremy: Sarah, do you know the number? I think we have like eight or nine.

Sarah: Yeah, but not everybody is certified in both QuickBooks Online and Xero. Usually, that’s something we implement as soon as we bring on new people. People usually come certified in either or though.

Ellen: Awesome. Carol has asked, does A2X integrate with QuickBooks Desktop and Shopify?

Yes, A2X does integrate with Shopify. It’s one of our main ecommerce platforms. And we also do have an integration with QuickBooks Desktop. It is a manual, custom integration. So it’s slightly different from the Xero/QuickBooks Online integration.

How to get the correct reports from Amazon etc., inventory by shipping warehouse? Jeremy, I’ll put that over to you.

Jeremy: A2X has one of the tabs in the software that has the inventory reporting.

Ellen: I can move on to some of these questions I’ve seen in the community [while you find that]. Jared you might have some insight into this as well: What do you do when your CPA or bookkeeper isn’t willing to embrace automation and/or technology?

Jeremy: I’ll give some commentary. We all know the “why” behind some of that resistance. Years ago, it may have been costs and stuff, and now, of course, there’s cost but it can honestly be app overload, as a lot of people get into it, and they’re like, “well, you know, I spent the other day researching and I have more questions than answers now in terms of what I should use for my clients, what I should recommend.”

And I think when it comes down to it—I talked about earlier—empowering the accountants and bookkeepers. If you’re in the small business niche and saying, “hey they won’t embrace automation,” or if you’re the bookkeeper and you [embrace technology], but you’re working in tandem with an accountant that does the tax side, and they don’t [embrace technology], all you can do is advocating for the client experience.

I can even share an example. Before I came to Xero, I had a small practice myself. I did not specialize in ecommerce for my practice, but I did have a client for whom I was the day-to-day outsourced bookkeeping component. They were an online marketplace for auto parts. And another firm just did the taxes (I wanted to avoid dealing with the taxes). We had a good relationship, but this [resistance to embrace technology] was very much the story. While I could talk about Xero and the apps, what this fee is, etc., they would have a hard time because they were just focused on the taxes.

What you do is make sure you’re highlighting and advocating for the client and saying everyone needs to understand the why behind what they do and the why behind the questions they’re asking. Why do they want to move further along the technology spectrum: to save time.

And we all want the business to succeed, so this is where we can lean in and show that while there’s not just one solution for everything, our awareness of knowing what’s going on and why can go a long way with small business clients. And it goes a long way in your relationship with the accounting counterparts as well.

Ellen: What do you do when your bookkeeper or CPA consistently misses deadlines? Is this something that you have seen, Jeremy?

Jeremy: Yeah, especially with the tax law changes that came through and the complexity of tax code, I think especially on the bookkeeping side, if there’s a cleanup—say the client didn’t do their books for the year, and there’s a cleanup—sometimes that takes a while.

As we discussed, communication is the key to these types of things. If things are behind, it’s prudent to ask why and what the plan is to move things forward. Communication is the answer to that question.

There was an earlier question regarding the inventory reporting by state for Amazon. A2X has a feature, and it’s the inventory tab: it has locations tracking. So that’s how you can see the inventory by state.

Ellen: All right. We also have a couple of questions related to A2X coming up as well: Is there an easy way to pull a report from A2X for sales tax by state that shows total sales and total tax? Shopify doesn’t have it.

Jeremy: For sales tax, we primarily use Avalara for the clients we do sales tax compliance for. Avalara hooks into the various channels and then pulls that data into their system to calculate it there. I think some other ones that people use are Tax Jar, and there are a few other ones that people use for managing that sales tax side. But I have yet to really use A2X for the sales tax side of it. Do you have insight on that, Ellen?

Ellen: Yeah, so A2X does break down the sales tax. It takes it out of that net deposit, which is what you want to do, and puts it into a liability account where it belongs. But you need to break that out by the states where you need to report.

Jeremy, I’ll also ask you this, What are the major merchant accounts that will have a report with the gross sales and fees? So there’s Amazon, Shopify, PayPal—is it all ecommerce channels?

Jeremy: I mean any time you have a fee—Etsy, is also part of that, eBay, you have the same thing

Sarah: Walmart’s a newer one

Jeremy: Yeah, Walmart as well

Ellen: And those are all ecommerce channels that A2X integrates with and supports.

Jeremy: Yep, so A2X will do all that heavy lifting for you, so you don’t have to figure it out. On the Shopify side, you have gateways too, which used to be a huge pain point but A2X will push that to the specific gateway account.

Ellen: One more question about the CPA/bookkeeper relationship, which is from a CPA: I* consistent get books that are incorrect and riddled with mistakes, which is really difficult. How would you handle that?*

Jeremy: Depending on what we find, we would try and talk with the bookkeeper and go through what we’re seeing. Try and build an understanding with the bookkeeper on what changes we’d like to see. If at the end of the day, they’re combative or not understanding what we’re saying, then we’ll go talk to the client because our allegiance is to the client to do good work and have books that are accurate. That’s typically our approach in that situation.

Ellen: The bookkeeper/accounting relationship doesn’t need to be butting heads all the time—and I do see this a lot —when it’s managed well, it’s actually a referral channel and a really great way to grow your business. Bookkeepers refer clients to CPAs, and CPAs refer clients back to bookkeepers. So it’s definitely helpful to embrace your checklist and try and work on that, and look at processes, technology, collaboration, and communication to strengthen their relationship and hopefully scale your own practice.

So that’s all the questions that have come through. Thank you so much for your time, Jeremy, and the amazing resource you’ve put together to help CPAs and bookkeepers. We will send that to everyone alongside some other process checklists to help you out there.

Thank you so much to Jared from Xero for talking to us more about that. And remember to check out the Xero app store and Xero certification for accountants and bookkeepers, which is also super helpful.

Also on the blog

Want to feel completely confident in your ecommerce bookkeeping?

Businesses that document their processes grow faster and make more profit. Download our free checklist to get all of the essential ecommerce bookkeeping processes you need every week, month, quarter, and year.

Download it here